By Bill Smith, Fixed Income Trader and Portfolio Manager

For an asset class sometimes considered unexciting, the bond markets have been anything but dull in 2023. Bank failures, a hawkish Federal Reserve (Fed), disinflation, and higher yields have all contributed to a year of heightened volatility and significant opportunity across the fixed income landscape.

FOMC September Policy Meeting – Another Pause

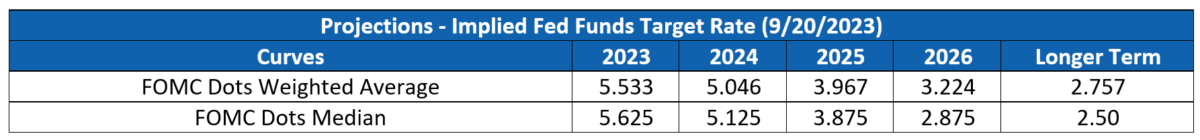

Following the Federal Open Market Committee (FOMC) meeting held September 19-20, the Fed decided to pause its hiking campaign once again. Citing restrictive monetary policy and the delayed impact of previous rate increases, the committee concluded it would “proceed carefully” when determining the need for further tightening. FOMC “dot plot” projections now call for one additional hike in 2023, followed by a more gradual set of cuts beginning in 2024, as shown in the table below:

Source: Bloomberg. Past performance is no guarantee of future results.

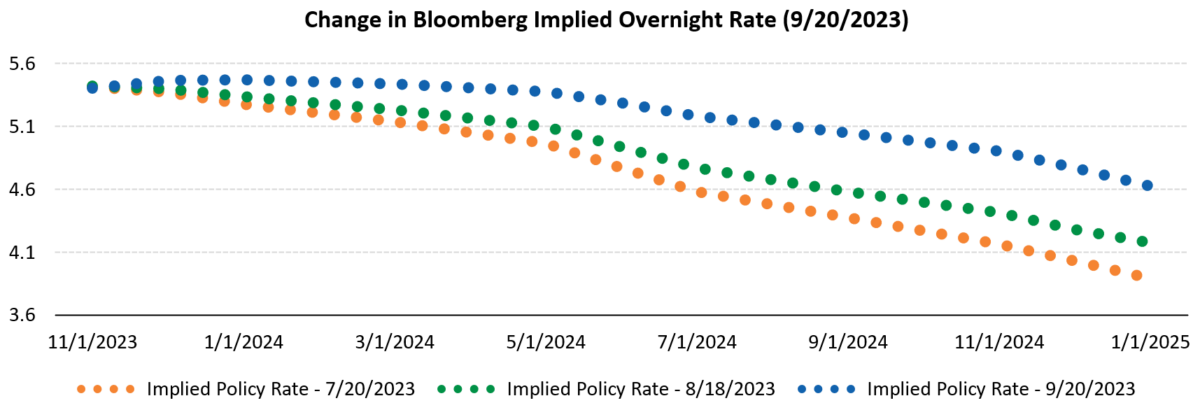

This sentiment is mirrored by Bloomberg’s interest rate probability model. The futures market is now pricing in a 53% chance of one additional 25 basis point hike in 2023, and expectations for significant policy easing in 2024 have dropped.

Source: Bloomberg

While shifting rate projections highlight the uncertainty of future monetary policy, we continue to believe we are nearing the end of this hiking cycle. This thesis was reinforced by Jerome Powell in his post meeting press conference, when he stated, “We’re fairly close, we think, to where we’ll need to get.” For now, a transition from “how high can rates go” to “how long they can stay elevated” appears to be well underway.

Fixed Income YTD Performance Summary

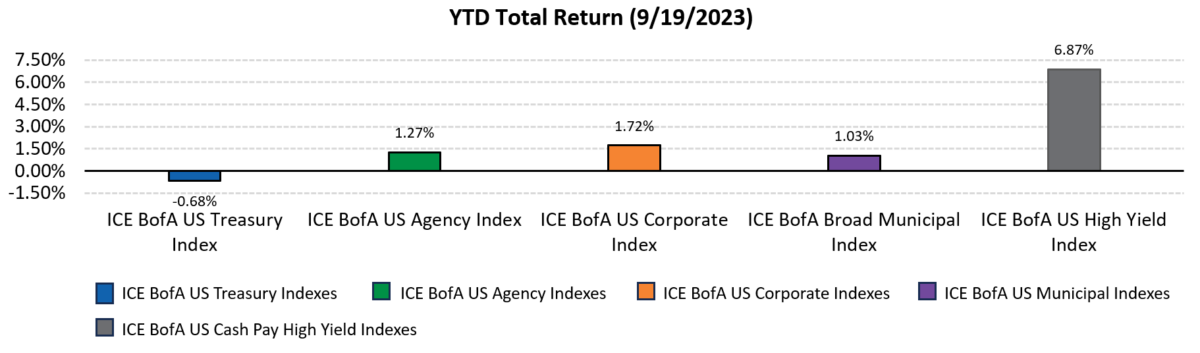

Apart from the broad Treasury index, returns across most fixed income asset classes are positive for the year. Significant outperformance was seen in high yield bonds, a sector that is traditionally highly correlated with equities, followed by corporate and agency bonds. The chart below, “YTD Total Return,” provides the year to date (YTD) return summary for some major ICE BofA bond indexes.

Source: ICE BofA Indexes, Bloomberg. Past performance is no guarantee of future results.

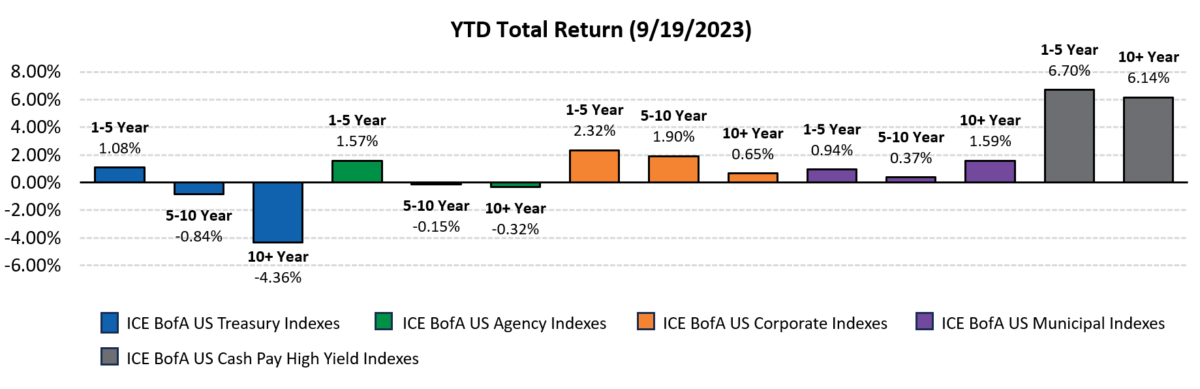

Short duration also broadly outperformed intermediate and long, largely driven by lower sensitivity to the Fed’s rate increases. This illustrates the importance of diversifying across maturities while also highlighting the ballast shorter bonds can provide fixed income portfolios in volatile markets. The chart below, “YTD Total Return,” provides a YTD return summary, broken out by maturity band, for some major ICE BofA bond indexes.

Source: ICE BofA Indexes, Bloomberg. Past performance is no guarantee of future results.

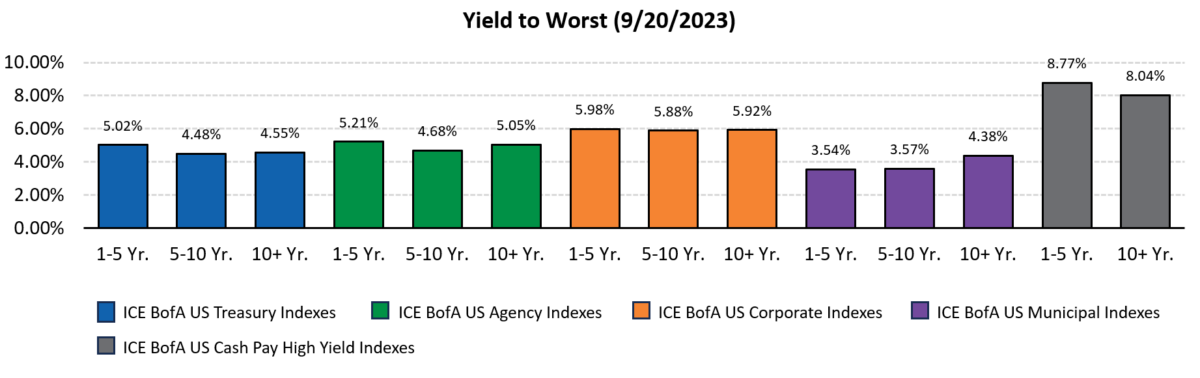

Fixed Income Yield Summary

Yields across fixed income asset classes and maturities remain attractive. Reiterating our call from previous Dynamic Bond Market Updates, we believe now is an exciting time to look at the bond market. The chart below, “Yield to Worst,” summarizes the current yield of various ICE BofA indexes, broken out by maturity band.

Source: ICE BofA Indexes, Bloomberg. Past performance is no guarantee of future results.

A prudent approach to fixed income investing calls for diversification across both credit and duration exposure. As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating fixed income for your clients, please contact Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or [email protected].

Bill Smith serves as president, Portfolio Management & Trading, of Harmont Fixed Income in Phoenix.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock

For more news, information, and analysis, visit the ETF Strategist Channel.