By Komson Silapachai, Sage VP of Research & Portfolio Strategy

Fueled by stimulus and pent-up demand from the Covid-induced recession, the U.S. economy staged one of the sharpest recoveries in the first half of 2021 to output levels well beyond the slowdown experienced last year. As a result, policymakers are looking to transition from unprecedented monetary stimulus to a policy that reflects the improved condition of the economy. Given the fact that quantitative easing (QE) served as a ballast to financial assets during their recent ascent – the act of withdrawing liquidity through either the tapering of QE or raising rates leaves market participants at a crossroads.

The concept of the Fed tapering Treasury and agency MBS purchases during the current monetary cycle was first officially acknowledged by Fed Chairman Jerome Powell following the June FOMC meeting.

In the days after the announcement, interest rate markets reacted by pulling forward the policy rate liftoff date to around September/October 2022, while the longer-term “terminal rate” in which the Fed would stop hiking fell by three to four hikes (earlier hikes would necessitate less hikes over the full cycle).

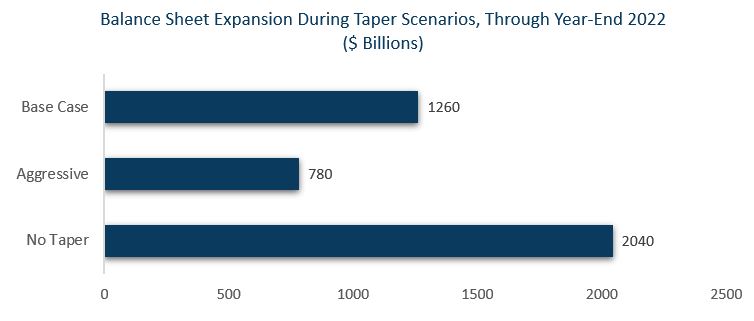

Our base case is for tapering to commence in January 2022 at a pace of $10 billion per month, with a rate liftoff in December 2022. The more aggressive case has tapering begin in November 2021 at a pace of $15 billion per month for eight months, with a rate liftoff starting in July or August. The third and least probable case is no tapering, which will serve as the dovish higher boundary for asset purchases over the next year.

In all three cases, the Fed balance sheet is expected to grow – by $1.26 trillion in our base case, $780 billion in the aggressive case, and $2.04 trillion in the no-taper scenario. Even with an extremely aggressive Fed tapering scenario, the Fed will buy at least $780 billion of bonds from the open market! To put that into perspective, the highest pace of asset purchases pre-Covid was during the 2012-2013 period in which the Fed purchased $85 billion per month of Treasuries and agency MBS. Over that time period, the balance sheet grew by $1.02 trillion.

The scale of the current pace of purchases underscores the urgency with which policymakers are trying to “thread the needle” in the tapering of bond purchases. It’s important for investors to keep in mind that the current taper pace in our base case would result in $200 billion more in bond purchases than at the peak post-Great Financial Crisis pace!

BOTTOM LINE FOR MARKETS

Despite the fears around tapering as the harbinger of volatility for credit, equities, and other risk assets, we believe that, as asset purchases are going to continue at a historical pace for some time, financial conditions should remain accommodative. This is likely to continue supporting credit spreads and market segments linked to cyclical growth, such as transportation, consumer discretionary, financials, and real estate.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Sources for chart “Balance Sheet Expansion During Taper Scenarios, Through Year-End 2022” are Sage and Bloomberg, as of 8/13/21.