Key Takeaways:

1. Historical one year returns after bear market events are higher on average compared to overall market history.

2. Market volatility during the year following a bear market event is higher, and uncertainty of the 1-year return is also higher.

3. For long-term investors, staying invested during a bear market rather than acting on the worst possible outcomes can be an advantage.

In 2022, US and global markets have been rattled by various macro-economic headwinds such as rising interest rates, persistent inflation, an ongoing Russia-Ukraine war, rising oil prices and supply chain bottlenecks due to China’s COVID crisis. These occurrences have led to lower investor confidence, and, after several close calls, the S&P 500 fell into an official bear market (drawdown >20%) on June 13, 2022. With the Fed hiking interest rates to cool down an overheated economy, investors may be worried about their positioning and allocations. In this blog, we examine historical bear market events and the 1-year return following that event, while offering thoughts on why investors should not use past performance to predict bear market returns, but instead consider how bear markets have affected prospects for future returns over time.

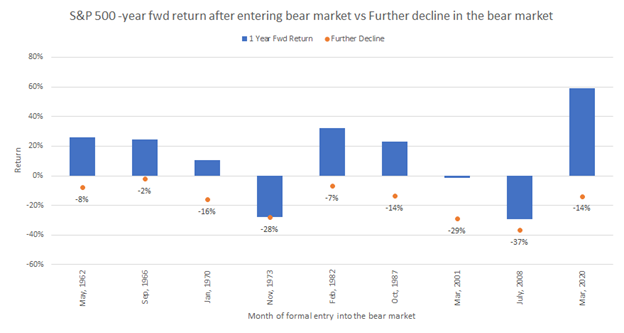

Using S&P 500 historical data from Jan 1960- May 2022, we were able to identify nine bear market events, with bear markets in this study defined as the first time a market drawdown is greater than 20% from the previous high. From there, we calculated the forward one-year return from that trigger event. Using this data, we found that the one year forward returns were deeply negative in only 2 of 9 such events (1973 and 2008), when the bear market continued through the following year. We also found that the (arithmetic) average one-year future return of all 9 events is approximately 13%, which compares favorably to the average 8% annualized return over the whole history; volatility, however was also higher over these periods. While investing at the onset of a bear market is no guarantee of positive returns, the higher average return accompanied with higher volatility is consistent with financial theory in which markets reward investors for taking additional risk.

(Source: S&P)

So how should a sophisticated investor interpret these results?

The key takeaway from this analysis is that there is no evidence that investors benefit from changing investment plans after markets fall into bear market territory. As expected, there is nothing special about future market performance related to the arbitrary 20% drawdown which typically defines a bear market. History shows investors could be slightly advantaged by investing during these times, but financial theory does not predict any such advantage. Overall, staying invested during bear markets rather than focusing on the worst possible outcomes seems advisable. While selling could prevent potential further loss, investors would likely miss the upside gains, as our study observed positive one-year future returns in 6 of 9 such events and new highs in all 9 cases. While thoughtful diversification is always prudent and reducing the overall risk profile of one’s portfolio during uncertain times can help to avoid intolerable risks to one’s wealth, these interventions can also dampen the often-outsize positive returns equities experience during the subsequent upswings.

What do we offer?

New Frontier’s patented investment process accommodates daily information on market conditions to build optimally diversified portfolios that mitigate undesirable risks and provide better risk-adjusted returns over long-term horizons. Given that there is no free lunch in investing with many bumps on the road to success, we aim to construct independently-researched reliable long-term portfolios that are also short-term efficient. Our adaptive process optimizes over thousands of scenarios (including a fundamental shift in security prices in rising rate environments) to uniquely account for uncertainty in capital markets and estimation error in the optimized portfolios without trying to speculate on the future so investors can invest and stay invested without being at the mercy of any current market scenario Learn more about New Frontier strategies.

Disclaimer:

New Frontier Advisors LLC (“New Frontier”) is a federally registered investment adviser based in Boston, MA. The information discussed here is for information purposes only. Past performance does not guarantee future results. As market conditions fluctuate, the investment return and principal value of any investment will change. Diversification may not protect against market risk. There are risks involved with investing, including possible loss of principal.