Wednesday will see the release of CPI, and Thursday will get PPI. As we have argued in the past, we think inflation will remain structurally higher in the years ahead. We have discussed with our clients the following reasons:

- Supply chains take years to build. Apple cannot simply move their supply chains from Asia and build a factory in New Mexico overnight.

- Corporations have pricing power that they haven’t had in some time. People are willing to pay higher premiums for goods/services.

- Monetary stimulus continues to increase. M2 money supply has risen about 40% over the past two years. This is twice as much as the pace of monetary expansion following the 2008-2009 crisis.

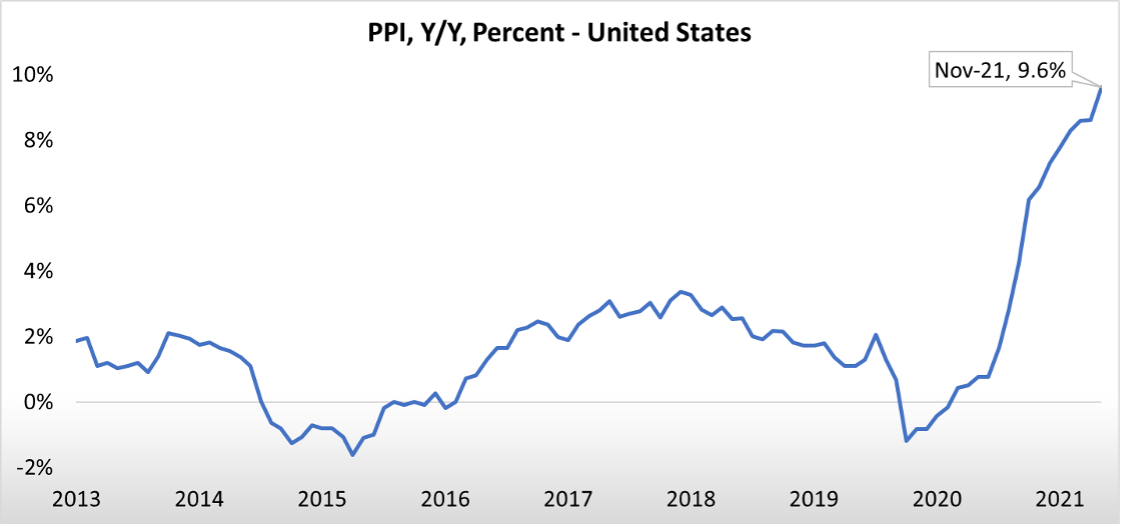

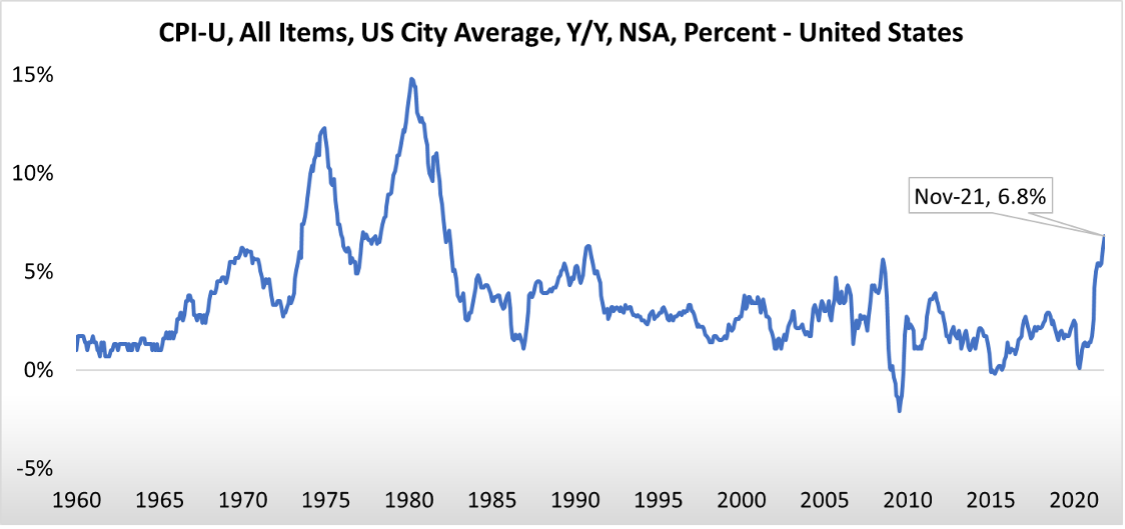

As the charts below show for PPI and CPI, we see levels of inflation we haven’t seen in decades.

From a portfolio management standpoint, most portfolios are very much titled towards deflationary strategies (i.e., growth/technology stocks on the equity side and traditional interest rate products on the fixed income side). Both components will struggle if rates continue to rise. Case in point this week, in the first week of January, interest rates spiked considerably, and we saw the following price action:

- QQQ (growth stocks) -4.5%

- S&P 500 -1.88%

- AGG (Core US bonds) -1.40%

- IEF (7-10 Treasuries) -1.97%

- XLE (Energy stocks) +10.5%

- KBWB (Large Cap Money Center Banks) +10.1%

We think advisors should be rebalancing their portfolios to prepare for structurally higher inflation in the years to come.

United States PPI

United States CPI

Best,

Astoria Portfolio Advisors

Astoria Portfolio Advisors Disclosure: As of the time of this publication, Astoria held positions in QQQ, AGG, IEF, XLE, and KBWB. Past performance is not indicative of future performance. Any third-party websites provided on www.astoriaadvisors.com are strictly for informational purposes and for convenience. These third-party websites are publicly available and do not belong to Astoria Portfolio Advisors LLC. We do not administer the content or control it. We cannot be held liable for the accuracy, time-sensitive nature, or viability of any information shown on these sites. The material in these links is not intended to be relied upon as a forecast or investment advice by Astoria Portfolio Advisors LLC and does not constitute a recommendation, offer, or solicitation for any security or investment strategy. The appearance of such third-party material on our website does not imply our endorsement of the third-party website. We are not responsible for your use of the linked site or its content. Once you leave Astoria Portfolio Advisors LLC’s website, you will be subject to the terms of use and privacy policies of the third-party website. Refer here for more details.

Photo Source: Astoria Portfolio Advisors