Let’s pick right up where last week’s market commentary left off: outlier days.

Outlier Days

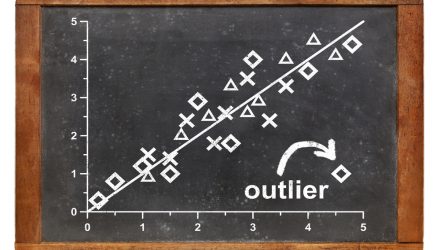

As a reminder, we define an outlier day as any trading day beyond +/-1.50%. This number is arrived at by using bell curve math. Here is a quote from last week’s commentary.

When the market is stable or is trading “efficiently”, investors should expect to see between 10 and 20 outlier days over the course of a year. So far in 2024, there have only been two outlier days. As we approach extreme low volatility, statistically speaking, the market could be due to see an outlier day or two.

-Canterbury Investment Management, “Declining Volatility and the Rise of Gold” March 9, 2024

Content continues below advertisement

Friday’s trading day was a rounding error from being an outlier day. The S&P 500 closed down (-1.47%). The Nasdaq was down (-1.60%) and the Russell 2000 declined by (-1.78%). The market’s decline on Friday was broadly felt, as every sector, besides Utilities, was down at least -1.00%. The equal weight S&P 500 was down (-1.59%).

Here is another quote from last week’s commentary:

I should note that more often than not, during normal market conditions, market fluctuations typically will go back to normal following an outlier day. The outlier day relieves some “pent-up” pressure caused by squeezed down volatility. If outlier days continue to occur, in clusters, it could be a cause for concern of rising volatility.

-Canterbury Investment Management, “Declining Volatility and the Rise of Gold” March 9, 2024

Now that the markets have seen an outlier day, we will see how things progress. Most of the time, outlier days within reason are not a cause for alarm, and markets return to normal within a short timeframe. We will continue to monitor for more outliers and increased volatility.

Chart of the Week: Russell 2000

Small cap stocks showed strength to end 2023 but have seen volatility in 2024. To chart small caps, we often look at the Russell 2000 index. Relative to large caps, small cap stocks have had declining relative strength since the beginning of 2021 and have continued to be weak in 2024.

Here is a chart of the Russell 2000 with some technical points:

Source: Canterbury Investment Management. Chart created using Optuma Technical Analysis Software

1. The horizontal black line represents prior resistance, that could behave as current support. Resistance and support are points where supply and demand shift. Right now, following a short decline, the Russell 2000 is sitting on potential support. Keep in mind that his area has shown to be strong resistance in the past. We will see if the support is strong.

2. Since early January, the Russell 2000 has used its 50-day moving average. You can see in the chart that every decline this year has found its footing right at the 50-day moving average of price. Last week, however, the Russell 2000 saw a “gap-down” through this moving average. A “gap-down” is when today’s high is lower than yesterday’s low. Gap-downs, particularly through areas of support, are not usually bullish.

3. We have shown the MoneyFlow index in several charts, but as a reminder, it is a volume indicator. Volume is used as price confirmation. While prices have moved higher, the MoneyFlow Index did not set a new high. It matched its prior high from July. This is small “negative divergence” where volume has not strongly confirmed the upward move.

Bottom Line

Markets just experienced an outlier day. Outlier days are typical when volatility gets too low. While they are typical, they should not be frequent.

Following Friday’s volatile move, Monday saw a decline where the S&P 500 was up as much as 0.80% but finished the day down (-1.20%). That is not the move that investors were hoping for, but it is not out of the ordinary. Most of the time, following an outlier day, markets will be shaky in short run, but eventually find some footing and carry on. We will continue to monitor for more outliers and rising volatility.

For more news, information, and analysis, visit the ETF Strategist Channel.