By Chris Konstantinos, CFA

SUMMARY

- The US economy continues to outperform its peers.

- We believe this relative strength will continue.

- Economic strength is positive for stocks but creates near-term policy uncertainty.

The (Mostly) Pros and (Occasional) Cons of the World’s Strongest Economy

The term ‘American exceptionalism’ refers to the belief that the United States is a unique and potentially superior nation for historical, ideological, or religious reasons[1]. Often first attributed to 19th century French political scientist Alexis de Tocqueville, the phrase can be controversial, depending on what side of the ideological or religious divide you find yourself on.

Why the US Economy is ‘Exceptional’

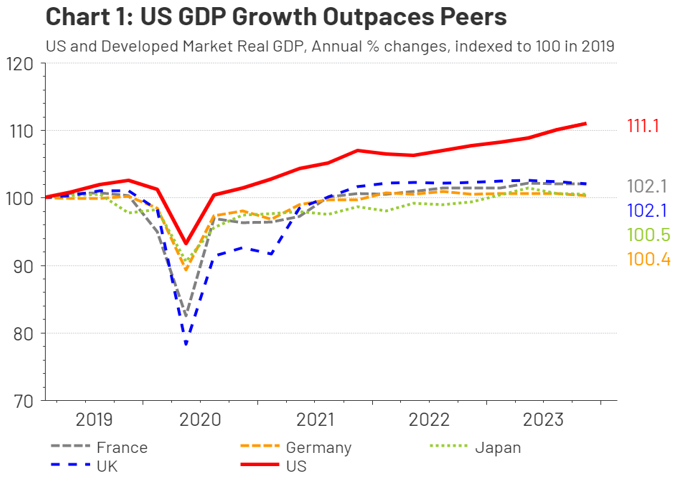

That said, simply looking at this claim in terms of what affects the markets we invest in, we believe there is strong evidence of what we call ‘American economic exceptionalism’. This refers to our view that the US economy is structurally more robust and resilient than its’ developed world peers. This point is getting harder to refute quantitatively, with the US’ remarkable relative rebound coming out of COVID-19.

As can be seen in Chart 1, the US was not only growing faster than Europe or Japan heading into the 2020 pandemic, but it also dropped less during the pandemic AND rebounded more powerfully coming out of it. Most remarkable, the US economy – the world’s largest – is 11% larger today than it was in 2019. Meanwhile, Germany and Japan’s economies are essentially the same size as pre-pandemic, and France and the UK are only marginally bigger[2].

Source: LSEG Datastream, RiverFront. Data quarterly as of November 15, 2023. Chart right shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

[1] Definition courtesy of Encyclopedia Brittanica: https://www.britannica.com/topic/American-exceptionalism

[2] Note: we chose not to display China – the world’s 2nd largest economy – on this chart. While official Chinese National Bureau of Statistics (NBS) data suggests the mainland economy is about 14% larger than in 2019 on the same metric, there is widespread skepticism – which we share – about the credibility of that data. It is widely believed that the national GDP is heavily ‘massaged’ by the Chinese Communist Party for political aims – see our Weekly View from 8/29/23 for more on this topic.

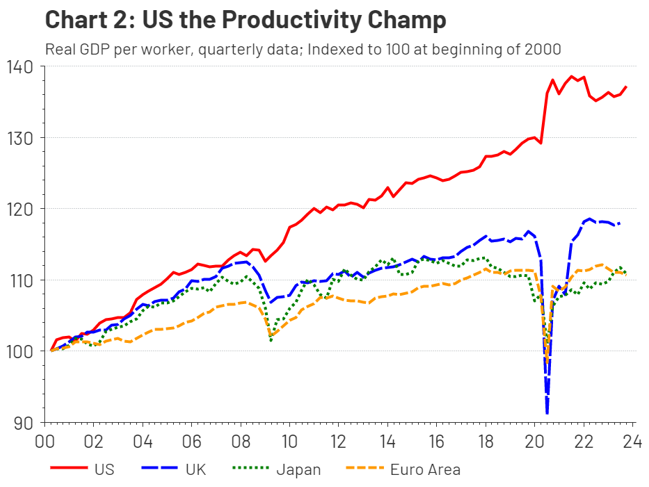

What Makes the Us Economy ‘Exceptional’: Productivity is Key

Chart 2 below, measuring real GDP per hour worked, suggests that US productivity has been on the rise for decades, and seems to have accelerated on a relative basis since the pandemic. What facets make the US economy so productive? The reasons are myriad and deserve deeper exposition than we have space for in this publication. However, at the risk of oversimplifying, we think it boils down to three major differentiators for the US:

- A culture of innovation and entrepreneurship: Our higher education system turns out many of the world’s foremost innovators (and innovations) in technology, healthcare, and engineering. The power of artificial intelligence (‘AI’ – see our Weekly View from 9/5/23 for our thoughts on AI) will likely only extend this lead. This track record of entrepreneurship is supplemented by low barriers to starting a company, relatively pro-business regulatory environment, strong intellectual property (IP) protection, and deep, established capital markets. These characteristics result in the US remaining a bastion of entrepreneurship compared to Europe or Japan, in our view.

- Greater labor flexibility: We believe the US labor market is more flexible than those of Europe or Japan. Companies in the US are less encumbered by regulation and more able to flex their workforce up and down in real time to meet changing industry conditions, protecting profits and increasing productivity in the process. While this can make employment more stressful for workers, it allows for greater employee mobility and, in our opinion, leads to greater employment opportunities en masse. We think this point is backed up by the US leading its developed peers with the lowest unemployment rate at 3.7% as of January 2024.

- More advantaged demographics: Unlike much of Europe or north Asia, the US boasts a meaningfully younger demographic and a population that’s still growing. This is in large part thanks to the ‘Millennial’ and ‘Gen Z’ demographic cohorts, which represent two of the largest ‘baby booms’ in US history. Consider the median US citizen age of 38.5 years old, versus Germany at 46.7, Italy at 48.1 and Japan at 49.5 (data: cia.gov, 2023 estimates). While China’s median age skews a bit younger than Japan or Europe at 39.5, their population has now started to shrink for the first time since the 1960s (see Weekly View on China from 8/29/23), suggesting their demographic dividend is now well behind them.

Source: LSEG Datastream, OECD, RiverFront. Data quarterly as of September 30, 2023. Chart shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

What it Means for Stocks…Strategic Benefits of Economic Exceptionalism

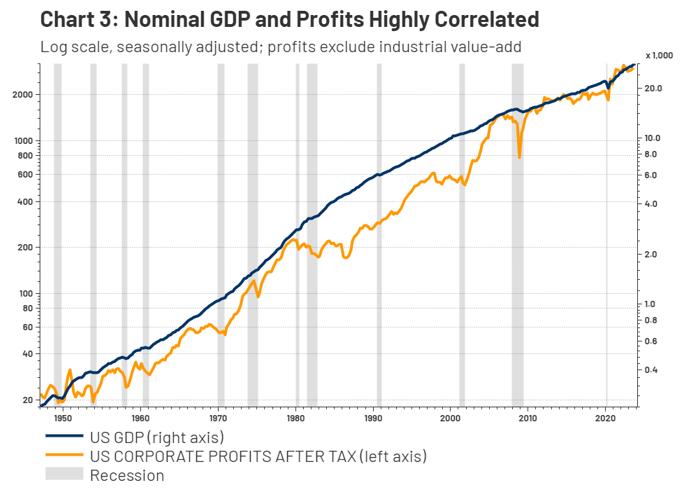

For both US stocks and for the US dollar, being connected to a more productive, growing economy has myriad benefits… not least of which is the strong long-term correlation between US GDP growth and corporate earnings growth (Chart 3, top of next page).

As equity investors, we care deeply about corporate profits…and thus we will take a structurally stronger economy over a weaker one any day – even if it means a slower interest rate cut cycle! While interest rates are a powerful driver of near-to-intermediate term stock sentiment and valuations, in our view corporate earnings are the more durable longer-term driver of a stock market’s returns (see our 2024 Outlook for more on this topic). Our Outlook calls for corporate earnings to be stronger than consensus believes in 2024.

Source: LSEG Datastream, BEA, RiverFront. Data quarterly as of November 15, 2023. Chart left shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

Tactical Perspective: Some Near-Term Challenges with a Hot Economy

However, from a tactical perspective, this economic strength may paradoxically also create near-term market volatility in 2024, as the economy’s buoyancy has stoked uncertainty about future Fed policy. While the market entered the year expecting five to six interest rate cuts from the Fed, RiverFront believed that the economy’s strength and the uncertain path of inflation from here would lead to fewer cuts. While the market has now come closer to our way of thinking – now Fed funds futures markets are now only pricing in approximately 3 cuts this year – we still believe this may be overly optimistic.

In the shorter run, we will also have to accept the additional market volatility and occasional scares that are likely to accompany speculation around the Fed and future inflation readings. The first half of presidential election years tend to be volatile for stocks, before generally resolving to the upside…and we expect the same in 2024. Thus, we expect alternative yield strategies which benefit from increased volatility to be a useful investment strategy for the current backdrop.

Conclusion

We believe ‘US Economic Exceptionalism’ is one of the main reasons that the US economy and stock markets have structurally outperformed international peers. We think this is likely to continue for the foreseeable future despite cheaper valuations overseas, a topic we covered in detail a couple of weeks ago in our Strategic View on developed international.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Definitions:

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health..

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at riverfrontig.com and the Form ADV, Part 2A. Copyright ©2024 RiverFront Investment Group. All Rights Reserved. ID 3369879

For more news, information, and analysis, visit the ETF Strategist Channel.