As we showed previously, inflationary pressures follow the change in the growth rate of money supply by six to eighteen months. Recognizing that relationship is how we predicted that the rate of inflation would fall precipitously during 2023.

Unless recent trends, such as a slowing in demand growth and/or money growth quickly reverse, it will become increasingly clear that the U.S. Federal Reserve has already done enough to achieve their 2% average rate of inflation goal.

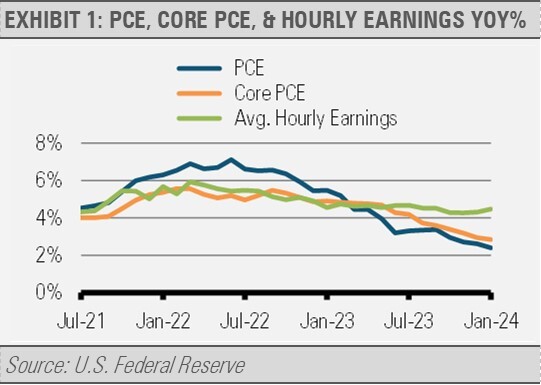

We view this as a very strong positive for U.S. households as wage growth persists at above-average historical rates that reflect the tight labor market. In fact, average hourly earnings have been growing faster than inflation for some time now as it has outpaced the rate of both PCE and Core PCE inflation. We expect that trend to endure as inflationary pressures continue to decline and wage growth persists. Persistent wage growth and falling inflation are important positives for the U.S. economy over the year ahead.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.

For more news, information, and analysis, visit the ETF Strategist Channel.