By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

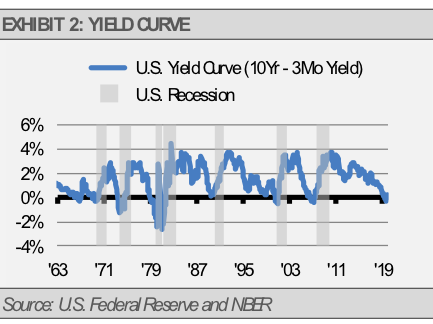

There was no surprise that the federal funds rate was left unchanged at the Federal Open Market Committee (FOMC) meeting in December. It was made clear with additional statements that we should not expect to see further rate cuts in 2020. With some mixed signals in economic indicators, low inflation, and mounting geopolitical risks, it would also be unlikely to see rate hikes, especially after the U.S. Federal Reserve’s apparent oversteps in raising rates in 2018 that led to a yield curve inversion. This would indicate a range bound 10-year Treasury yield and minimal interest rate risk in the near term. It is our opinion that with the pause and the fact that the yield curve inverted, we might expect to see more risk for credit than interest rates.

The yield curve is a strong indicator for economic slowdowns and Fed policy mistakes have been the cause of every U.S. economic recession since World War II in our opinion. Recessions usually follow a yield curve inversion with a long lag time as past recessions have occurred 8 to 18 months after a curve inversion. That means we are not out of the woods yet. While we remain cautiously hopeful that the Fed may for once side step a policy mistake, credit spreads are so narrow that investors are not getting paid for the risks in our view.

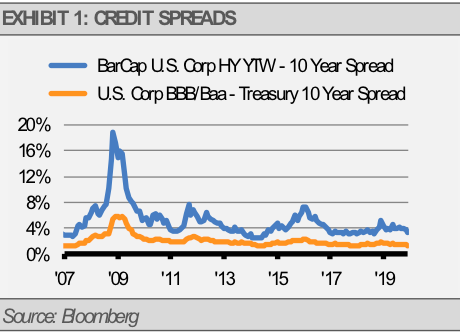

Credit spreads for BBB rated corporate bonds are running over 70 basis points lower than their historical average. Below investment grade bond yields are even lower at nearly 200 basis points under their historical average. Based on the usual lag time between a yield curve inversion and a recession, there could be some additional pressures on corporate bonds, such as BBB investment grade and high yield. Corporate bond spreads could widen well ahead of a recession as they tend to be an indicator themselves. In our opinion, investors are not being paid to take on credit risk at this point.

The yield curve has now normalized, which makes the thought of taking on some level of duration risk more appealing. With corporate bond spreads at historical lows, higher quality bonds, such as taxable municipals and government bonds with durations in the 7- to 10-year range, look like a more attractive space to pick up additional yield in the current environment where there is little risk of inflation. In our opinion, long-term interest rates will be contained in a range for now. If the inverted yield curve this past summer turns out to be indicative of a recession, then we could see longer rates move down significantly and higher quality longer duration bonds should outperform.

With mixed economic indicators and the normal lead time of a yield curve inversion to a recession it is hard to make the case that investors are being fairly compensated for credit risk at this point. With little inflationary pressure, picking up yield in higher quality bonds in the 7- to 10-year duration range makes more sense as they offer more protection and less downside risk in our opinion.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.