By Matthew J. Bartolini, CFA, Head of SPDR Americas Research

Well, I guess someone reads our stuff after all. Recently, we have written a lot about the importance of analyzing trading costs as a part of an ETF’s total cost of ownership (TCO). And how commissions are a big part of that side of the TCO equation. Or at least they were.

During the first week of October, a number of RIA custodian platforms and online brokerage firms cut commissions to zero for ETFs, options and single stocks. And while I take our thought leadership victory lap a bit in jest, the victory lap for investors is real.

Investors for the win

Commission-free trading is nothing new. At State Street SPDR ETFs, we have steadfastly promoted it for years by partnering with multiple platforms to offer a wide selection of our ETFs commission-free. However, the change from just a select list of commission-free ETFs from certain issuers to ALL ETFs industry-wide is a big win for every investor. It’s simple. Choice has expanded, further democratizing investing.

In the past, investors may have shied away from using ETFs that were not part of a commission-free arrangement, even though they felt the ETF’s strategy was superior or the liquidity profile was better than the commission-free option. The latter reason is more likely, as some of the more heavily traded ETFs were excluded from prior commission-free arrangement because the platforms’ commission give-up was previously just too great.

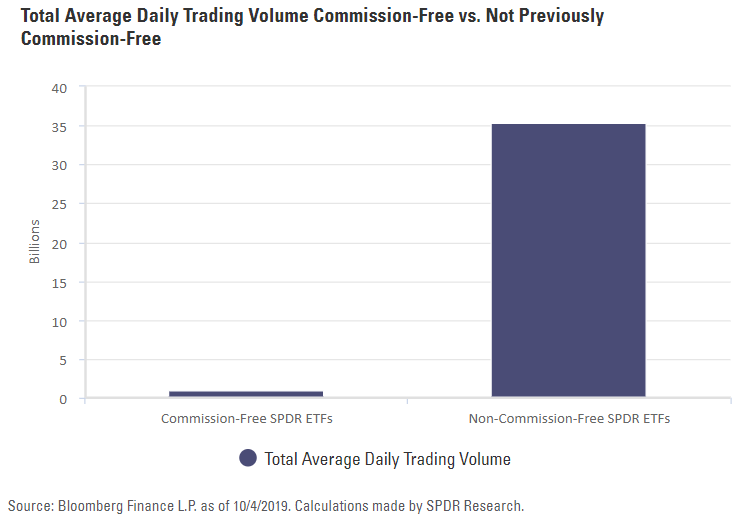

Now, by offering commission-free trading for all ETFs, these platforms are sacrificing revenue to expand the investors’ toolkit. That’s fantastic for portfolio construction and liquidity management. The figure below compares the total average daily trading volume over the past 30 days for SPDR ETFs that traded commission-free at both Schwab and TD Ameritrade (two of the larger firms now offering all ETFs commission-free) with our ETFs that did not trade commission free on either platform. The first list contains 84 ETFs while the second has just 26 funds.[1]

It is significant that the total average daily trading volume for our funds that previously did not trade commission-free is $35.4 billion versus less than $1 billion for the commission free-style funds. As far as SPDR is concerned, turn on the spigots and let liquidity run like the Mississippi River through your portfolio!

Still need to know TCO

Just because commissions have dropped across major platforms this doesn’t mean you should throw trading cost considerations or liquidity due diligence by the wayside. You still need to evaluate bid-ask spreads and depth of market. Depending on your rebalancing size and frequency, these trading costs can accumulate significantly and have a larger impact on the TCO than any expense ratio difference between two ETFs.

Investors are likely determining exactly how much commission-free trading will benefit their portfolios and how their trading execution strategies might change . We should also watch for derivative effects on the broader industry. For example, how might commission-free ETF trading impact the mutual fund industry—especially since ETFs are already more tax efficient?

As the dust settles on this positive new development, we reiterate our constant message about the importance of conducting due diligence. Liquidity matters, and it’s always crucial to evaluate an ETF’s TCO.

[1] The list doesn’t total to our total count of 140, as some funds were only commission-free at one firm. These lists are examining commission-free at both versus not commission-free at both.

This article was published with permission from State Street Global Advisors.