Major Indices Decline in August

Amid inflation concerns and fears that the Federal Reserve will keep interest rates higher for longer than expected, all three major US stock market indices were down in August. Broad-based emerging market equities (-6.1%) were among the worst performers, followed by US small-caps (-4.2%) and international developed equities (-3.8%). Aside from high yield credits (+0.2%), bonds were mostly down as investment grade corporates fell 1.2%, Treasury Inflation Protected Notes declined 0.8%, and municipal bonds decreased 0.8%. Commodities produced mixed returns as crude oil gained 2.6% while silver, gold, and broad-based commodities were down (-1.3%, -1.3%, and -1.0%, respectively).

Fed May Need to Raise Rates Further

At this year’s annual Jackson Hole symposium, Federal Reserve Chairman Jerome Powell expressed a hawkish stance. “Although inflation has moved down from its peak — a welcome development — it remains too high,” he stated, as core annualized CPI and PCE for July remain at more than double the 2% target (4.7% and 4.2%, respectively). His statements suggested that the central bank may need to increase interest rates further given robust GDP growth and consumer spending readings, as well as a resurgence in housing market activity. “Additional evidence of persistently above-trend growth could put further progress on inflation at risk,” Powell commented. He also acknowledged various indications that the strength of the labor market is cooling, but additional tightening may be warranted if such developments halt or reverse. Moreover, the Fed Chairman indicated policymakers will “proceed carefully” at upcoming meetings, and implied a patient approach to additional rate hikes so that officials have time to assess how recent tightening is affecting the economy.

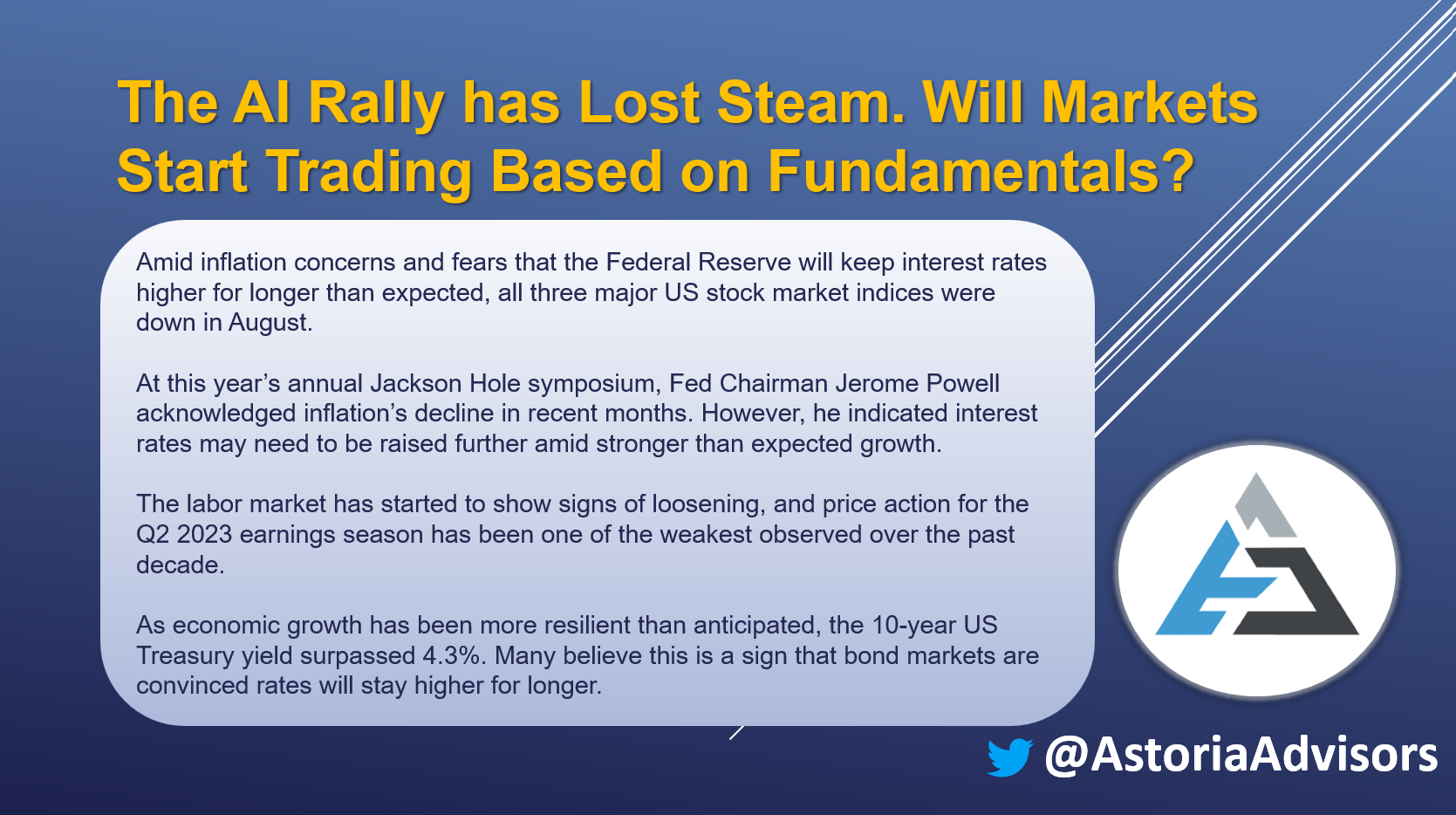

Loosening in the Labor Market

The most recent Job Openings and Labor Turnover Survey (JOLTS) revealed that job openings in July were 8,827 thousand, notching their lowest reading in 28 months. Additionally, August ADP payroll data came in softer than expected, and the prior two months of nonfarm payroll data saw big downward revisions, all suggesting that the labor market is loosening. As tightening has lagged effects, are the Fed’s interest rate hikes starting to take effect?

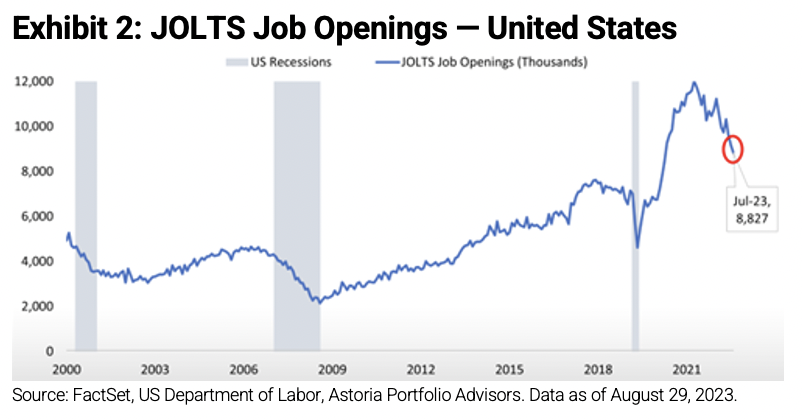

Sell the News?

In terms of price action on the day after reporting earnings, the Q2 2023 earnings season has been one of the weakest observed over the past decade. Even for stocks that beat earnings estimates, price action was more muted compared to history. Are investors starting to question the disconnect between market fundamentals and the economic outlook?

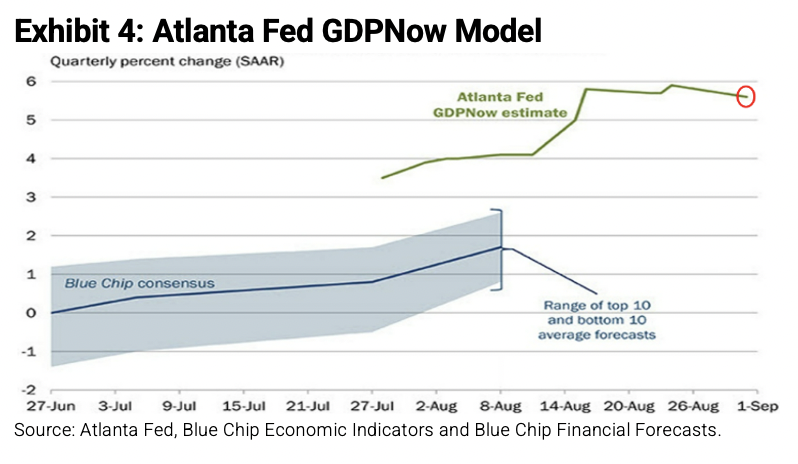

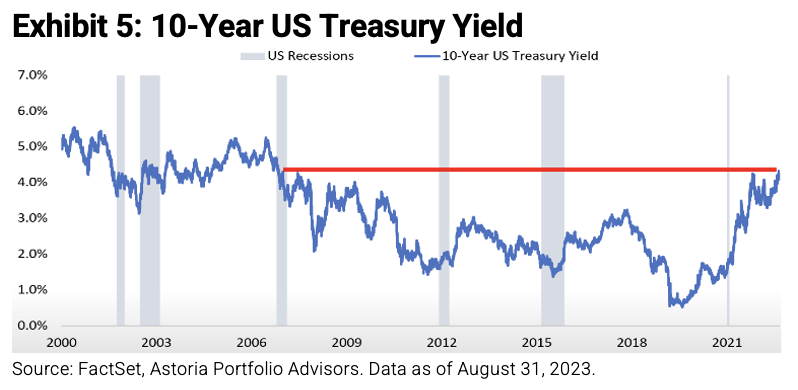

Long Dated Yields See Higher for Longer

Per the Atlanta Fed GDPNow model as of August 31st, GDP is expected to grow an annualized 5.6% in Q3 2023. Though this forecast is expected to come down as the quarter progresses, economic growth has been more resilient than many anticipated. As a likely result, the 10-year US Treasury yield surpassed 4.3% on August 21st, its highest level since 2007. Many believe this is a sign that bond markets are convinced rates will stay higher for longer to rein in the economy’s strength.

The AI Rally has Lost Steam. Will Markets Start Trading Based on Fundamentals?

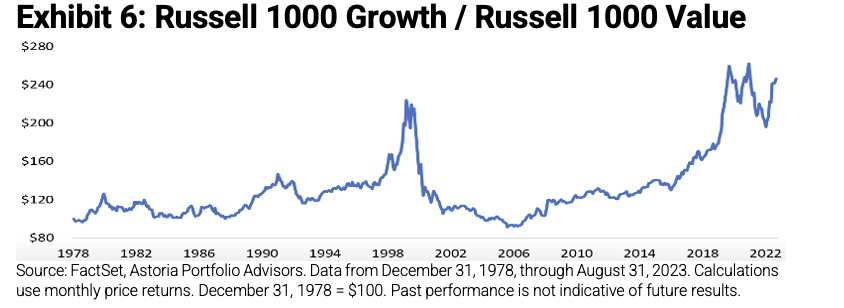

When looking at growth relative to value via their respective Russell 1000 indices, growth is outperforming value by historically elevated levels. As growth stocks have had an incredible AI-related run this year and their valuations have richened, does this suggest a turning point lies ahead where cheaper and fundamentally attractive stocks outperform? Furthermore, since 2019 to date, growth-like sectors have made up 70-80% of the S&P, exceeding the highs last seen around 2000. However, their share of the S&P has decreased from the highs in recent years, while the portion of cyclical sectors has increased. As we enter a new macroeconomic environment, likely characterized by not as stable inflation and higher volatility compared to the last decade, will this trend continue?

Warranties & Disclaimers

As of the time of this publication, Astoria Portfolio Advisors held positions in IEMG, IVE, SPMD, SPY, SPSM, IVW, IEFA, MUB, TIP, AGG, IEF, HYG, LQD, BCI, GLD, USO, and SLV on behalf of its clients. There are no warranties implied. Past performance is not indicative of future results. Information presented herein is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. The returns in this report are based on data from frequently used indices and ETFs. This information contained herein has been prepared by Astoria Portfolio Advisors LLC on the basis of publicly available information, internally developed data, and other third-party sources believed to be reliable. Astoria Portfolio Advisors LLC has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to the accuracy, completeness, or reliability of such information. Astoria Portfolio Advisors LLC is a registered investment adviser located in New York. Astoria Portfolio Advisors LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements.

For more news, information, and analysis, visit the ETF Strategist Channel.