by CHRIS KONSTANTINOS, CFA and KAETLIN COLLINS, CFA

Contagion Risks Receding…Contracting Loan Growth Likely to Slow US Economy

We are about six weeks removed from the ‘Bank Panic of ‘23’, when the abrupt failure of Silicon Valley Bank (SVB) and Signature Bank (see Weekly View from March 20, 2023) set off widespread investor concerns about a financial system contagion, ala 2008. While media coverage of banking troubles has receded, last week’s large deposit outflows at First Republic Bank (FRC) has investors on edge again, culminating with JP Morgan’s (JPM) announced takeover of the failed bank early Monday morning. RiverFront monitors a host of broad financial system data to try and gauge the level of stress US banks are facing. Today we provide a visual update on a few of the more important stress indicators, in our view.

Bottom Line: We believe the worst of the ‘contagion risk’ seems to have passed, due to swift action by the Fed and Treasury. However, we continue to believe the ripple effects, including lower earnings for regional banks and a contraction in credit availability to small and medium size businesses, will continue to be felt in the US economy. Positive earnings trends for large ‘global systemically important banks’ (‘GSIBs’) are helping ease the blow for large US and European banks, but we continue to avoid smaller regionals exposed to continued deposit outflows and commercial real estate lending.

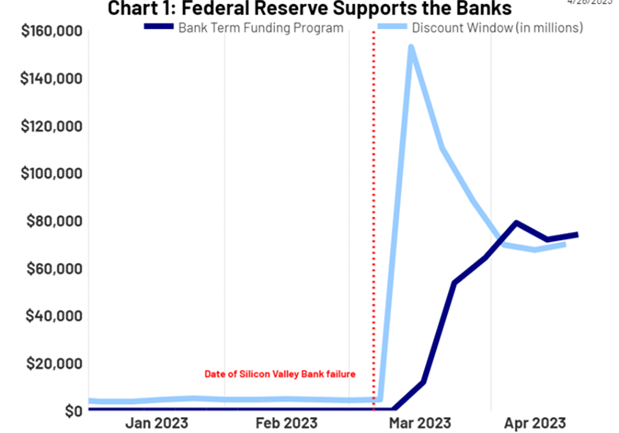

FED’s EMERGENCY LENDING PROGRAMS: Started Shrinking…a Sign That Contagion Risks are Receding

WHY IT MATTERS: The Fed has various emergency lending programs on its’ balance sheet to help banks with liquidity crises, including the ‘discount window’ and the newly formed Bank Term Funding Program (BTFP). In the aftermath of SVB, these two programs spiked, serving as a ‘lifeline’ for smaller US banks concerned about deposit outflows (see chart).

Source: Refinitiv Datastream, RiverFront. Data weekly as of April 21, 2023. Chart shown for illustrative purposes.

RIVERFRONT’S TAKE: As you can see, the BTFP demand (dark blue line) has retraced some and discount window borrowing (light blue line) has been cut in half from their crisis highs, highlighting increasing stability in the banking sector. We view this as a net positive for the financial system, suggesting that US banks on the whole are feeling more secure about their liquidity. However, the Fed balance sheet in general has not yet reverted to pre-March levels, suggesting to us that banks are still in a heightened state of tension.

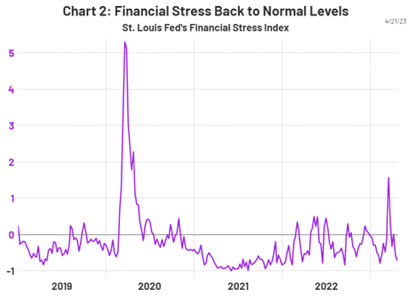

FINANCIAL STRESS: Back to Normal Levels…a Positive for Markets and the Economy

Source: Refinitiv Datastream, RiverFront. Data weekly as of April 21, 2023. Chart shown for illustrative purposes.

WHY IT MATTERS: The St. Louis Fed Financial Stress Index uses 18 weekly data series that include seven interest rate series, six yield spreads and five other indicators to capture some elements of financial stress. The average value of the index is designed to be zero. Thus, zero is viewed as representing normal financial market conditions.

Values above zero suggest above-average financial market stress, as in the early stages of the pandemic in 2020, or more recently in early March. Prolonged time above zero suggests the type of liquidity squeeze that can have adverse effects on the economy.

RIVERFRONT’S TAKE: We are heartened by this index’s move back below zero (see Chart 2) after the initial spike in March…this suggests to us that financial liquidity and stress are back below normal levels.

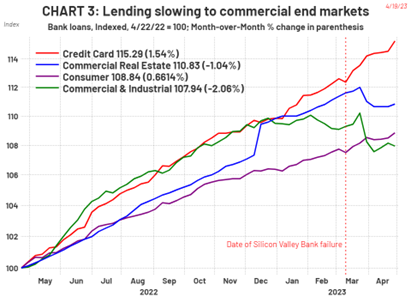

LOAN GROWTH: Starting to Contract in Commercial Real Estate, Industrial End-Markets

Source: Refinitiv Datastream, RiverFront. Data weekly as of April 21, 2023. Chart shown for illustrative purposes.

WHY IT MATTERS: Commercial real estate developers and other small US businesses rely on regional banks for capital needs. One result of the recent regional troubles is likely to be lower loan availability for entrepreneurs and businesses to fund new projects and working capital advances.

RIVERFRONT’S TAKE: While it hasn’t dropped significantly yet, we view the post-SVB contraction in bank loans to real estate and industrial end-markets (see blue and green lines on chart) as a potential negative catalyst for economic growth and employment. However, consumer and credit card lending (red and purple lines) appear unaffected thus far.

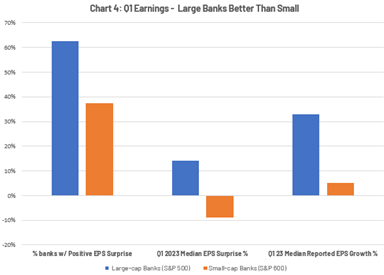

BANK Q1 EARNINGS: Successful for Large Banks, Much Less so for Regional Lenders

Source: Refinitiv Datastream, RiverFront. Data as of April 28, 2023. Chart shown for illustrative purposes.

WHY IT MATTERS: We tend to view earnings as a ‘scorecard’ on the health of a business. Declining earnings not only impact current operating activity but may also portend future business headwinds. To this end, we’ve seen a divergence in the Q1 financial results for banks. Earnings-per-share (EPS) for larger GSIB banks have been generally outperforming expectations, with smaller, regional banks generally underperforming (see chart, next page). Digging into the results shows regional banks struggling to maintain deposit levels, which is negatively impacting lending ability. However, larger banks’ revenue streams are typically more diversified, which has bolstered earnings.

RIVERFRONT’S TAKE: In our opinion, this bifurcation in results between larger and smaller banks is related in part to the SVB fallout. Regional banks saw an initial drop in deposits around the SVB crisis, and while they leveled out toward the end of Q1, flows to money market funds as well as toward larger, more stable banks have made it more expensive for smaller banks to attract new deposits. JP Morgan’s assumption of First Republic’s $92B of deposits in its’ takeover is another example of the ‘zero-sum’ nature of banking deposits, whereby often one institution’s loss is another’s gain. For the foreseeable future, we expect large banks to continue to benefit from these issues at the expense of smaller regional banks with less diversified revenue.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Definitions:

The Federal Reserve System (FRS) is the central bank of the United States. Often simply called the Fed, it is arguably the most powerful financial institution in the world. It was founded to provide the country with a safe, flexible, and stable monetary and financial system. The Fed has a board that is comprised of seven members. There are also 12 Federal Reserve banks with their own presidents that represent a separate district.

The discount window is a central bank lending facility meant to help commercial banks manage short-term liquidity needs. Banks that are unable to borrow from other banks in the fed funds market may borrow directly from the central bank’s discount window paying the federal discount rate.

The Bank Term Funding Program (BTFP) is an emergency lending program created by the Federal Reserve in March 2023 to provide emergency liquidity to U.S. depository institutions. It was established in response to the sudden bank failures of Signature Bank and Silicon Valley Bank, which were the largest such collapses since the 2008 financial crisis.

Primary earnings per share (EPS) is a measure of a company’s earnings per common share, prior to the conversion of any outstanding convertible securities. It is one of two methods for categorizing shares outstanding. The other method is fully diluted earnings per share (Diluted EPS).

RiverFront has exposure to JP Morgan (JPM) in a custom portfolio and a sub-advised ETF. This is not a recommendation to buy or sell a particular security and there is no guarantee that this security will be held in RiverFront products in the future. A full list of holdings is available upon request.

RiverFront does not have direct exposure to Silicon Valley Bank (SVB), Signature Bank (SBNY) or First Republic Bank (FRB) in any of its portfolios or sub-advised ETFs or mutual fund.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at riverfrontig.com and the Form ADV, Part 2A. Copyright ©2023 RiverFront Investment Group. All Rights Reserved. ID 2876973