“By suppressing volatility, central banks created a system unable to deal with bad news. Or to put it another way, leverage was built up on the premise that nothing bad happens.”

— Andrew Lapthorne

Given their swift plunge, the markets appear to many to be out of control, which increases the concern of investors. We believe the markets are behaving as expected. The investment markets are an abstraction of the real world, after all, with a lot of people using it for different ends.

Our clients use it as a long-term savings tool, believing that investment assets, in the aggregate, grow faster than inflation, giving their current savings greater purchasing power in the future. Though they have points of instability, the public markets have, over time, provided the liquidity and stability clients need to help obtain their retirement goals. The current market disruption does not change our belief that the markets will once again reach that objective.

There are other participants in the market who focus on the short term. Their primary focus is to look for arbitrage opportunities, buying assets that look undervalued and selling others that look overvalued. These participants are sometimes viewed with disdain, but they offer a valuable service by keeping markets honest, liquid, and relatively stable.

Over time, this combination of long- and short-term participation is synergistic, but it can result in periodic imbalances and short-term instability. These periods of disruption are typically short, painful, and can bring about a wonderful long-term opportunity to reinvest at much lower prices for those that have been sitting in excessive amounts of cash. These dislocations have happened in the past and they will happen in the future.

We believe we are in one of those times when the activities of the long and short-term participants are out of balance. How long it will last and how painful it will be is unknown because the data is changing rapidly. As we have stated, patience is a long-term investor’s most important characteristic, especially right now. And with Auour’s strategies holding over 50% cash, patience is a virtue we can afford.

Our signals point to further near-term turmoil as the arbitragers continue rushing for the exits. (Relatively few long-term investors show some of the early signs of cashing out. We took advantage of the slight reprieve early Friday morning to add a little more cash, moving to 52% to 70% across all strategies.

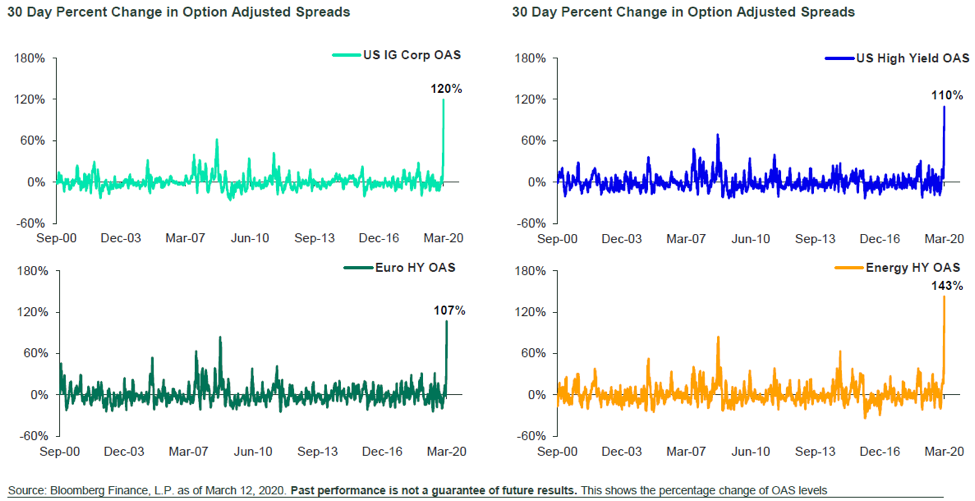

The credit markets are behaving abnormally, with large, sudden movements. Credit spreads (i.e., the risk investors place on debt) are experiencing a jolt not seen before. We believe this recent dislocation is a direct result of the short-term arbitragers being caught on the wrong side of a trade and needing to react at all costs. We see these moves as temporary and would expect central banks to add additional liquidity to the system to help calm the markets. Again, patience is going to be needed.

This article was written by Joseph B Hosler, Managing Principal, at Auour Investments, a participant in the ETF Strategist Channel.