Auour Investments

162 Main Street #2

Wenham, MA 01984

Articles by Auour Investments

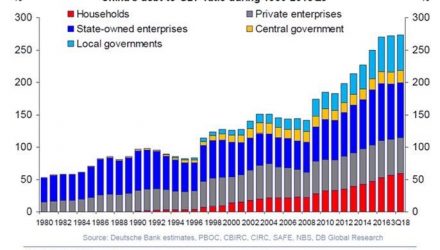

Dollar Dominance

The media often plays up the narrative that the U.S. dollar is about to lose its dominance. We can understand…

Kenneth J Doerr

Ken Doerr’s 22 years of experience includes successfully managing funds with both growth and value mandates, long/short hedge funds, long-only portfolios, quantitative research, and risk modeling. Prior to the founding of Auour, Ken was a Senior Portfolio Manager Mid/SMid-Cap Growth and Head of Quantitative Research for Evergreen Investments Fundamental Equity Group. Prior to Evergreen, Ken was Founding Partner, Chief Investment Officer of Trilene Endeavour Partners, a newly-organized firm offering Market Neutral U.S. Equity Hedge Fund. Ken was a Portfolio Manager at 2100 Capital Group, a subsidiary of Marsh & McLennan, managing the 2100 Capital Endeavour Fund, a market neutral equity hedge fund. Prior to 2100 Capital Group, he was a Senior Vice President and Portfolio Manager at Putnam Investments where he managed a $1 billion dollar sub-account of the Mid-Cap Putnam Vista Fund, a growth fund, and a $3.5 billion sub-account of the Specialty Growth Putnam New Opportunities Fund. Ken served as a member of the portfolio team at Equinox Capital Management that managed a $4.5 billion dollar sub-advisor account of Vanguard Windsor II, a large cap-value oriented fund. He was the portfolio manager for the Equinox Mid-Cap Value Fund. Before joining Equinox, Ken was a Senior Quantitative Analyst at Sanford C. Bernstein. He earned an M.S. in Electrical Engineering from Brown University and a B.E. in Electrical Engineering from the Cooper Union. Ken resides in Bolton, MA with his wife of 17 years, his daughter, two cats, two dogs, and one horse.

Joseph B Hosler

Joseph Hosler, CFA, brings 23 years of investment experience serving the needs of large institutional clients. His background includes portfolio management and investment analysis, predominantly focused on domestic and international public companies. Prior to the founding of Auour Investments, Joe led investment activities within various sectors at Pioneer, Babson Capital, Putnam Investments, and Independence Investment Associates (IIA). While at IIA, Joe drove the effort to design, develop, and launch one of the first quantitatively driven tax efficient investment approaches focused on individuals and taxable organizations. Joe holds an MBA from The Darden School of the University of Virginia, as well as, a B.S. and M.S. in Mechanical Engineering from Boston University. He is an active volunteer within his community and currently sits on the Boston Security Analysts Society’s Strategists/Economists Subcommittee and the Montserrat College of Art Investment Committee. Joe resides in Wenham, MA with his wife of 25 years, two children and three dogs (soon to be four).

Robert Z Kuftinec

Robert Kuftinec has a background in corporate finance having worked in both investment banking and private equity. Prior to the founding of Auour, Robert was a Managing Director at TransOcean Capital where he was responsible for significant foreign equity and real estate investments in the United States. Prior to TransOcean, he was a Managing Director at Overture Capital Partners, a private equity investment firm focused on the middle market, and a Managing Director at Shields & Company, a Boston-based investment bank. Robert has been active on several corporate Boards of Directors including those at the Deutsche Asset Management Small Cap Fund (NYSE), Stronghaven, Inc., and Halcore Inc. He also has been a board member and treasurer at several non-profit organizations. He has an undergraduate degree from Babson College and earned an MBA from the Darden School at the University of Virginia. Robert resides in Carlisle, MA with his wife of 19 years and two children.