By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

As election day approaches and political news reaches a fever pitch, commentators are likely to emphasize the potential implications of the November elections. As professional investors, it is our job to do the best we can for our clients regardless of the environment. We utilize our Multiple Scenario Analysis (MSA) process to think critically about the probabilities and the impact of each potential outcome. In this way, we strive make good decisions by effectively dealing with our biases and prepare for low probability, high impact events in addition to those that might be the most obvious.

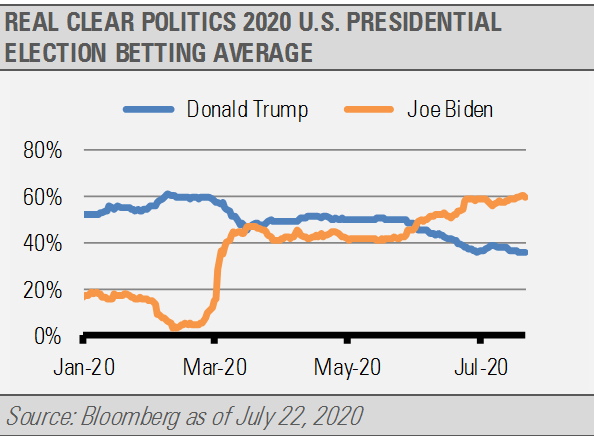

While the polling and betting market data remain fluid, Biden is currently polling better than Trump and the betting markets suggest an approximately 60% probability of a Joe Biden Presidency. These betting markets generally favored Trump until late May with Biden taking the advantage in early June. Keep in mind that these forecasts can change significantly prior to election day and may just be flat wrong. Still, the base case scenario currently involves a Biden victory.

Additionally, Republicans have three times more House of Representative seats at risk than the Democrats in the next election. Our base case scenario is that the Democrats will hold the House in the next Congressional session.

The Senate is more complicated. Currently, Republicans hold 53 seats while Democrats hold 47 seats. Senate rules require 60 votes to overcome a filibuster and close debate on most legislation. It’s important to note that some votes are not subject to the filibuster rule, such as revenue, spending, and debt limit bills as well as executive branch appointments and Federal judgeships. Currently, neither party has enough votes to overcome a filibuster. Therefore, most legislation requires compromise.

In total, there are 35 Senate seats open for the November election. In 12 cases, the incumbent senator is either a Democrat or caucuses with the Democrats. The other 23 seats are held by Republicans. Importantly, of the 23 Republican seats open for reelection, five are considered to be toss ups.

While it is possible that the Democrats win a net three seats to get to 50 and hold the Vice-Presidential tiebreaker, at this point that would not be our base case scenario. Even more unlikely is the idea that the Democrats could win a net 13 seats needed to overcome a filibuster and be able to pass most types of legislation without compromising with the Republicans.

As a result, our base case scenario results in no material legislative change due to filibuster or mixed government. Under this scenario, Biden could make changes by executive order and by executive branch department regulation changes. We doubt that we would see major policy changes otherwise.

So, this scenario suggests no major tax policy changes, although the 2017 tax cuts may get rolled back to some extent. Again, the budgeting process is subject to reconciliation and is not affected by the filibuster rule. As a result, the Democrats could make significant tax and spending changes with a simple majority. But again, that is not our base case scenario. Additionally, we are not likely see such things as a $15 national minimum wage nor other major liberal programs.

Rather, we expect pain for certain industries and companies as a result of more stringent regulations and tougher environmental standards under a Biden administration.

Overall, we do not expect a fundamental change to the U.S. economy, though the markets may become more volatile as the election nears. With no major government policy changes likely, and assuming economic fundamentals do not deteriorate due to some other factors, such as more governmental imposed shutdowns due to a COVID-19 outbreak or a geopolitical crisis, we view an equity market selloff as a buying opportunity.

In fact, this outcome would be consistent with history. As we have demonstrated before, U.S. elections generally do not have major economic impacts. Click here to read our previous article.

In a capitalist system like the U.S., it is our belief that what happens on Main Street is far more important than what happens inside the Washington, D.C. beltway. Productivity, innovation, and strong demographics drive growth and continue regardless of political party. While there is some risk to sectors based on an administration’s platform, we believe that environment can provide opportunities for investment managers with the ability to allocate tactically. In short, it does not pay for investors to significantly alter course due to a pending election.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.