![]() By Ryan Gilmer, CFA – VP Investment Management – TOPS ETF Portfolios

By Ryan Gilmer, CFA – VP Investment Management – TOPS ETF Portfolios

After struggling for years relative to US stocks, emerging markets led major assets classes in 2017 with a return of 37.28% for the MSCI Emerging Markets Index. This year, however, the trend has reversed. Emerging markets have been force fed a cocktail of stronger U.S Dollar valuations, U.S. rate hikes, concerns over new tariffs and renewed local political concerns.

With concerning news surrounding emerging markets, how should investors respond? We believe now is a time to avoid panic and stay the course – here are four reasons why:

Diversification

Investment research for decades has supported the principle that investors receive better risk adjusted returns over the long run by diversifying asset classes inside a portfolio. Since asset class returns are difficult to predict in the very short term, owning a group of investments (including fixed income) should help to smooth out returns over time. Thus, investors are more likely to make better behavioral decisions if they hold a diversified portfolio. Emerging market stocks provide a portfolio with non-dollar exposure, which US based investors may need, while also giving exposure to international economies.

If all the investments in a portfolio move in tandem, there is no diversification benefit. That is, for diversification to work, the underlying assets need to perform differently over time. Consider the YTD returns of the following ETFs through June 30, 2018:

- SPDR S&P 500 Value (SPYV): down +2.24%

- SPDR S&P 500 Growth (SPYG): +7.11%

- iShares Core Mid-Cap (IJH): +3.46%

- iShares Core Small-Cap (IJR): +9.31%

- Vanguard FTSE All World ex-US (VEU): -3.88%

- Vanguard FTSE Emerging Markets (VWO): -7.32%

The long-term benefit is also the short-term problem with diversification – if assets have varied performance, this means certain investments will outperform while others underperform. In other words, a diversified portfolio means there will always be a laggard. The very thing that is designed to generate better risk adjusted returns over time will hamper returns in the short run. But, if you want the long run benefits of diversification, you must maintain a disciplined investment approach and stick with underperforming asset classes. Maintaining a proper allocation to emerging markets is a strategy to achieve this result.

Cyclicality

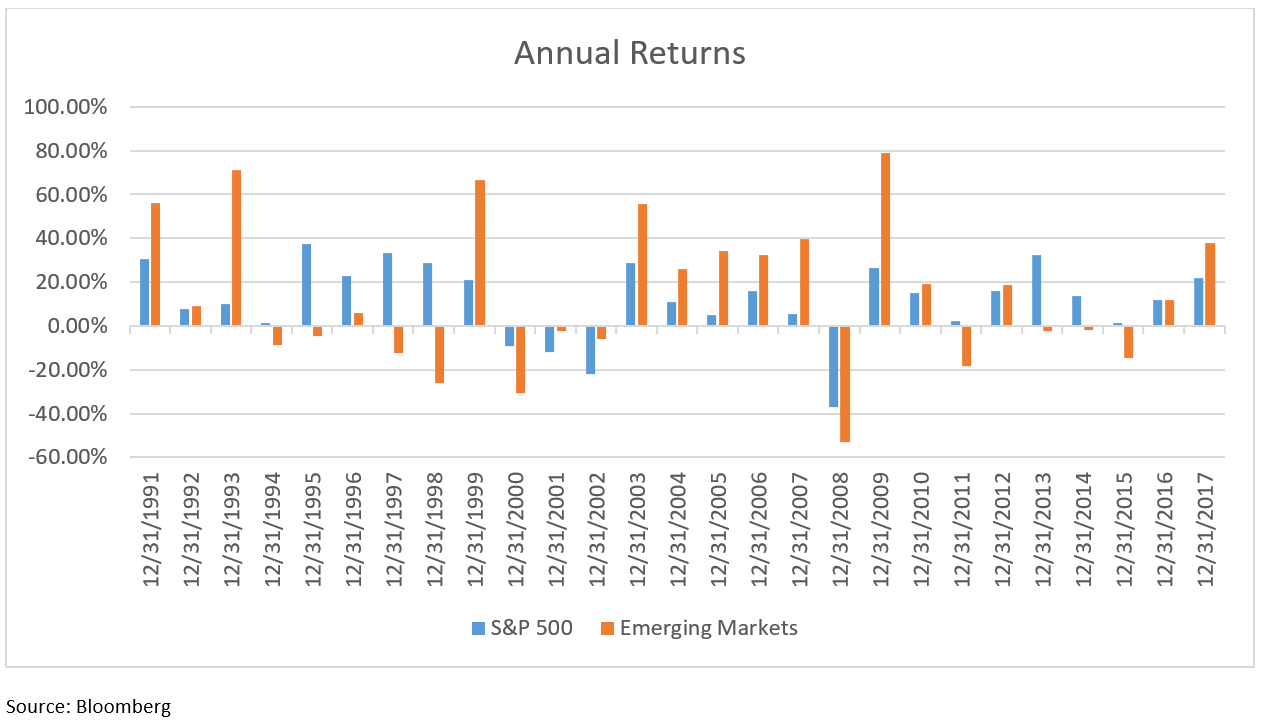

Built into the logic of diversification is the assumption that investment returns are cyclical. Diversification can’t work if certain assets lag in every environment – in that case, you would be better off just to avoid investing in those areas. Over time, however, we find that asset returns are mean reverting. In other words, while emerging markets are performing poorly this year, there are likely to be future periods where they outperform. Historically, this has been the case. Consider the annualized performance for the EM index versus the S&P 500 looking back twenty years:

As you can see from the chart, going back to 1991, emerging markets have had many years both outperforming (2003 – 2007) and underperforming (1995 – 1998) US stocks. In many cases, there is significant return deviation. While it’s not enjoyable to hold emerging markets during the underperforming years, maintaining discipline pays off during the outperforming years. Based on the past 20 years, emerging market underperformance won’t last forever. In fact, given that their weakness has already lasted five years, the cycle would be a factor for positions to change.

Related: Inflation. What Inflation?

Valuations

Both company earnings and price to earnings ratios fluctuate over time. The forces of capitalism drive both fluctuations. In the long run, if corporate earnings stagnate, some businesses will consolidate or be driven out of the marketplace. Those that remain will face less competition and likely make higher profits. Over time, entrepreneurs innovate more efficient products and services, which creates wealth and drives stock prices higher.

As you can see below, the long run trend for earnings is up. Any long-term investment thesis for growth is based on this trend continuing. Even so, there can be extended periods where earnings stagnate. EM earnings are at the same levels they were a decade ago, and lower than they were five years ago, but also roughly four times higher than they were in 1995. It’s worth noting that in 2009, S&P 500 earnings stalled for a similar length of time, before rocketing higher over the next nine years.

While the long run trend of earnings is up, the price to earnings (P/E) ratio is much more cyclical and highly correlated with investor sentiment. When investors are optimistic, they drive the P/E ratio higher, and when they are pessimistic, they force it lower. Most of the time, US stocks command a valuation premium, meaning that they trade at a higher ratio than emerging markets stocks. This makes sense, as US stocks have less volatility, less uncertainty, more stringent accounting standards and rule of law, and generally less risk.

Currently, however, EM stocks trade at a higher than normal discount to US stocks. This means investor expectations are quite low. They are expecting bad news, such as tariffs, trade wars, and continued Federal Reserve rate hikes to continue.