By RiverFront Investment Management

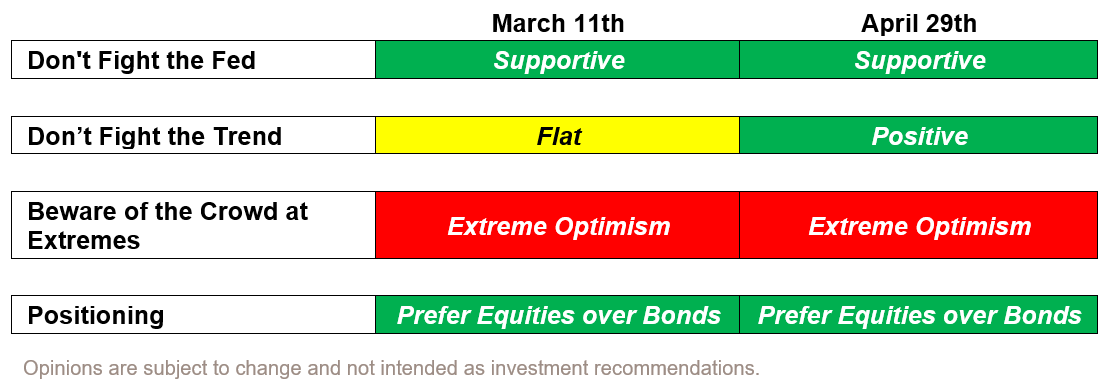

Seven weeks ago, we updated our three tactical rules: 1.) Don’t Fight the Fed, 2.) Don’t Fight the Trend, and 3.) Beware of the Crowd at Extremes. A lot has transpired in that short period of time. First, the Federal Reserve officially announced a revised balance sheet normalization plan that would slow the runoff of Treasuries and mortgages starting in May and ending in September of this year. Second, the S&P 500 rose over 150 points from 2783 to its current level of 2939. Finally, additional progress was made in the trade negotiations between the US and China, China’s economic data improved, and earnings season in the US is off to a better than expected start; influencing investor sentiment. Below you will find a summary chart highlighting changes in the three rules since our March 11th, Weekly View:

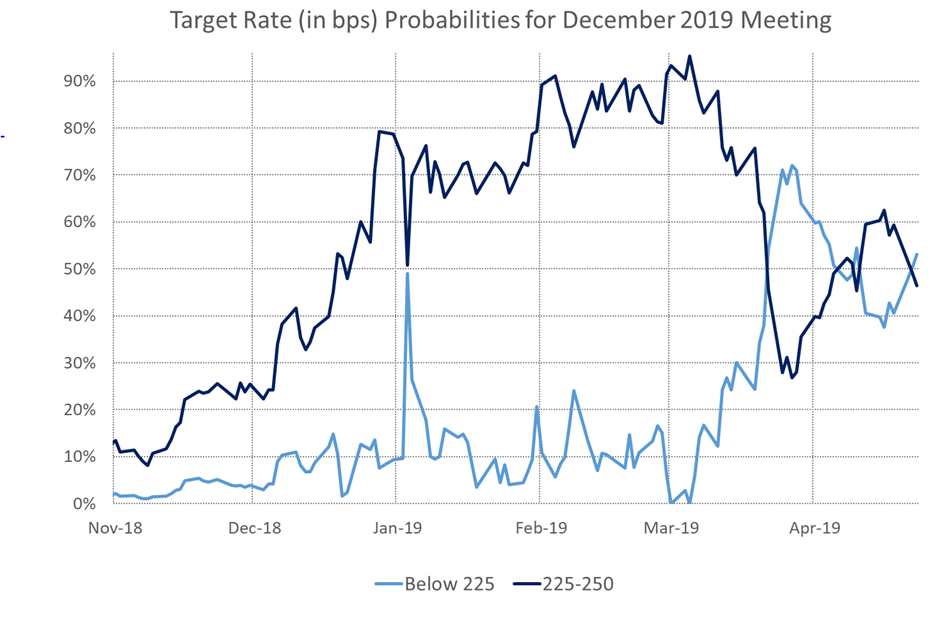

Now that the Federal Reserve rate hiking campaign has been taken off the table and the Fed has stated its willingness to allow inflation levels to run above its 2% target for an extended period, we believe that the Fed continues to be supportive. The Fed’s pausing has helped facilitate lower mortgage rates and to reinvigorate a slowing housing market. The range for the fed funds rate is currently between 2.25 and 2.50%. Since our last update, the probability of the fed funds rate being unchanged through December 2019 has fallen to 36% due to the market pricing in a 64% chance of at least one rate cut before year-end; a scenario that did not exist in March (chart above). Although we believe that traders are now overly optimistic about the prospects of a rate cut we recognize that the Fed is willing to respond quickly to softer data. Thus, for now we believe the Fed is on the investor’s side.

Source: Chicago Mercantile Exchange (CME) Group, RiverFront. Past performance is no guarantee of future results. Not indicative of RiverFront Performance.

Internationally, while the backdrop of central bank policy is accommodative in Europe and Asia, we believe further stimulus is necessary given the tepid trajectory of growth, hence our neutral view. In China, the Peoples’ Bank of China (PBoC) is providing its own version of quantitative easing and we view the central bank guidance as bullish.

The trend, which we define as the S&P 500’s 200-day moving average (smooth line, right chart), flattened after the S&P 500’s high of 2940 in September 2018. The subsequent 6 months consisted of the S&P 500 trading in a range.

Past performance is no guarantee of future results. Shown for illustrative purposes and not indicative of RiverFront performance. See disclosures for index definitions.

However, now that the S&P is nearing its all-time trading high, the trend has steepened and turned positive. This is a significant change from seven weeks ago, reflecting accelerating momentum due to investors embracing the return of Chinese growth and better than expected first quarter earnings by US companies. We wrote on March 11th that the trend was at a crossroad. If it turned positive, the odds for a positive return over the next three months would improve above the long-term average when combined with current sentiment levels. However, a decidedly negative turn of the trend would warrant caution. The former scenario is playing out and therefore we rate the trend overall as ‘bullish’.

Past performance is no guarantee of future results. Shown for illustrative purposes and not indicative of RiverFront performance. See disclosures for index definitions.

Internationally, the positive economic growth in China combined with de-escalating trade tensions has turned the trend from negative to flat as shown by the smooth line in the chart (bottom right) of the MSCI All-Country World ex- US Index. We are encouraged by the index rising above its 200-day moving average.

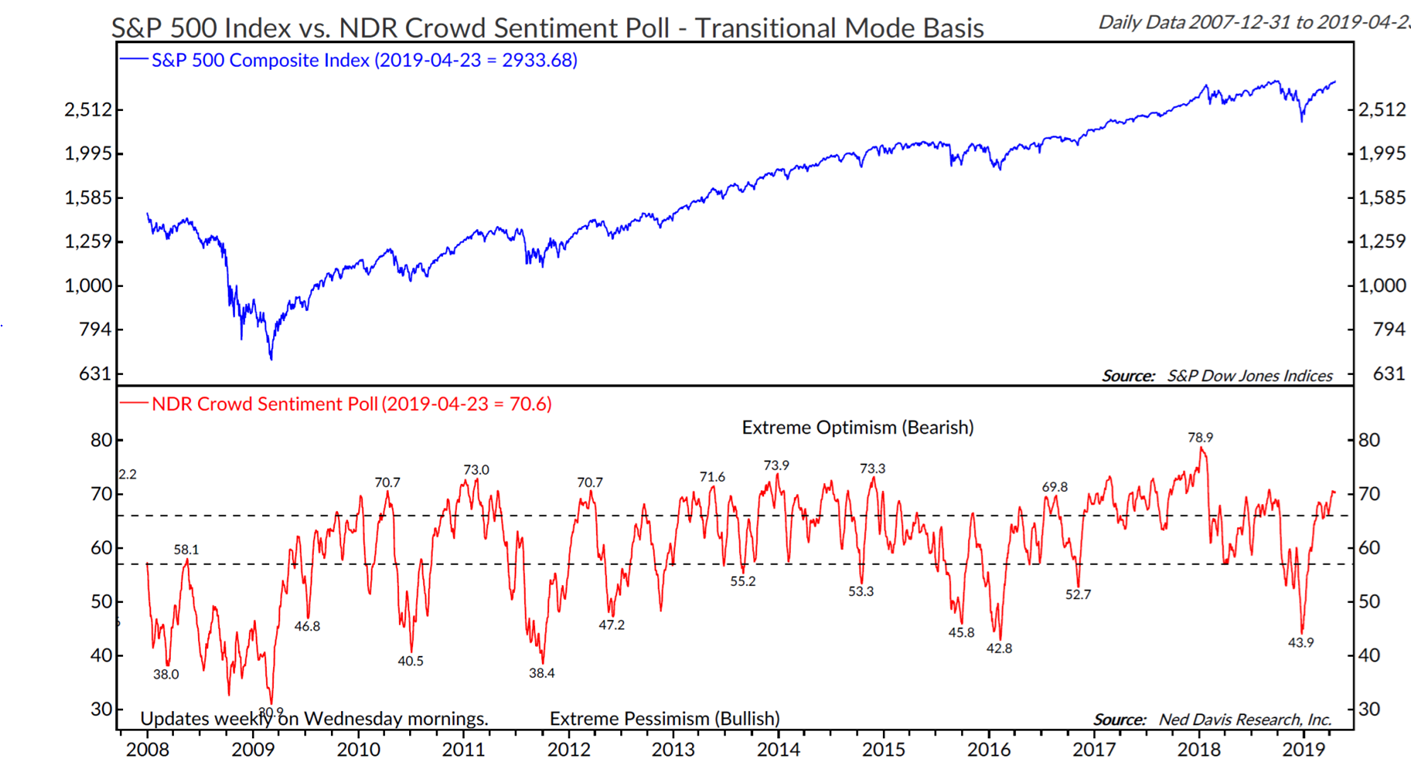

BEWARE OF THE CROWD AT EXTREMES: Sentiment is a contrary indicator at extremes. Analyze sentiment by determining if it is sustainable at current levels. If sentiment is identified to be unsustainable, then as investors we should be willing to lean in the other direction and be prepared to act more aggressively once the condition changes. Current Condition: US: Extreme Optimism, International: Neutral.

Given the S&P 500’s strong start to 2019, investors’ fear of “missing out” could drive the crowd to reach higher extremes of optimism, as sidelined investors are enticed to chase returns. We use Crowd Sentiment Polls from Ned Davis Research (NDR) to help gauge whether the “Crowd” has reached optimistic or pessimistic extremes. As can be seen in the chart below, NDR’s sentiment poll has moved further into “extreme optimism” territory over the last seven weeks, suggesting that we should continue to be more cautious going forward. Extreme optimism can resolve itself in one of two ways; either the market can decline making investors less optimistic, or simply consolidate (trend sideways) until the condition fades.

We have found judging the “Crowd” to be important, however we recognize that crowd sentiment signals often require additional interpretation. For instance, when extreme optimism is combined with a positive trend, which is the current condition in the US, markets have historically tended to grind higher over time. Today, we believe that the US market will encounter some resistance at the S&P’s historical highs and will be range-bound until it can ‘work-off’ the high levels of investor optimism.

While there is no comparable sentiment indicator for international equities, we judge international sentiment to be relatively neutral.

Past performance is no guarantee of future results. © 2019 Ned Davis Research Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com /copyright.html. For data disclaimers refer to www.ndr.com/vendorinfo/.

THE FINAL VERDICT:

We believe the Fed is on the investors’ side, the trend is positive, but the ‘crowd’ is too optimistic. Net/net the conditions for our three tactical rules have improved from neutral to positive. Therefore, we believe that it is appropriate to remain slightly overweight equities given our view of the low probability of a recession and reasonable valuation levels.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

It is not possible to invest directly in an index.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared the composite benchmarks for each portfolio. Composite and benchmark definitions can be found on our website.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

MSCI ACWI ex USA Index captures large and mid-cap representation across 22 of 23 developed markets (DM) countries (excluding the US) and 23 emerging markets (EM) countries.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 834055