The market is transitioning from an environment of interest rate hikes to an environment of interest rate cuts. There is a specific portfolio to own when rates are rising and an entirely distinct portfolio when rates are declining.

- The rate of change for future rate hikes has materially changed. The market is pricing in a higher probability of rate cuts compared to an incremental rate hike. This inherently translates into a new market cycle and hence a different portfolio construct.

- The US earnings recession is now over. With 98% of companies reporting actual results, the blended year over year earnings growth for Q3 2023 is 4.8%, well ahead of the -0.3% estimate as of September 30th. As the prior three quarters saw declines, this will mark the first quarter of positive growth since Q3 2022.

- Investors seem to have thrown in the towel on the recession call. Q3 2023 GDP printed a 5.2% handle per the second estimate, even higher than the original 4.9%. In fact, we had an economic expansion amid an earnings recession in 2023. This is quite rare.

Because of items 1, 2, and 3, investors should consider moving beyond T-Bills, rolling, and waiting an entire year to accrue 5%. We believe this won’t cut it in the new cycle. While those T-Bill yields were attractive, just remember there is an opportunity cost of missing out on larger potential equity gains/fixed income price appreciation if the underlying macro picture continues to improve in 2024. Moreover, investors should ask themselves if it’s prudent to keep buying seven US stocks while ignoring the rest of the world. A broadening out of the market is likely to occur at some point while we transition to a new cycle.

We think five rate cuts is far too aggressive and is likely the market getting ahead of itself. With that said, even the potential end of Fed rate hikes is enough for stock market investors to cheer – see the 9.1% rally in the S&P 500 Index for the month of November.

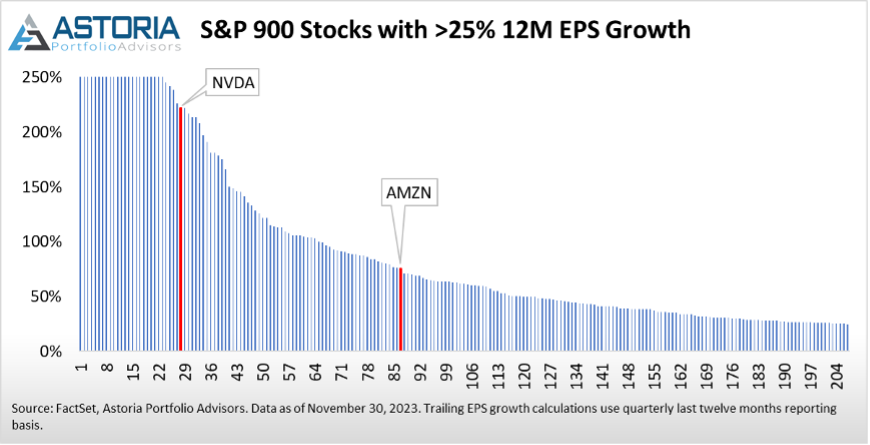

Lower rates will help the housing sector, small businesses, and the mounting credit card delinquencies. In particular, the state of the housing market is crucial. No bull market is likely to commence without a recovery in housing market. From October 27th through December 5th, the SPDR S&P Homebuilders ETF (XHB) is up 23%. Also, it’s worth pointing out that investors no longer need to crowd into defensive mega-cap growth stocks. Going down the market cap range, there are attractive opportunities across other cheaply valued US stocks with appealing growth potential. For instance, when analyzing 900 constituents in the S&P 900 Index, 207 companies saw earnings growth greater than 25% over the last twelve months. More interestingly, only two of the “Magnificent Seven” stocks (NVDA & AMZN) make that list.

In 2023, we were constructive on bonds evidenced by our 10 ETFs for 2023 publication (click here). As the potential peak of the Fed’s tightening cycle is priced in, money market funds and short duration bonds likely won’t be able to keep up in 2024 if rates decline. For those that bought T-Bills in January 2023 and rolled ahead, you tied up your money for twelve months waiting to accrue a 5% yield. Meanwhile, investment grade corporate bonds via the iShares iBoxx $ Inv Grade Corporate Bond ETF (LQD) rallied 7.6% in November.

The biggest risk for 2024 is that the Fed lowers rates and demand inflation resurfaces, creating another 2022 feedback loop.

- Markets typically trade on the margin, and the rate of change is what drives risk assets. Stocks are forward looking, discounting instruments and are rallying because five rate cuts are currently priced in for 2024, there is an acknowledgement that inflation is no longer the primary risk for stocks, and the US earnings recession is over.

- The biggest risk we see is that lower rates shift back demand curves and re-ignite the inflation trade, leading to incremental rate hikes once again. We argued in 2020 that inflation would be a sticky problem lasting for many years. This is a key reason why we are saying investors should always carry inflation protection. The irony of this call is that inflation-linked assets have low correlation to US index beta, carry well in a multi-asset portfolio, and trade at a 40-45% discount to the S&P 500 Index. This has been a no brainer for us.

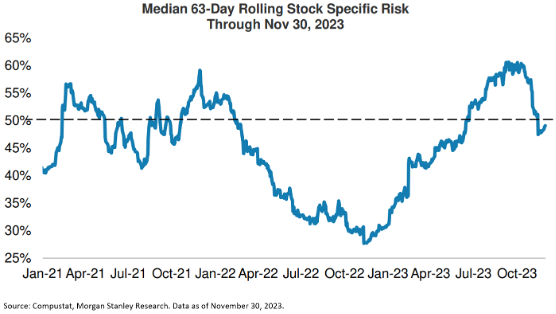

- While the profits recession may be over, corporates are not out of the woodwork. With wage growth expected to decline and hiring to be sluggish, earnings and fundamentals may be of focus when it comes to selecting stocks. Stock-specific has increased in 2023, and we believe it should rise further in 2024 as macro variables become of less importance while corporate earnings take center stage.

It may be difficult to part way with winners, but one should consider this as nothing likely goes up (or stays up) forever.

Amongst our peers, Astoria was arguably one of the first and biggest inflation hawks. We had the fastest rate hiking cycle in half a century, and we are still way above the Fed’s inflation target. Hence, the inflation trade is not over.

We believe there’s north of 75% probability inflation will stay above 2% throughout 2024. We’ve had nearly 500bps of tightening and October annualized Core PCE is still at 3.5%, 1.75x the Fed’s 2% target. With 2024 being an election year, it is our view that the Fed backs off on aggressive monetary policy to let the political cycle run its course.

Our bottom line is that the inflation problem is now more anchored on the supply side, which is tricky and takes years to shift. As mentioned in numerous posts, Apple is not going to shift its supply chains from Asia to the United States anytime soon.

How should investors position their portfolios in 2024?

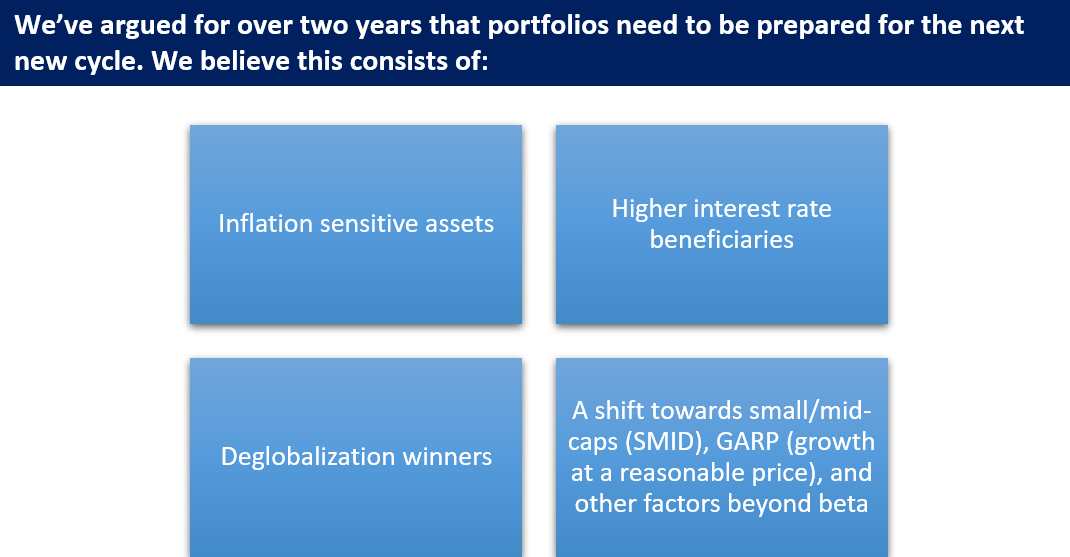

- Increase your equity beta and be overweight equities. Barbell your portfolio risk by owning cyclical growth, transition away from market cap weighted strategies, overweight inflation sensitive assets, nibble on international developed markets, and diversify away from US large-cap index beta (we like GARP and US mid-caps). A new cycle usually signals a change in market leadership.

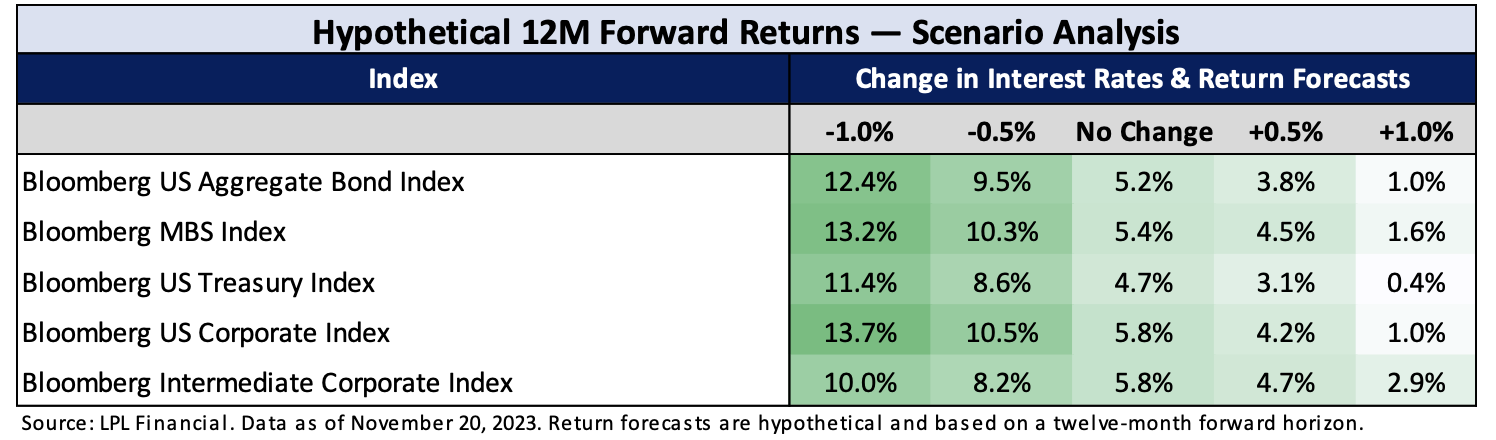

- Say sayonara to those T-Bills. If the underlying macro improves in 2024 and market leadership broadens, the opportunity cost of sitting in money market/T-Bills as yields decline could cause one to miss out on larger potential equity gains/fixed income price appreciation. Deploy that cash in the above equity cohorts or in fixed income via extending duration and increasing exposure to investment grade, high quality corporates and municipal bonds. Why? Given the level of starting yields, hypothetical forward returns for bonds look appealing. For instance, a 50bps decrease in interest rates would cause the Bloomberg US Treasury Index to gain over 8% in the next twelve months. As the bond indices in the table below are high in quality, some may refer to this as a possibility to earn equity-like returns without equity-like risks.

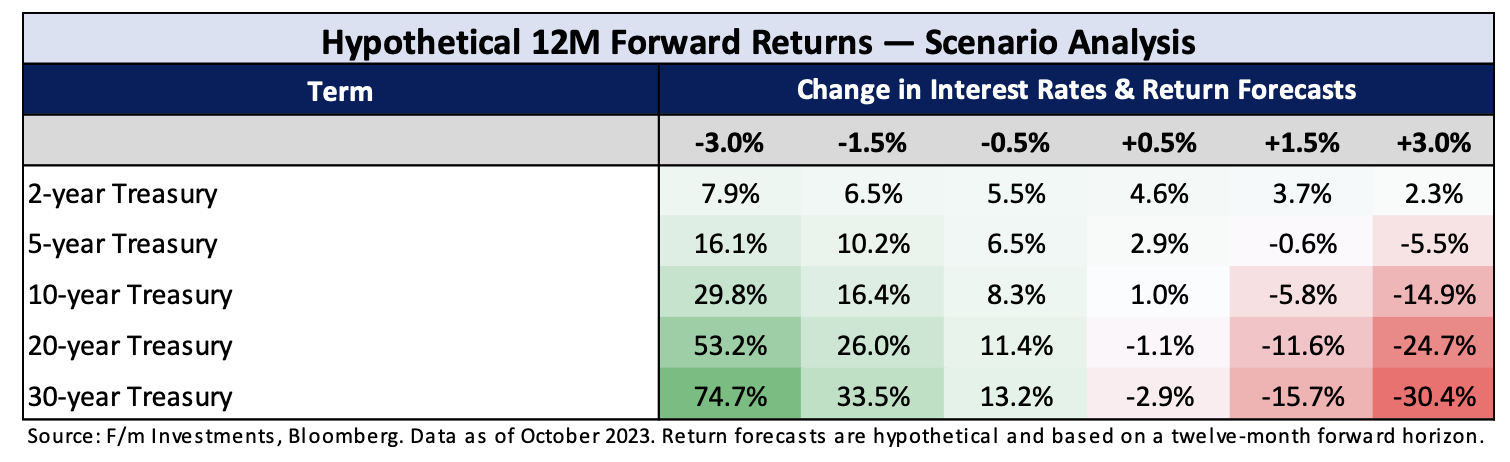

- Play convexity in the rates market. One of our best ideas for 2024 is to use fixed income strategies that benefit from declining rates at the intermediate and back end of the curve. Though the twelve-month forward return forecasts in the table below are from October and rates have come down since, it can be observed that the risk/reward for duration is attractive.

- Find alternatives which give equity-like returns but lower volatility. This is crucial. Fund your alternatives by being underweight bonds.

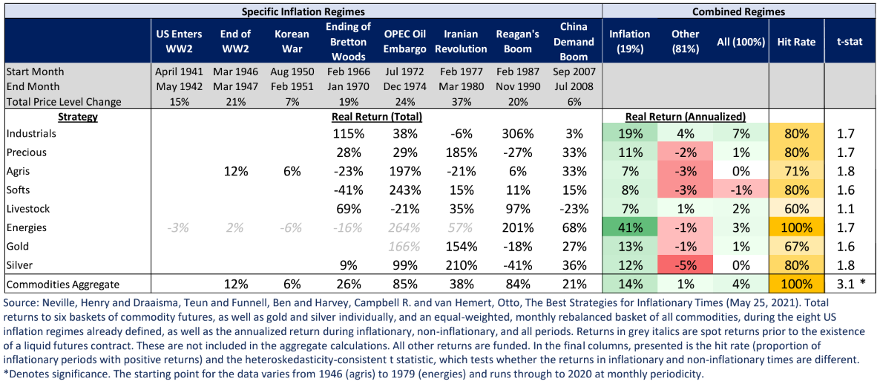

- Overweight inflation-linked assets such as energy, industrials, commodity equities, and physical commodities. As the table below shows, various commodities have produced positive returns with a high hit rate during prior inflationary regimes. When the profit cycle recovers, value centric stocks have historically performed well and many currently trade at a discount to the S&P 500 Inex. These opportunities will likely not last forever.

- Diversify away from the “Magnificent Seven.” If you were underweight technology, close the gap by using equal weighted growth/technology/broad market strategies.

- Investors typically have a home country bias, but we strongly encourage advisors to look at international developed markets. Europe and Japan, specifically, have appealing growth prospects. Provided the US recession is modest, the rest of the world should benefit.

- Use active managers for emerging markets as the region is highly nuanced. High US interest rates have always been an impediment to emerging market investing; 2023 was no different. However, emerging markets are trading at substantial discount to the US and can aid in portfolio diversification. Close your eyes and hold it for ten years or so.

Other Portfolio Construction Thoughts

- At the end of the day, market performance in 2023 was primarily driven by rates. Generally speaking, when rates went up, stocks went down. When rates went down, stocks went up. This relationship will be crucial to watch in 2023. Our view is that idiosyncratic and stock specific risk (corporate earnings, margins, etc.) will return in 2024 and macro factors will wane (the Fed, inflation). Back-to-back years of macro driven markets present hardships for any fundamental investor.

- The strength of the US consumer may be fading. High interest rates are now being felt given we’re nearly two years into this Fed tightening cycle. While the demand side of the equation may be lower, we still have a supply side problem. This is why we don’t think inflation will fall to 2% and hence we still have ways to go in the inflation cycle. Remember, we are still above the Fed’s inflation target via Core PCE, and that’s with the fastest rate hiking cycle in forty years. It’s been our mantra that inflation and rates are to stay higher and for longer which is why we began running a systematic inflation hedging strategy in Q2 2020.

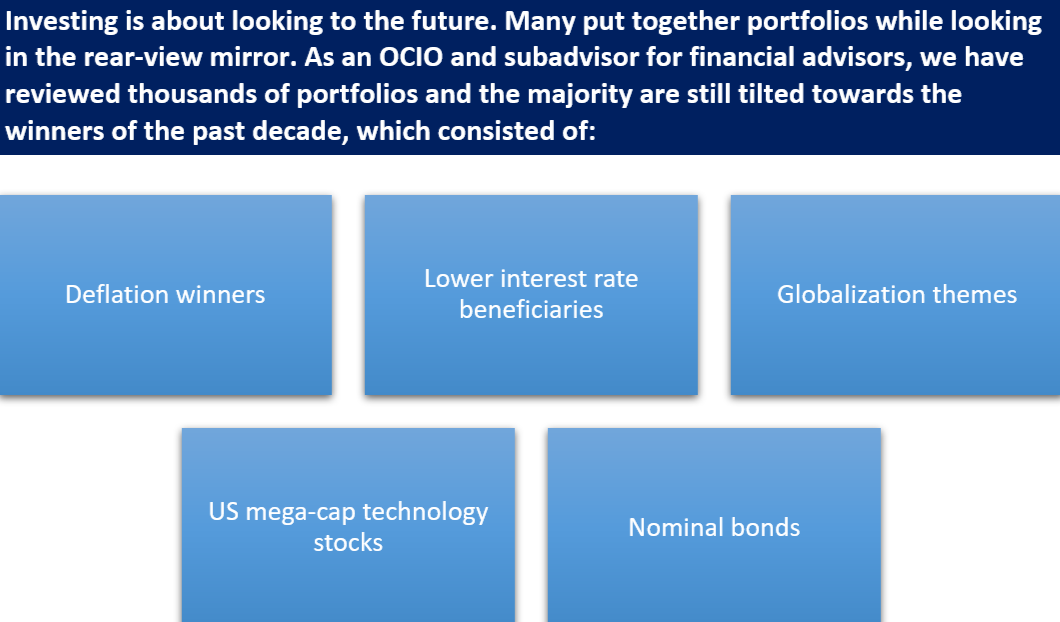

- We are entering into a world of deglobalization, onshoring, and reshoring. In this new environment, investors should own real assets and stocks in sectors such as industrial, materials, energy, etc. From the thousands of portfolios we oversee, we still see remnants of the prior decade that are present in most advisors’ portfolios. Our view is that portfolios should be readjusted to reflect structurally higher real rates.

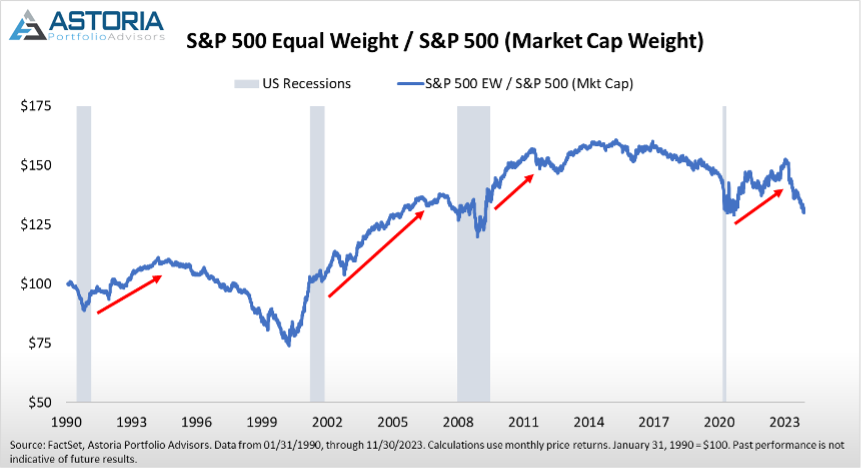

- Equal weight over market cap weight. It’s okay to own the “Magnificent Seven” stocks, but we advocate reducing one’s exposure. As seen in the chart below, new market cycles have historically corresponded with equal weight outperforming market cap weight.

- Equity risk premiums may not be attractive for US large-cap index beta stocks, but they look relatively attractive elsewhere. Our big view is that investors really need to look at Europe and Japan, US SMID, and cyclically oriented sectors which will likely be the new leaders in a new market cycle that consists of structurally higher real rates and stubborn inflation. The earnings yield for developed Europe is currently hovering around 9-10%.

- There is some convexity in the back end of the curve that many tried to play and failed in 2023, mainly because rates keep marching up. That trade is now working because rates have come down. In short, we think equal weighting or slightly overweighting duration makes sense for benchmark-oriented investors. There’s still a ton of demand for short duration ETFs, T-Bills, floating rate notes, and senior loans. Those strategies will likely underperform on a relative basis if rates continue to decline.

Conclusion

- Forget trying to figure out the next rate hike or rate cut and instead build a portfolio that can sustain in a world of deglobalization, structurally higher real rates, and stubborn inflation.

- Nothing stays at the top of the index forever. MSFT wasn’t even in the original FANG Index. An equal-weighted basket of high-quality stocks trades at a 25-30% discount to the S&P 500 Index.

- Remember, we’ve been in a bear market for 2 years now. Last year was a bear market for unprofitable technology and long dated bonds, and this year we saw narrow market leadership and significant underperformance again for long duration bonds. As a result of excessive rate hikes, economic growth expectations have fallen, which is exactly why the market is pricing in rate cuts. We highly doubt we will get five rate cuts next year, but the important point we want to deliver is that your portfolio should evolve in 2024 and look different from the past one to two years.

- Stay tuned for our annual 10 ETFs for 2024 report. Historically, this has been Astoria’s most widely read report.

Below are a few crucial interviews and publications:

-

- Webinar: Inflation Down but Not Out — The Playbook for Investors (click here) – We explain in detail how to invest in a higher inflation, structurally higher real rate world.

-

- Webinar: 10 Ways an OCIO Can Augment Your RIA Practice (click here) – We explain how Astoria works with financial advisors.

-

- Research: Cycle Indicator Deck (click here for the free version; click here for clients) – We publish all the key indicators we monitor for our portfolio construction process on our website. Please contact Frank Tedesco at [email protected] if you would like to receive access.

-

- Blog: How to Construct an ETF Model Portfolio? A 5 Step Program (click here) – Lastly, we published a report almost three years ago on how we construct model portfolios.

Warranties & Disclaimers

There are no warranties implied. Astoria Portfolio Advisors LLC is a registered investment adviser located in New York. Astoria Portfolio Advisors LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Astoria Portfolio Advisors LLC’s web site is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Accordingly, the publication of Astoria Portfolio Advisors LLC’s web site on the Internet should not be construed by any consumer and/or prospective client as Astoria Portfolio Advisors LLC’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Astoria Portfolio Advisors LLC with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of Astoria Portfolio Advisors LLC’s current written disclosure statement discussing Astoria Portfolio Advisors LLC’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from Astoria Portfolio Advisors LLC upon written request. Astoria Portfolio Advisors LLC does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Astoria Portfolio Advisors LLC’s web site or incorporated herein and takes no responsibility therefor. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. This website and information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy. This website and information are not intended to provide investment, tax, or legal advice.

Past performance is not indicative of future performance. Indices are typically not available for direct investment, are unmanaged, and do not incur fees or expenses. This information contained herein has been prepared by Astoria Portfolio Advisors LLC on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Astoria Portfolio Advisors LLC has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information and are subject to change at any time without notice and with no obligation to update. Any ETF Holdings shown are for illustrative purposes only and are subject to change at any time. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by Astoria Portfolio Advisors LLC. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of Astoria Portfolio Advisors LLC. Investing entails risks, including possible loss or some or all of the investor’s principal. The investment views and market opinions/analyses expressed herein may not reflect those of Astoria Portfolio Advisors LLC as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.

For more news, information, and analysis, visit the ETF Strategist Channel.