By Chris Konstantinos, CFA

SUMMARY

- The investment team discusses market controversies for 2024.

- Topics include the Fed and bond yields, inflation, our region and style preferences, and risks.

- We also discuss process improvements and the role of leadership on an investment team.

A Wide-Ranging Interview with RiverFront’s Investment Team

As a teaser ahead of our 2024 Outlook release next week, RiverFront’s Chief Investment Strategist Chris Konstantinos sat down with the firm’s two Chief Investment Officers, Global Equity CIO Adam Grossman and Global Fixed Income CIO Kevin Nicholson, for a wide-ranging discussion on the most important controversies facing investors as we look into ‘24. Here is a transcript of that interview, edited for clarity.

Chris Konstantinos: OK Kevin, let’s start with a frequently asked question: What is your view on the number of rate cuts we’ll see in 2024?

Kevin Nicholson: Currently, the market is predicting two rate cuts in the first half of 2024… however we do not subscribe to this narrative. The Fed has said they are going to be data dependent, and while we believe economic conditions will ease from the red-hot Q3 GDP growth we saw, we do not believe the economy is going to come to a grinding halt.

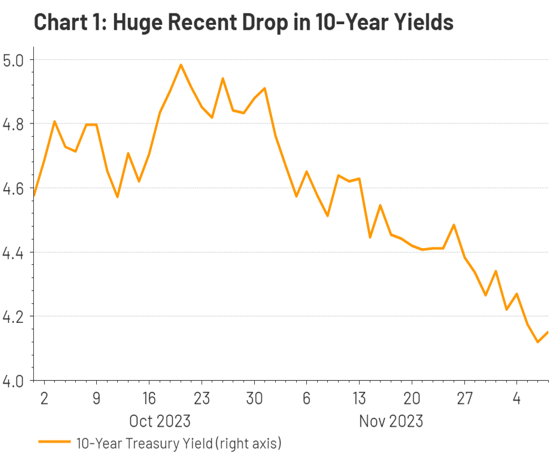

Source: LSEG Datastream, RiverFront. Data daily as of December 7, 2023. Chart shown for illustrative purposes. An investment cannot be made directly in and index.

Chris Konstantinos: The big move down in government bond yields since November has moved contrary to our fixed income positioning. Have yields moved far enough to change your stance here?

Kevin Nicholson: The recent bond market rally has been admittedly hard to digest. One would expect this type of rally when a recession is triggered, and you need to bring rates down to stimulate the economy. However, we don’t believe a recession is imminent. Through that lens we examined the various recession indicators used by the National Bureau of Economic Research (NBER). Most of them, including real personal income less transfer payments, real personal consumption, real business sales, payroll data, and employment surveys are not showing any signs of a recession. This makes us believe that the recent bond market rally is an overreaction and that the Fed is less likely to relent by cutting rates before they are certain inflation has been conquered. Currently, sticky inflation is still close to 5%, which is elevated for the big expenditures such as shelter, education, and medical.

Chris Konstantinos: Given that view, what is your favorite and least favorite part of the fixed income market for 2024?

Kevin Nicholson: My favorite part of the fixed income market for 2024 is high quality BBB and BB corporate credit, as each allows for a pickup of incremental yield without taking on an exorbitant amount of extra risk. Based on current levels, my least favorite part of the fixed income market for 2024 would have to be the Treasury market… as yields have come down too far in my view.

Also, we get a lot of questions from investors concerning municipal bonds…our stance here is that those have become less attractive as well with the current bond rally. Municipal AAA general obligation yields have fallen relative to comparable maturity Treasury bonds. Prior to the rally, municipal bonds were offering roughly 75-85% of Treasury yields. Now that has fallen to 61%, which effectively eliminates the advantage on a taxable equivalent yield basis even for the highest marginal tax bracket of 37%.

Chris Konstantinos: Adam, switching to equities, our portfolios clearly favor US assets over international ones. How do we square this, especially given our valuation work that suggests developed international indices have higher long-term upside?

Adam Grossman: Having a strong strategic preference for a market requires belief in three things:

- That the macroeconomic fundamentals driving that market will be a tailwind for stocks…or at least not a headwind;

- That companies will be able to translate that tailwind into corporate earnings;

- And that intrinsic valuations are ideally cheap – or at least not highly overvalued – relative to that earnings power.

In the US, we are confident in all three points, though valuations in certain areas are growing a bit more challenging. Looking at international, the view is much more circumspect. Our base belief is that slightly elevated inflation should serve as fuel for revenue growth in areas like Europe. This is due to the more cyclically oriented business models in those markets versus the US, with larger index weightings to industries such as energy, materials and financials and a significantly lower weighting to technology. As our core belief is that we settle into a structurally higher global inflation regime for the foreseeable future, the macro backdrop seems like a potential positive for Europe and international.

However, we struggle with International and especially European companies’ inability to consistently drive earnings growth. As you can see in Chart 2 to the right, European earnings have grown significantly less than the S&P 500 since the financial crisis in 2008. This makes a huge difference when we think about intrinsic value, while international areas like Europe are “cheap” on many definitions, when you factor in weaker growth, the ‘intrinsic value’ (aka, valuation on plausible future earnings) is actually not as attractive as it seems. If we see earnings consistently respond to the positive macro backdrop, then there is a case for a multi-year advantage in Europe over the US…we just aren’t fully convinced yet.

Source: Refinitiv Datastream, RiverFront. Data daily as of December 1, 2023. Chart shown for illustrative purposes.

Chris Konstantinos: In 2023, your equity selection process focused on finding high free cash flow generators in such disparate areas as mega-cap tech, energy, etc. In ’24, do you think you will continue this focus?

Adam Grossman: Yes, in our base case and bull (optimistic) case scenarios I think the economic fundamentals for both of those factors have a long way to run. Technology is a story of sustainable growth that we believe can last for much longer than the market does (see Taylor Bryan’s Weekly View from August 5th), and the energy trade reflects pessimism about a cyclical sector that we believe has very strong fundamentals (see Dan Zolet’s Weekly View from November 6th). I love that our team has identified both value-oriented and growth-oriented themes to believe in– it points to some intellectual flexibility.

Chris Konstantinos: We get the large-cap vs small cap stock question frequently from clients. For ’24, how do you expect this dynamic to play out?

Adam Grossman: The key to making the large-versus small-cap stock decision in ’24 is interest rates, in our opinion. An interesting analog we can draw is with mortgage rates: while new homeowners are faced with painfully high mortgage rates out there right now, many folks who have already locked in long-term mortgages in prior years at lower rates aren’t negatively affected. For companies, a similar dynamic is in play; new corporate debt is sourced at high interest rates, whereas existing debt is at much lower levels. While not uniformly true, larger companies tend to issue debt for longer periods of times through fixed income/investment grade bonds, while smaller companies issue debt through shorter term high yield or bank loans, which tend to have floating rates that reset. That makes the impact of today’s higher rates being felt much faster and restricts a lot of activity for smaller-cap companies.

There is also the issue in financials of banks being “locked up” due to rising rates – banks essentially don’t have to realize losses as long as they hold long term bonds to maturity, but this restricts their lending and growth opportunities. Larger banks are less affected because they tend to have more diversified sources of revenue, which makes us favor large financials over smaller ones.

We do think that a key to 2024 is being more selective in general. While we expect our comments above will guide our allocation decisions, there will likely be specific thematic opportunities within the small cap universe that we may try to capitalize on as the year plays out.

Chris Konstantinos: Is P.A.T.T.Y.* still valid as a theme? In other words, does it still make sense to focus on dividend-oriented stocks in a world where you can get 4-5% yields out of Treasuries? Why or why not?

Adam Grossman: Yes, P.A.T.T.Y. is still valid, in our view. To us, P.A.T.T.Y. is as much about free cash flow ‘yield’ – sustainable profitability – as about dividend. Our belief is that rising rates will make companies that are only marginally “economically profitable” – which means profit after accounting for the cost of their capital – really struggle in a high-rate environment, especially if bonds are offering an attractive alternative.

*’P.A.T.T.Y.’ stands for ‘Pay Attention to the Yield’ – see July 5th Weekly View for more information about PATTY in 2023.

Chris Konstantinos: The next few questions are for both of you. From a risk perspective, what ‘keeps you up at night’?

Kevin Nicholson: There are several things that keep me up at night. First, the balanced portfolios I manage with my partner, Lead Multi-Asset Portfolio Manager, Tim Anderson, are generally underweight fixed income and effectively have short duration. I am concerned that bond prices have risen too far too fast and could face a nasty setback. While our portfolios would benefit from such a move in relative terms due to our positioning, bond investors would still lose money.

Secondly, on the equity side of the ledger, I am concerned regarding the narrowness of leadership year-to-date and the catalysts that will drive the market forward. More broadly, what keeps me up at night is not knowing what I don’t know.

Adam Grossman: I do worry about stagflation a lot, which occurs if inflation sticks around while growth disappears. Stagflation is a tough environment where it can seem that nothing is working. I think this creates a lot of perverse market behavior, such as investors’ directing funds from long-term investments to money market funds, which we think is a mistake. I don’t think 10-year Treasury yields go to 7% – but I think our bear (pessimistic) case scenarios go on the table if they do, and I know that the ripples effects will harm investors for years after.

Chris Konstantinos: Having observed you both as CIOs over the past 5-plus years, I have had a front row seat to the myriad improvements you’ve spearheaded in RiverFront’s team personnel and process. Can you give us some sense of what you think we do better than before? And some areas where you think we still need improvement?

Kevin Nicholson: While I would love to say that as an investment team we are and have always been perfect, that is obviously not achievable. The biggest improvement we have made as a team over the last five years is clearly defining decision rights for everything we do. This includes portfolio decisions and more structured meetings that are led by our portfolio managers. This empowers the investment team associates to own their part of the process. On the flip side, I believe we still need to improve our devil’s advocacy process further to avoid complacency in our investment themes.

Adam Grossman: I think when we look back on the past five years, we will be thankful for two key decisions. The first was decision rights, as Kevin rightfully points out. Knowing ‘who has the call’ made a lot of the unintentional ambiguity melt away, and I believe enabled us to engage in true collaboration on research.

The other was hiring the cohort of four talented analysts over five years ago that now comprise a core group of our portfolio managers. Those hires enabled us to really flex our ‘bottom-up’ stock selection muscles, and ultimately enabled a more flexible and innovative portfolio approach. That decision has enabled us to be able to research and add to our portfolios alternative yield strategies in 2022, and the creation of our Custom Portfolio Solutions (CPS) for certain clients.

That being said, we still see a number of areas where we can get even better. For example, we would like to continue to improve our tools and how we think about downside protection. We are also working on serving a broader client base. Our Custom Portfolio Strategies, for instance, have shown us the growing demand for a more personalized portfolio.

Chris Konstantinos: RiverFront’s Investment team motto is “Process Over Prediction.” As leaders, what does that mean to you? How do you work to inculcate this culture across our team?

Kevin Nicholson: Process over prediction means that, as an investment team, we will establish an investment thesis based on our four pillars: strategic asset allocation, tactical allocation, security selection, and risk management. Our first three pillars help us construct the portfolio, and once the portfolio is built, we let incoming data shape our subsequent portfolio decisions instead of being blindly committed to an outdated forecast. Our 4th pillar, risk management, helps put guardrails to limit the negative impact on the portfolios when our forecasts are wrong. We work hard at inculcating this motto into our culture by having our portfolio managers fill out a trade memo to understand the thought process during times of calm, so to avoid emotional decisions in moments of chaos.

Adam Grossman: To me, process over prediction means a lot of meetings, research and memos. While that may seem mundane it is really important, in my view. While I romanticize in my mind the idea of heroic ‘gut’ decisions, everything we know about behavioral science suggests that good decisions come from careful measurement and consistent re-evaluation. That is why I love our process.

We have a lot of small teams that are empowered to conduct research at the macroeconomic, company-specific, and risk management levels, and we are encouraged to embrace the uncertainty that comes from those multiple perspectives. While no process is foolproof, my belief is that the methodical way we move: from idea – to research – to evaluation – to sizing our trades, prevents muddled thinking to make it to execution. Paradoxically, that gives license to ‘out-of-the-box’ thinking earlier in the process and has produced what I think are some really novel approaches to our multi-asset portfolios.

My role on my team is to be two things. The first is a minimum-standard setter – I do believe that setting a high bar is critical to be a high-achieving team. The second role is to be a mentor, helping our younger associates get to where they ultimately should be, by providing advice and resources and not imposing my opinion too much. I want everyone I work with to go further than they ever thought possible. I have to be open to the team doing amazing things that are frankly better than I ever could have done – that is both a humbling and wonderful part of being a leader.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

High-yield securities (including junk bonds) are subject to greater risk of loss of principal and interest, including default risk, than higher-rated securities.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

MSCI Europe Index – represents the performance of large and mid-cap equities across 15 developed countries in Europe.

Definitions:

A basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security. (bps = 1/100th of 1%).

A senior bank loan is a debt financing obligation issued to a company by a bank or similar financial institution and then repackaged and sold to investors. The repackaged debt obligation consists of multiple loans. Senior bank loans hold legal claim to the borrower’s assets above all other debt obligations. Most senior loans are made to corporations with below investment-grade credit ratings and are subject to significant credit, valuation and liquidity risk.

Small-, mid- and micro-cap companies may be hindered as a result of limited resources or less diverse products or services and have therefore historically been more volatile than the stocks of larger, more established companies.

The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate every six months and it pays the face value to the holder at maturity. The U.S. government partially funds itself by issuing 10-year Treasury notes.

The National Bureau of Economic Research (NBER) is a private, non-profit, non-partisan research organization with an aim is to promote a greater understanding of how the economy works. It disseminates economic research among public policymakers, business professionals, and the academic community.

Ba3/BB- is the bond rate given to debt instruments that are generally considered speculative in nature. Ba3 is a long-term bond rating provided by the Moody’s credit rating service, while BB- is the parallel rating provided by both the Standard & Poor’s and Fitch rating services.

A bond is a debt security issued by a company or government to raise money and cover spending needs. A municipal bond, also known as a muni, is debt security used to fund capital expenditures for a county, municipality, or state. Municipal bonds are commonly tax-free at the federal level but can be taxable at state or local income tax levels or under certain circumstances.

Stagflation is an economic cycle characterized by slow growth and a high unemployment rate accompanied by inflation. Economic policymakers find this combination particularly difficult to handle, as attempting to correct one of the factors can exacerbate another.

Interest rate sensitivity is a measure of how much the price of a fixed-income asset will fluctuate as a result of changes in the interest rate environment. Securities that are more sensitive have greater price fluctuations than those with less sensitivity. This type of sensitivity must be taken into account when selecting a bond or other fixed-income instrument the investor may sell in the secondary market. Interest rate sensitivity affects buying as well as selling.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at riverfrontig.com and the Form ADV, Part 2A. Copyright ©2023 RiverFront Investment Group. All Rights Reserved. ID 3276277

For more news, information, and analysis, visit the ETF Strategist Channel.