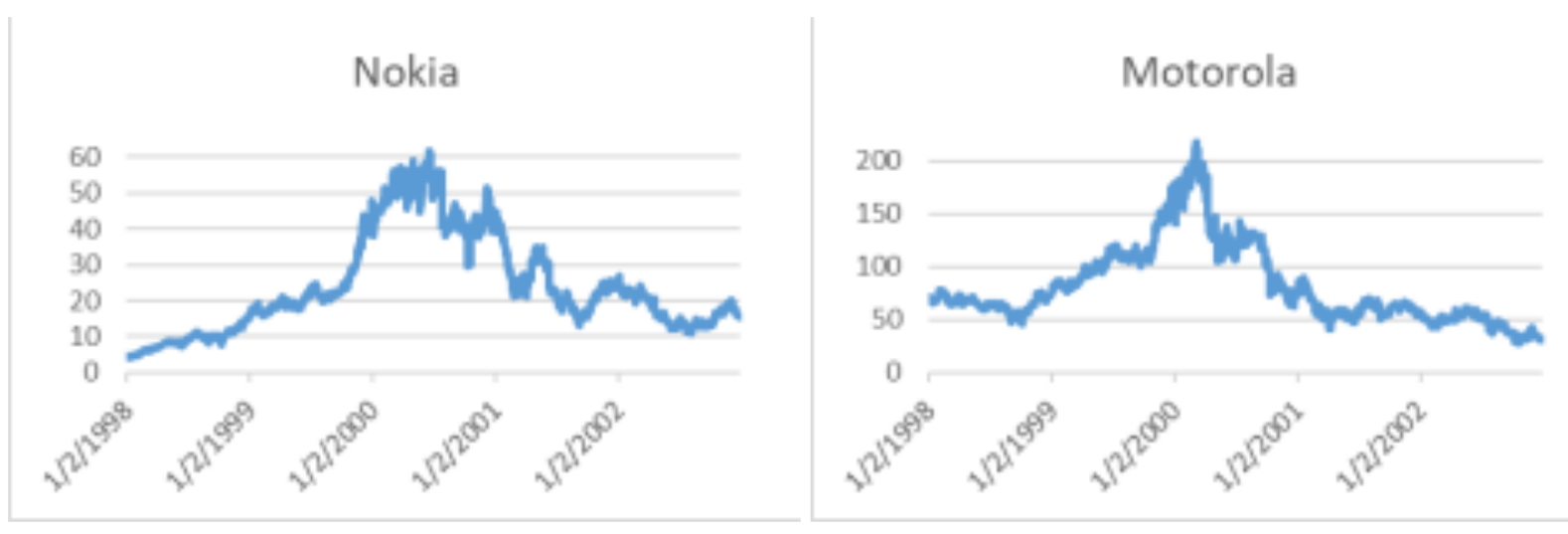

Back in 1999, while still cutting my teeth on a bond-trading desk at Merrill Lynch in New York City, a seasoned veteran trader and astute investor in his own right suggested to me several stocks for my “forever portfolio”. His investment thesis was that these companies were “disruptive” and well positioned in the rapidly growing space of portable telecommunications, and they would likely dominate the field for decades to come. Being long on student loan debt and short on discretionary cash flow, I didn’t quite have the means to take him up on his advice. Which turned out to be somewhat fortuitous, as two of the half-dozen or so companies he mentioned were Nokia and Motorola.

Amidst all the hype and hoopla surrounding the burgeoning technology, media and telecom (TMT) field back then, nascent companies needed little more than a zany internet-based idea, followed by “.com” in their name, and a lucrative IPO awaited. Similar to the SPAC craze today, gullible investors awash in liquidity chased company after company, justifying increasingly dizzying valuations with newly formed metrics touted by Wall Street sales departments and technology gurus like George Gilder (remember him?). Alas, as is often the case when hope triumphs over experience, many were left disappointed amidst the rubble of bankrupt companies.

Without looking to rain on anyone’s parade or spoil the glad tidings associated with the holidays and promise of a new year, I can’t help but think back to this time as the stock market hits new highs and is taken over by the new “super six” – Apple, Microsoft, Google, Meta (nee Facebook), Tesla and Nvidia (a relative newcomer to the mix). Perhaps the outcome will be different this time around. Moreover, it’s quite possible these behemoths will continue to dominate their respective industries for years to come. Does that make them good investments today? Only time will tell, but today’s valuations discount an awful lot of good news into their respective stock prices.

One need only look back at Microsoft in 1999 for a case in point. Sporting a market capitalization of $586 billion then, MSFT traded at 90 times earnings of $0.35 per share. Over the next decade, Microsoft’s sales grew from $19.7 billion to $60 billion, while its net income rose from $7.8 byn to $17 byn. The poor investor, however, saw the value of their holdings drop from $60 per share at its peak in

1999 to just $16 a decade later. In addition, it wasn’t until 2016 that MSFT’s share price topped the peak level from 1999. By then Microsoft had $96 byn in revenue, $24 billion in net income and traded at a saner 21x earnings.

My point is that even great companies can become mispriced. In this era of artificially suppressed interest rates, there are an awful lot of stocks that are mispriced in our opinion. We think the pandemic has only amplified some of these skewed valuations. While we’ll be the first to note the disruption being caused by a handful of companies in the fin-tech, cloud, AI and communications fields, as with the late ‘90’s, it’s unlikely they’ll all be winners a decade hence.

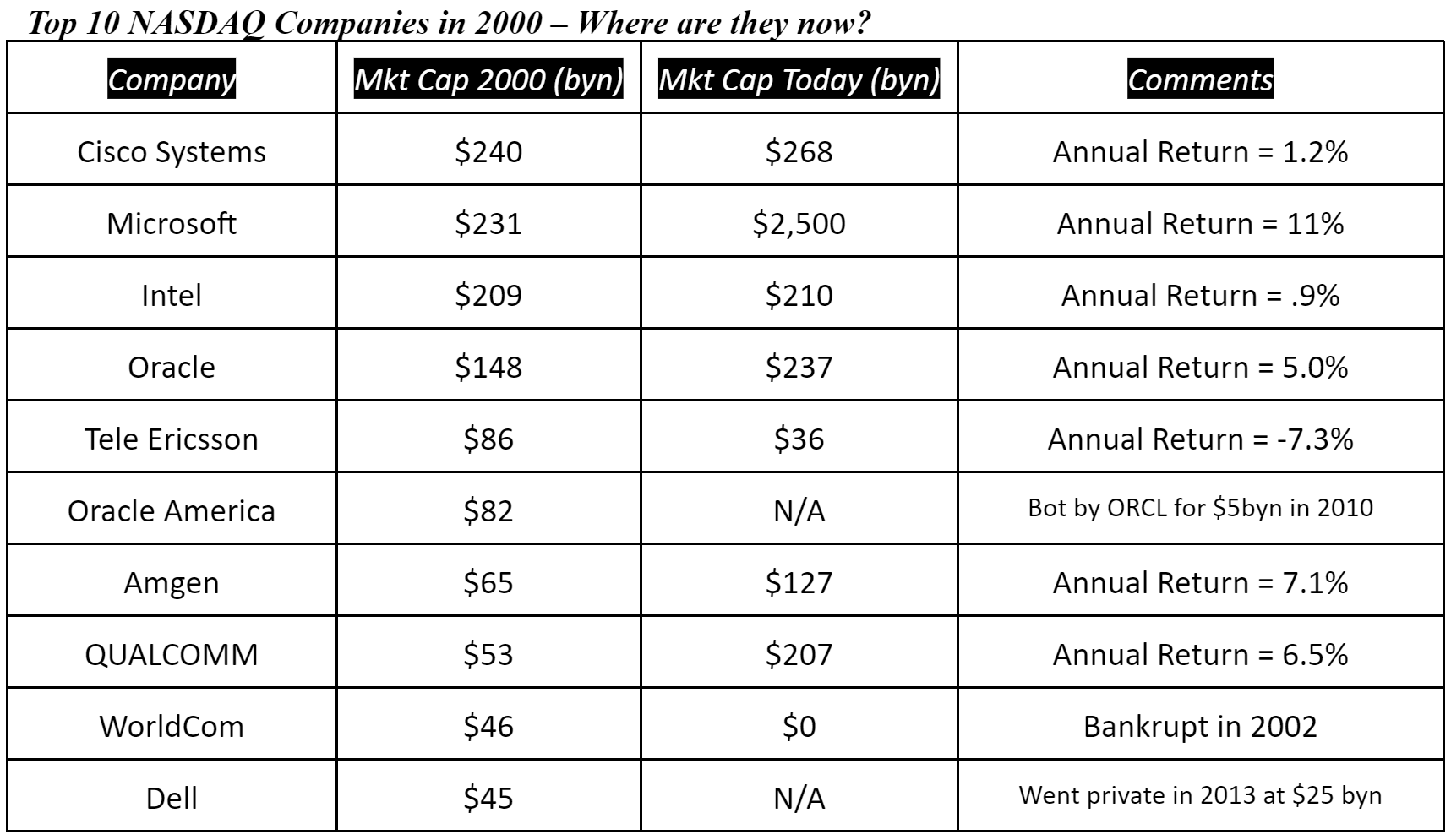

The NASDAQ has returned 6.7% per annum since early 2000 while the S&P 500 has compounded at 7.9% and the global MSCI All Country World Index at 5.9% annually. Of the list above, only Microsoft and Amgen have beaten the broad averages since this pronounced and memorable period of equity euphoria. Buying yesterday’s winners is a time-honored recipe for locking in low future returns. And, since we don’t really know which stocks will be tomorrow’s big gainers, owning a diversified basket of equities from around the world would seem practical.

I’ve lamented in recent missives over the declining value being assigned to diversification, along with the frustration associated with being invested in certain sectors (anything non-tech), regions (anything non US) and styles (anything non-large-cap growth) that seem permanently out of favor. The perils of being a “Value” manager nowadays are well documented. After all, who doesn’t look at past returns and extrapolate them well out into the future?

Well, we don’t at Nottingham. Call us old-fashioned, stubborn or what you will, we think there’s virtue in diversification and that ultimately the long-term investor will be rewarded. Although Emerson suggested that a foolish consistency is the hobgoblin of little minds and Einstein quipped that insanity is doing the same thing over and over again while expecting different results, we continue to think low-cost, well-diversified, multi-asset class portfolios tailored to an investors risk tolerance (remember that?) and rebalanced periodically make sense.

While 2021 wasn’t our finest hour from a tactical perspective, with some notable stumbles in the EM space (last year’s big winners gave back their gains and more), Nottingham’s core allocations once again delivered as expected. While striving for consistency of return while managing overall portfolio risk, our

strategies are designed for investors with long time horizons and who understand the cyclical nature of markets. We don’t chase fads or hot markets, sometimes at our own peril.

Today’s 5%+ inflation readings have investors everywhere reassessing their outlook for economic growth. The Federal Reserve is squarely behind the curve in terms of reigning in its loose monetary policy, with tapering of bond purchases now set to expire in late Q1 of 2022 and interest rate hikes expected to begin soon thereafter. Market volatility is rising as investor anxiety grows over the fate of ultra-low interest rates and sky-high technology stock valuations.

In Washington, Congress is struggling to enact President Biden’s signature $2 trillion Build Back Better social spending program, with odds now for a scaled down version passing in Q1. The recently passed $1.2 trillion infrastructure bill should add to economic growth over the coming decade, albeit modestly.

The combined impact of this fiscal spend could be enough to carry the U.S. economy through an inflation-induced consumer spending slow-down.

The recent surge in covid-19 cases due to the omicron variant hasn’t rattled markets as much as the case count might suggest. Perhaps it is the less virulent nature of this strain that has investors more at ease, but we are beginning to see some cities and regions enact more restrictive social policies. The great “re opening” trade may see a pause as travel restrictions mount, roiling what was a promising post-covid recovery. As with everything pandemic-related, wait 5 minutes and things will change.

Our thoughts as we look ahead at 2022 are mixed, with most asset classes trading at expensive levels and a US central bank looking to tighten monetary policy to address soaring inflation. Adopting a more sanguine outlook, if the Fed can successfully raise interest rates without upsetting markets, we could find ourselves in a much better place a year from now, with equities more or less where they’re trading today and bond yields measurably higher, nearly to the point of attractiveness.

Long-suffering fixed income investors are due for a break, in our opinion, with historically low credit spreads compounding the challenge of historically low interest rates. Negative real interest rates (and still negative nominal rates internationally) aren’t helping anyone but the heavily indebted, case in point, the U.S. government. A 1% increase in the US Treasury’s borrowing costs would increase federal debt expense by a staggering $290 billion per year, or nearly 5% of the federal budget. 2021’s federal budget deficit alone of $2.8 trillion should be enough to give anyone pause.

With this in mind, we would guess the symbiotic relationship between the US Federal Reserve and the Treasury Department will only get stronger as the government tries to manage its way through its exploding debt burden. The luxury of having the world’s reserve currency may be sorely put to the test unless we find a way to curb our appetite for debt-fueled spending. For now, however, that’s a concern for another day (which day precisely, no one quite knows).

This past year at Nottingham had its share of triumphs and challenges. However, we have emerged stronger and more capable than ever before. We welcomed Meagan Reimann to the team as our Director of Marketing and you will soon be seeing a brand new look on our website. Mike Skrzypczyk overcame numerous pandemic induced challenges to pass Level 3 of the CFA exam and is now a full-fledged CFA charter holder. Way to go Mike! After elevating Matt Krajna, CFA to Co-Chief Investment Officer last year, I will be ceding my remaining half of that title to Tim Calkins, CFA. Tim will continue in his role as Director of Fixed Income, but will now join Matt in leading our expanding investment process. Lastly, we brought Ryan Flynn on board as a Trading Associate and he will be sitting for Level 1 of the CFA exam shortly. Fingers crossed, Ryan!

The New Year will certainly bring new and unforeseen obstacles to investment success. We’re hopeful that pandemic-related challenges will fade by the Spring. We’re excited at the pace of technological innovation occurring in the U.S. and remain convinced America’s best days are ahead. If there were anything challenging that notion, it would be the political circus in Washington. However, we’ve survived worse times politically and are hopeful that political divisions will narrow and true leadership will emerge from the quagmire.

Rest assured the team at Nottingham will remain at the ready, doing our best to grow and protect our clients hard-earned capital. We begin 2022 with some exciting new initiatives that will take our assets under advisement to over $4 billion. With that comes increased responsibilities to our clients that both Tom and I feel our team is more than capable of meeting and exceeding.

To all of you in 2022, we wish health, happiness, peace and prosperity in your lives. Thank you again for entrusting Nottingham with your financial futures.

Larry Whistler, CFA

President

January 2022

Nottingham Advisors, LLC (“Nottingham”) is an SEC registered investment adviser located in Amherst, New York. Registration does not imply a certain level of skill or training. Nottingham and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Nottingham maintains clients. Nottingham may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. For information pertaining to the registration status of Nottingham, please contact Nottingham or refer to the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). Any subsequent,

direct communication by Nottingham with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This newsletter is limited to the dissemination of general information pertaining to Nottingham’s investment advisory services. As such nothing herein should be construed as the provision of personalized investment advice. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Adhering to the assumptions, theories and principles serving the basis for the information contained herein should not be interpreted to provide a guarantee of future performance or a guarantee of achieving overall financial objectives. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. Furthermore, this newsletter contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. As such, there is no guarantee that the views and opinions expressed in this article will come to pass. This newsletter should not be construed to limit or otherwise restrict Nottingham’s investment decisions.

This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Some portions of this newsletter include the use of charts or graphs. These are intended as visual aids only, and in no way should any client or prospective client interpret these visual aids as a method by which investment decisions should be made. We have provided performance results of certain market indices for illustrative purposes only as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio. It should not be assumed that your account performance or the volatility of any securities held in your account will correspond directly to any benchmark index. A description of each index is available from us upon request.

Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.