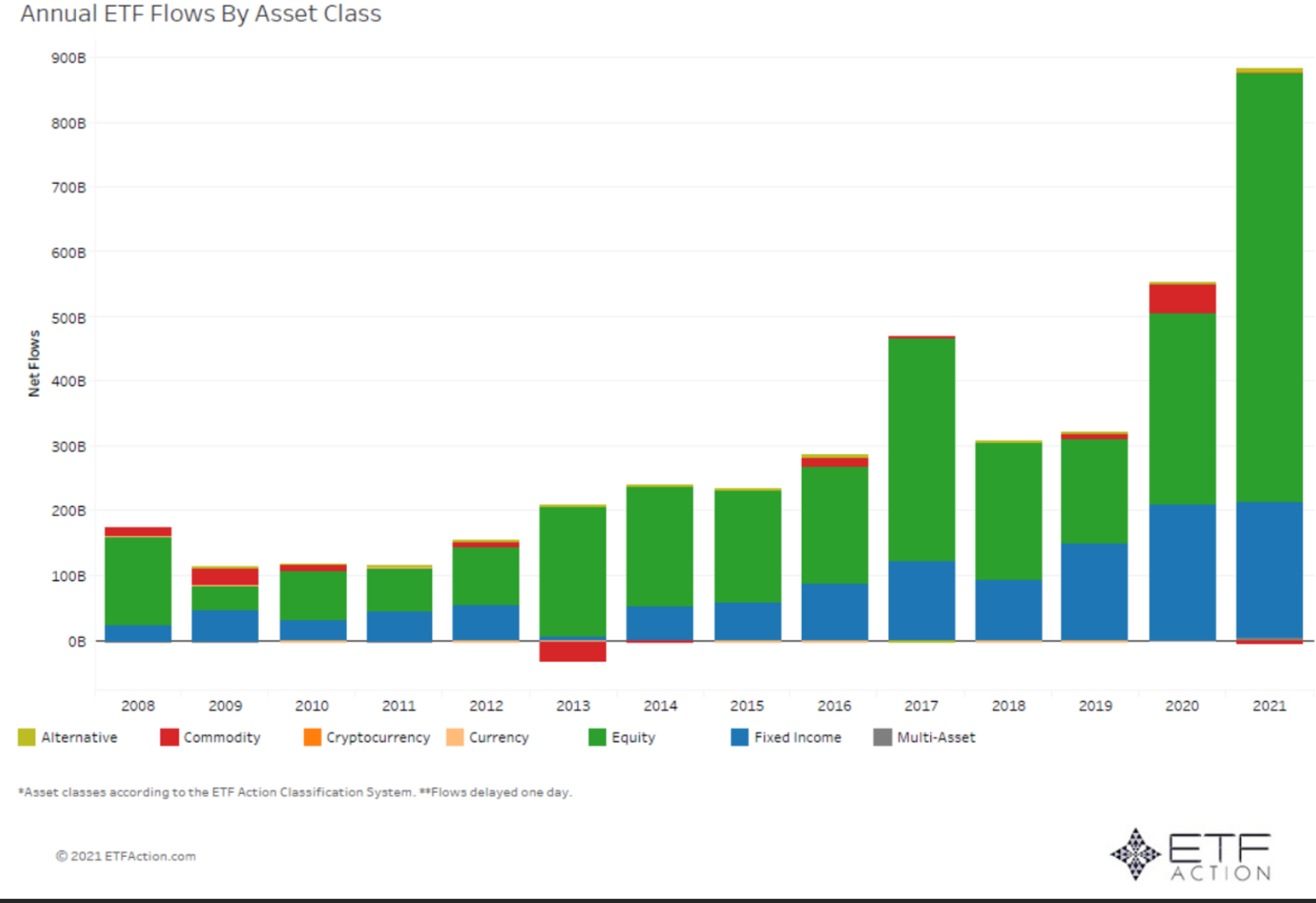

The year 2021 saw many major changes and broken records in the ETF industry. Many of these historic evolutions are documented in this excellent write up from @NateGeraci: “ETFs in Pictures 2021.” One of the most amazing ETF stories of 2021 was the sheer magnitude and breadth of asset flows, topping $900 billion – close to $400 billion more than last years record. The ETF Think Tank strives to provide education, information and business growth strategies to advisors and investors. The ETF Think Tank is supported by the portfolio management team at Toroso Investments and our platform for ETF Entrepreneurs known as Tidal ETF Services. Tidal also had a record year: we have now helped 17 firms bring ETFs to market and are surpassing $3 billion in assets. Our passion for helping entrepreneurs’ launch and grow ETFs is unparalleled, and as we head into 2022, we thought we would share six tips for success if you are considering launching an ETF.

Client Alignment

In many previous writings, we pointed to the success of the ETF industry being linked to four client alignment factors: liquidity, transparency, tax efficiency and lower cost. These are four components of the ETF structure that allows them to enhance the outcomes for most investment strategies. Which brings us to one of the most important keys to succeeding as an ETF Entrepreneur:

- Start with an existing successful SMA, Hedge Fund, Mutual Fund or Newsletter, and convert the strategy to the ETF wrapper. By embracing the client alignment factors of the ETF structure, a new sponsor can enhance distribution while simultaneously improving the outcome for their clients. The ETF wrapper can take a good investment strategy and generate extra structural alpha.

Field of Dreams

With advent of multiple ETF services platforms like Alpha Architect, Exchange Trade Concepts and Tidal ETF Services, the barriers to entry are much lower for new ETF entrepreneurs. That said, launching unsuccessful funds can still be expensive. The era of launching the next “hot idea” and simply hoping the market embraces it is over, simply put. If you build it, they may not come.

- Budget appropriately. The standardized operational expenses of maintaining an ETF can vary, but a good rule of thumb is to assume a cost of about $20,000 a month, or $240,000 a year. Additionally, new sponsors should expect to spend at least that much more on necessary conditions like sales and marketing. The point is that success requires survival, which in turn requires the proper capital to ensure a sufficient runway and awareness.

Necessary Conditions

Simply having a great investment strategy in the proper ETF structure doesn’t guarantee assets if no one knows it exists. At the same time, sales and marketing cannot grow the assets of a bad investment idea packaged in an ETF.

- Sales and Marketing are a necessary condition. Awareness is the goal for any new ETF. This can be achieved through PR, content, social media, boots on the ground and many other communication strategies. The process begins with messaging as part of product development, and it is important to be concise with the ETF name and ticker. Sales and Marketing cannot make a bad ETF successful, but are necessary for a good ETF to succeed.

“From little seeds grow mighty trees.”

Investing is about trust. Allocators to any new fund will need to trust the strategy, the portfolio manager, the sponsor and most importantly, the viability of the ETF. Every new fund will face two primary objections: closure risk and on-screen volume. Significant seed capital solves for many statutory trust concerns.

- Seed capital is the single most important factor to a new ETF’s success. Not only does it provide trust to investors in the viability of a fund, but it also supports the on-screen liquidity and capital markets strength. Assuming the $240,000 operational cost noted in tip #2, a new sponsor should look for seed capital that covers at least that expense. The formula is quite simple:

(Initial Seed Capital) x Expense Ratio = $240,000

By having the proper seed, a new ETF evokes trust, and allows the sponsor to focus on using capital for sales and marketing rather than operational maintenance.

Excellence in Execution

Above, we noted the client alignment factors that make the ETF structure a superior way to deliver an investment strategy. That said, these inherent factors require a lot of work and knowledge to be achieved operationally.

- ETF operations are unique and require precision. Tax efficiency is not a forgone conclusion for ETFs, it requires knowledge of custom baskets and trade execution. The same is true for capital markets relationships which are the key to liquidity. Proper management of trading, administration, dividends, and other distributions are paramount for the success of an ETF.

Solve a Problem

All successful business endeavors begin with the client. ETF entrepreneurs must identify an existing need of their target investor to properly craft an ETF solution.

- Your ETF must solve a problem for investors. Institutional portfolio managers will often point to statistics like Sharpe Ratio or Sorrentino to illustrate their value propositions. This simply doesn’t work with ETFs since 99% of the buyers don’t care about these metrics, and the 1% that do probably won’t buy an ETF. Successful ETFs identify an investor problem like access to theme, income or hedging, and then concisely articulate a solution to that issue.

Navigate with Tidal ETF Services

The ETF Think Tank strives to provide education, information and business growth strategies to advisors and investors. The ETF Think Tank is supported by the portfolio management team at Toroso Investments, and our platform for ETF Entrepreneurs known as Tidal ETF Services. With another record year for ETF growth, we invite new ETF entrepreneurs to talk with us at Tidal about joining us on this journey.

For more news, information, and strategy, visit the ETF Strategist Channel.