By Tim Anderson, CFA, and Rob Glownia, CFA, RiverFront Investment Group

An annual tradition in RiverFront’s yearly Outlook is to publish wide-ranging and candid interviews with our key portfolio decision makers, and 2020 is no exception. Today, we’re featuring a transcript of an interview recently conducted with Global Fixed Income CIO Tim Anderson for the Outlook about what to expect in bond markets in the coming year. Senior Portfolio Manager Rob Glownia is moderating the Q&A.

Q: After cutting rates three times in 2019, the Fed has raised the bar for future easing. Do you think more rate cuts will be necessary in 2020?

We believe that Fed policy is truly data dependent at this point, and that no further rate cuts will be necessary. We believe that the Fed’s current level is appropriate for a slow-growth, stable-inflation environment. If economic growth slows further, however, we believe that the Fed would not hesitate to begin another rate cut cycle or resume quantitative easing.

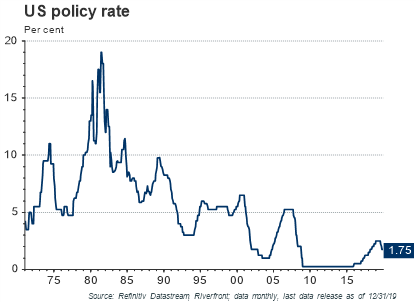

Source: Refinitiv, Datastream, RiverFront; data monthly, last data release as of 12/23/19. Past Performance is no guarantee of future results.

Q: Much of the developed world is experiencing negative interest rates. How likely is it that the United States will see negative rates as well?

We believe that negative rates are unlikely, but not impossible. The Fed has been vocal about its desire not to cut rates into negative territory. Critics question whether negative rates in Europe and Japan have been effective in stimulating growth and inflation. In addition, negative rates punish savers and can distort financial markets. The struggle of European banks in a negative rate environment serves as another example of the downside. The current Fed Funds Rate of 1.50-1.75% (right chart) also gives the Fed a cushion to cut rates significantly without having to go negative.

Q: Corporate Bonds had one of their worst years in 2018 but snapped back in 2019 to be one of the best-performing sectors in Fixed Income. What should investors expect from credit in 2020?

With corporate bonds returning slightly more than 14% in 2019, we are expecting 2020 to be more of a coupon-clipping year, leading to returns of around 3%. The starting Treasury yield and corporate bond spreads dictate that a repeat of 2019’s returns is unlikely, in our view. We entered 2019 with the 10-year Treasury yield around 2.7% and corporate bond spreads around 160 basis points (“bps” = 1/100th of 1%). As we near the end of 2019, the 10-year yield is currently around 1.9% and spreads are just above 100 bps. It would likely take a recession/deflation scare for Treasury yields to repeat 2019’s drop; in that event, corporate bonds spreads would likely widen. Corporate bond spreads are well below their long-term average and not too far off their all-time lows of 79 bps.

Q: The credit market is signaling an “all-clear” on the economy, but the US Treasury market seems to be flashing caution. How should investors interpret the divergence?

We think the credit markets have been relatively “well behaved” in 2019, especially within the investment-grade sector. In 2018, BBB-rated bonds had a particularly bad year, but that trend reversed in 2019 with BBB’s posting the strongest returns. In general, it was also a very constructive year for high yield bonds. High-yield spreads are currently at their 2019 lows of about 353 bps. However, despite the overall rally in junk bonds, there has been some weakness in certain sectors, such as Energy, Retail, and CCC-rated bonds. Overall though, the credit market is not signaling an upcoming recession as spreads continue to grind tighter.

We believe that traditional bond market signals regarding the state of the US economy are being somewhat distorted by the tremendous amount of negative-yielding debt around the world. Capital tends to flow where it is treated the best, and the US currently has relatively attractive yields. Although European and Japanese investors can no longer economically hedge the currency risk when buying US Treasuries, we believe that many foreign buyers have become comfortable buying on an unhedged basis. We believe that US rates would be slightly higher than current levels if they were not being pulled down by negative interest rates overseas. On a positive note, the US yield curve has steepened, and neither the 3-month/10-year or 2-year/10-year curve is currently inverted. A negative yield curve is typically viewed as a harbinger of recession.

Q: What is your highest conviction theme in fixed income for 2020?

It is hard to get too excited about any sector of the fixed income markets next year, given the starting point for both yields and spreads. We would say the highest conviction theme would be to underweight fixed income with the S&P 500 index dividend yield at around 1.9%.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

Dividend yield is the ratio of a company’s annual dividend compared to its share price. Dividends are not guaranteed and are subject to change or elimination.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Bond yield is the return an investor realizes on a bond.

Duration is a measure of the sensitivity of the price of a fixed income investment to a change in interest rates. Duration is expressed as a number of years. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices.

High-yield securities (including junk bonds) are subject to greater risk of loss of principal and interest, including default risk, than higher-

rated securities.

A fixed income obligation rated BBB by Standard & Poor’s exhibits adequate protection parameters. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitment on the obligation.

A fixed income obligation rated CCC by Standard & Poor’s is currently vulnerable to nonpayment, and is dependent upon favorable business, financial, and economic conditions for the obligor to meet its financial commitment on the obligation. In the event of adverse business, financial, or economic conditions, the obligor is not likely to have the capacity to meet its financial commitment on the obligation.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market. It is not possible to invest directly in an index.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 1043853