Click here to read the 10 ETFs for 2020

- Investors’ love affair with past winners is insatiable. The ‘conventional wisdom’ on Wall Street is that US stocks, private equity, private credit, venture capital, and bonds will continue to be the ‘big winners’ in the years to come. Unfortunately, yesterday’s darlings almost never outperform in the future with the same risk-adjusted returns per unit of liquidity risk (this is important). Paradigm shifts typically happen slowly and quietly with most investors realizing after the fact.

- Many firms put out their 2020 outlook reports but very few of them are actionable. The goal of this piece is to not only provide unique thought leadership but to provide investors with actionable investment ideas.

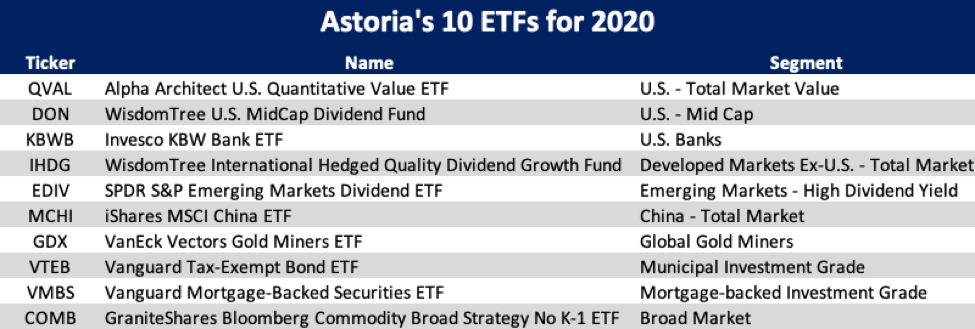

Exhibit 1. Astoria’s 10 ETFs for 2020

Source for 10 ETFs for 2020 is Astoria Portfolio Advisors. Category data retrieved from ETFAction.com on December 30, 2019.

Best,

Astoria Portfolio Advisors

Disclaimer:

Astoria runs various ETF managed portfolios with different risk tolerance bands and a result with different holdings. The commentary in this report is generally centered around our dynamic portfolios and our strategic ETF models will vary from the holdings noted in this report.

The ETFs highlighted in this report are solutions that Astoria finds attractive on a per unit of risk basis. However, this list is not meant to be an asset allocation strategy, a trading idea, or an ETF managed portfolio. As such, this list doesn’t constitute a recommendation of any ETF. There are other ETFs that Astoria currently owns which are not highlighted in this report. Contact us for a list of all of Astoria’s ETF holdings.

Any ETF holdings discussed are for illustrative purposes only and are subject to change at any time. Readers are welcomed to follow Astoria’s research, blogs, and social media updates to see how our portfolios are shifting throughout the year. Refer to www.astoriaadvisors.com or @AstoriaAdvisors on Twitter.

Past performance is not indicative of future results. Investors should understand that Astoria’s 10 ETFs for 2020 is not indicative of how Astoria manages money or risk for its investors. Note that Astoria shifts portfolios depending on market conditions, risk tolerance bands, and risk budgeting. As of the time of this article written, Astoria held positions in QVAL, DON, IHDG, EDIV, MCHI, GDX, VTEB, VMBS, & COMB.

For full disclosure, please refer to our website: https://www.astoriaadvisors.com/disclaimer