When seeking a diversified investment, investors may even be taking on more risk than they intend. Davis pointed out that so-called dividend darlings carry more risk than many may expect. For instance, the average price-to-earnings ratio of the 25 most commonly held dividend paying stocks trades at 25x, compared to the S&P 500’s P/E of 21x. With more investors looking at yield-paying stocks to bolster an income portfolio, some may find they are sitting on pricey valuations.

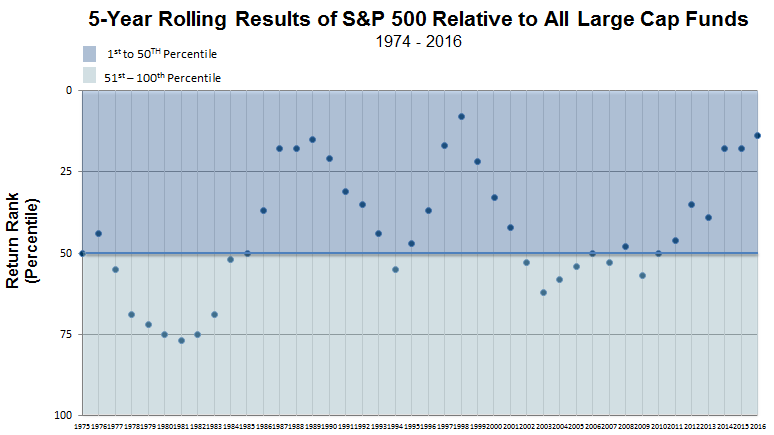

Many investors have shifted into passive index-based strategies and dumped actively managed funds over the years, but Davis warned that active and passive investments have historically moved in cycles. In an extended bull market environment, active managers that have more flexibility may be better positioned to outperform a benchmark ahead.

If investors are looking for an alpha-generating active manager, Davis suggested that people look for quantifiable characteristics of a successful manager, such as low fees, different from an index, low turnover, long-term orientation, proper incentives, strong alignment of interest, experienced management team and a proven record.

For example, Davis Advisors manages benchmark agnostic, high conviction, low turnover portfolios. They have over $2 billion invested alongside shareholders in the portfolios they manage, ensuring a strong alignment of interests. Instead of making capricious trades based on instincts, the fund manager has implemented a disciplined strategy to successfully access various markets.

Now, ETF investors can also gain exposure to Davis’ proven research and investment styles through the Davis Select U.S. Equity ETF (NasdaqGM: DUSA), Davis Select Financial ETF (NasdaqGM: DFNL), and Davis Select Worldwide ETF (NasdaqGM: DWLD). DUSA is managed by Christopher Davis and Danton Goei, a portfolio manager for the Davis Large Cap Value Portfolios and a member of the research team. Davis also manages DFNL while Goei manages DWLD.

Financial advisors who are interested in learning more about better investment practices can watch the webcast here on demand.