Happy Women’s History Month! So many successful firms have relied on women leaders throughout the years, and the same is true today. It may be a good time to take a look again at the Fidelity Women’s Leadership ETF (FDWM), an ETF investing in companies based on one of three criteria committed to promoting women: C-suite leadership, a gender-diverse board of directors, or best-in-class gender diversity initiatives. It’s often the company’s initiatives, philosophies, and policies that result in meaningful progress on diversity and come together to create a culture of inclusion.

For example, investors may want to get to know Accenture (ACN)—which FDWM weights in its top three stocks—and its CEO, Julie Sweet.

See more: Fidelity Investments Pushing Forward on Active ETFs, Launches 2

ACN, based in Dublin, works in the IT and consulting spaces. As of the first quarter of 2024, the firm claimed more than three-quarters of the Fortune Global 100 and Fortune Global 500 as clients.

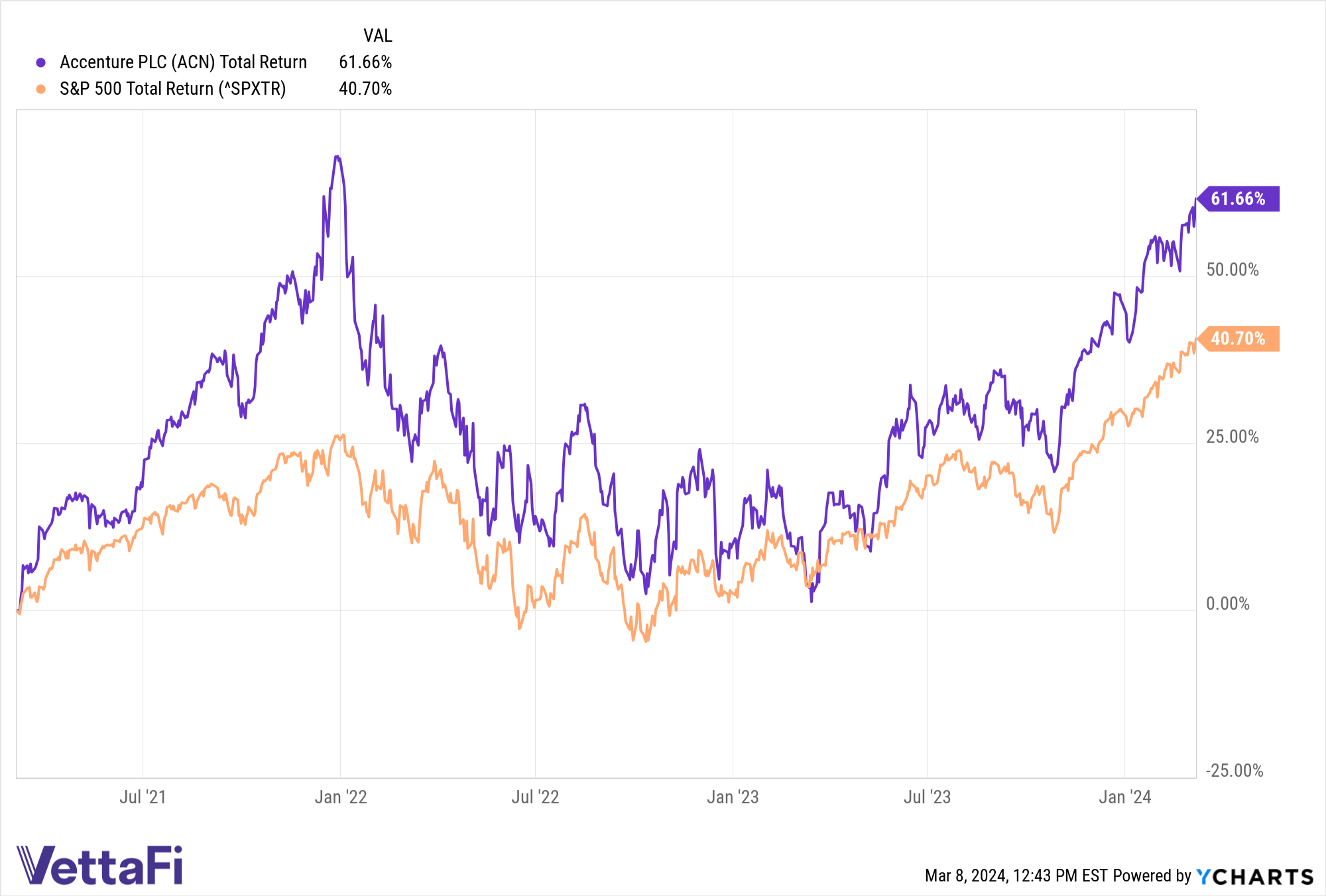

Its total client base includes those in more than 120 countries, with more than 700,000 employees. ACN has returned 61.6% as an investment over the last three years, per YCharts, as of March 8. It has also seen 11.2% five-year earnings per share growth.

Accenture’s returns over the last three years, under Sweet’s leadership, have outperformed the S&P 500. References to specific securities should not be construed as recommendations or investment advice. The statements and opinions addressed are those of the speaker and are not necessarily representative of Fidelity’s opinions or views.

ACN and Women-Led Firms

Julie Sweet took on the CEO role at the firm in September 2019, and also took on the chair position in September 2021. She previously served as ACN’s North America CEO, having also worked as general counsel, secretary, and chief compliance officer. Previously, outlets like Forbes recognized Sweet as one of the world’s most powerful women.

FDWM looks for women-led firms and firms that emphasize women’s contributions as part of their strategy. The fund, which will reach its three-year ETF milestone this June, does so with an active approach. It charges 59 basis points for its approach. In doing so, it has returned 23.5% over the last year, as of March 8, per VettaFi data. That has helped the ETF outperform its ETF Database Category and its FactSet Segment averages in that time.

Fidelity Investments® is an independent company, unaffiliated with VettaFi. There is no form of legal partnership, agency affiliation, or similar relationship between VettaFi and Fidelity Investments, nor is such a relationship created or implied by the information herein. Fidelity Investments has not been involved with the preparation of the content supplied by VettaFi, and does not guarantee, or assume any responsibility for, its content.

For more news, information, and strategy, visit the ETF Investing Channel.

1137397.1.0