Could healthcare innovation be one potent opportunity area to start 2024? Healthcare investing wasn’t necessarily the best in 2023. However, changing conditions could make it an appealing place to invest in the new year. As such, a disruptive medicine ETF like FMED, the Fidelity Disruptive Medicine ETF, could offer one intriguing option for investors.

See more: Clean Energy ETF Comeback? Watch FRNW

What’s changed for the healthcare tech outlook entering 2024? For one thing, markets are expecting growing M&A activity which can be a big boost for health care companies. When the biggest names in health innovation buy up-and-coming disruptive medicine companies, that can benefit the ETFs that hold the smaller firms’ stocks.

For example, FMED holds Icosavax, Inc. (ICVX), which is currently being acquired by AstraZeneca (AZN). Overall, whether that M&A growth comes from a greater appetite for deals from smaller firms facing pressure on balance sheets or an anticipated drop in financing costs, a disruptive medicine ETF like FMED could appeal.

At the same time, for those disruptive firms that are not acquired, potential rate cuts could provide a helpful boost to their prospects. Smaller, disruptive tech-oriented health firms often rely on significant loans. This is while waiting for patents to be approved or new products to hit the market. Interest rate relief from the Fed could be a big help and boost opportunities available in FMED.

Disruptive ETF FMED’s Approach

How does the strategy invest, in that case? FMED takes an active approach to identify disruptive innovation in medicine, investing in both domestic and foreign issuers. The ETF uses proprietary strategies to identify firms that may deliver innovations that could dislodge industry leaders. FMED looks for growth and value stocks from firms in areas including, but not limited to, genomics, medical devices, and robotic surgery.

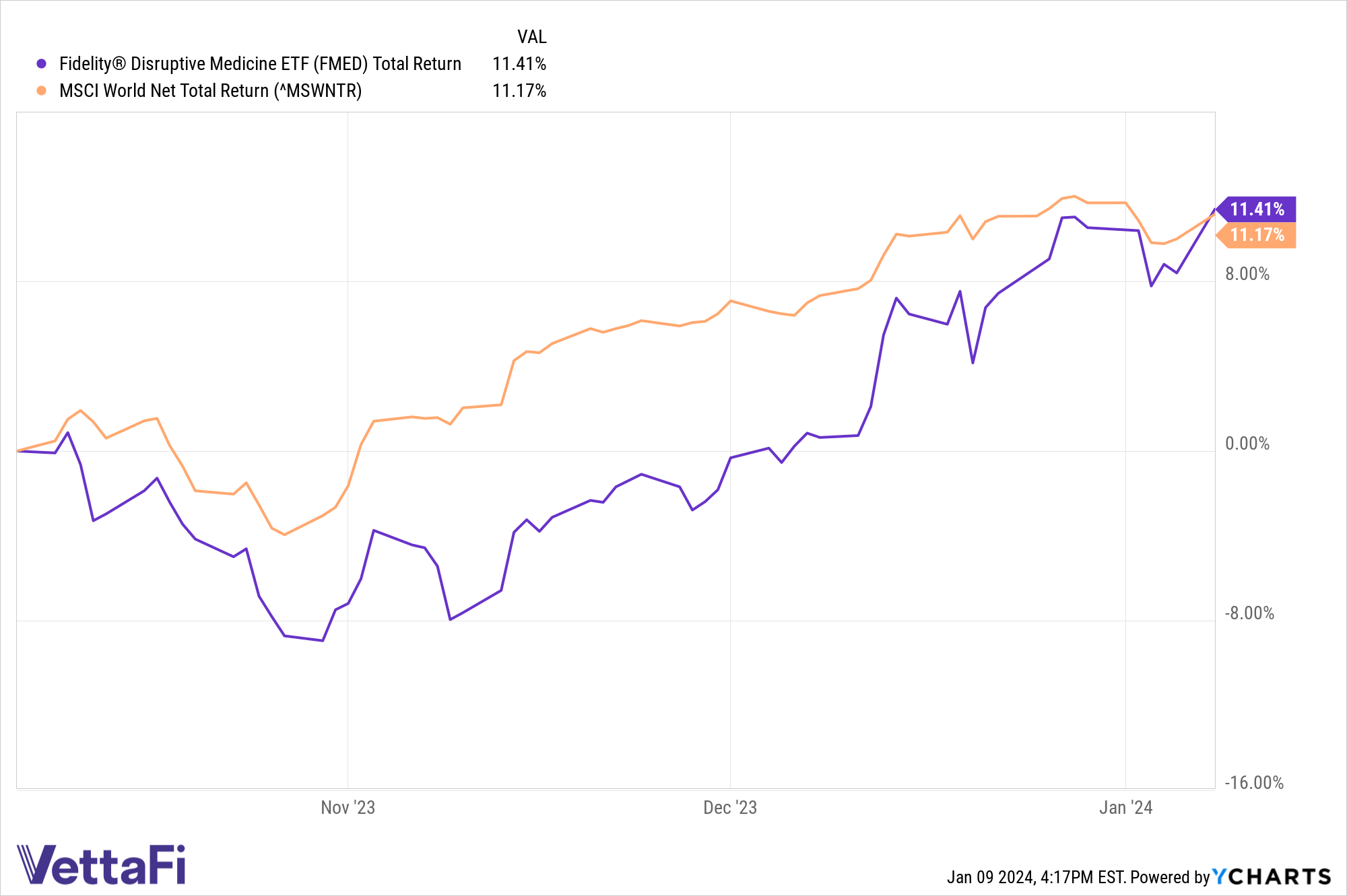

FMED has performed well over the last three months per YCharts as of January 9th.

The fund has returned 11.4% over the last three months as of January 9th, per YCharts. That’s outperformed the MSCI All Country World Index, for example. For investors looking for competitively priced (50bps) active equity slices to add to their portfolio, FMED may be one option to watch.

Fidelity Investments® is an independent company, unaffiliated with VettaFi. There is no form of legal partnership, agency affiliation, or similar relationship between VettaFi and Fidelity Investments, nor is such a relationship created or implied by the information herein. Fidelity Investments has not been involved with the preparation of the content supplied by VettaFi and does not guarantee or assume any responsibility for its content.

For more news, information, and analysis, visit the ETF Investing Channel.