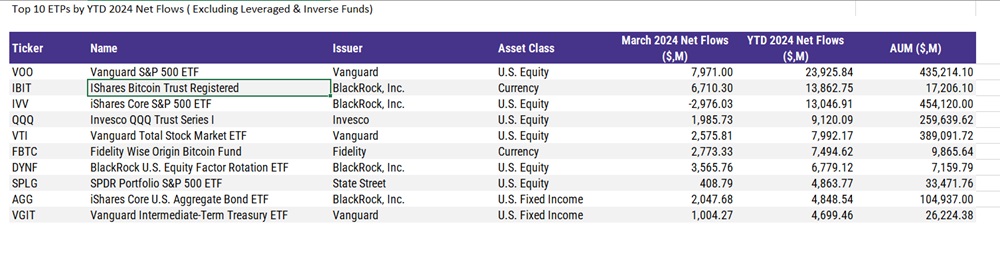

Talk about a friendly market. Not even an uptick in inflation or lofty stock valuations could keep the bulls at bay in the first quarter. The S&P 500 clung to record highs and notched its strongest first quarter since 2019. Markets rode out a decisive uptrend, though the moves were fairly “fat and flat” (broadly higher but still range-bound). Here are some of the more popular ETFs in the first quarter.

Staying in the Game

It should come as no surprise that big, broad-based index equity ETFs managed to come out on top. Investors looking to either get a taste of the rally or maintain exposure scooped up the Vanguard S&P 500 ETF (VOO) – which topped the charts at #1 with nearly $24 billion in inflows. The iShares Core S&P 500 ETF (IVV) was not far behind. Lots of love shown for large-cap darlings like Microsoft, Apple, NVIDIA, JPMorgan Chase, and Visa. But small-cap equity ETFs were less popular – with net outflows in funds like the iShares Russell 2000 ETF (IWM).

Getting More Cost-Conscious?

Also making the top 10: the SPDR Portfolio S&P 500 ETF (SPLG). Of all the major cap-weighted S&P 500 ETF offerings, SPLG is by far the smallest – with only $33 billion in total assets. But it is also the cheapest – with an expense ratio of 0.02% – indicating investors have grown more cost-conscious in 2024. Both the VOO and IVV charge 0.03% each, while the SPDR S&P 500 ETF Trust (SPY) stands strong at 0.09%.

SPY has seen net outflows for the year – though it was a big winner in March, with roughly $18 billion in net inflows.

Growth Tilt in Play

The Federal Reserve’s rate regime may change the calculus on growth, but investors embraced mega-cap growth in Q1. The Invesco QQQ Trust Series (QQQ) raked in more than $9 billion in net flows and is up 8% for the year. There was more appetite for large-cap, high-duration growth and less for high-momentum movers, such as the ARK Innovation ETF (ARKK).

Crypto’s Time to Shine

And of course, investors remain fixated on the topic du jour in the ETF industry: cryptocurrencies. The crypto community is all abuzz about the fresh crop of products after years of grappling with the SEC over approval for a spot bitcoin ETF.

These products just came to market in January, but BlackRock and Fidelity are undoubtedly leading the pack. The iShares Bitcoin Trust (IBIT) has already racked up more than $13 billion year-to-date, while the Fidelity Wise Origin Bitcoin Fund (FBTC) has accrued more than $7 billion in net inflows.

Rise in Active ETFs/Factors in Focus

It’s worth noting the BlackRock U.S. Equity Factor Rotation (DYNF) took the top spot among actively managed ETFs in the first quarter – with inflows of $6.8 billion. The active fund selects large-cap stocks based on the rotation of five traditional factors – minimum volatility, momentum, quality, small size, and value. Even with inflows of $6.8 billion, this brings the total asset base up to $7.2 billion – making DYNF the smallest ETF among the top 10 most popular this year.

We’ll be following the flows to see whether these trends spill over into the second quarter and beyond.

For more news, information, and analysis, visit VettaFi | ETF Trends.