With government bond yields low, many income investors are embracing alternative yield sources this year, including preferred stocks and their related exchange traded funds.

While yields on preferreds remain elevated relative to broader equity benchmarks and aggregate bond funds, some market observers believe preferreds are currently priced for perfection. That could be a sign investors may encounter limited near- to medium-term upside with basic preferred strategies.

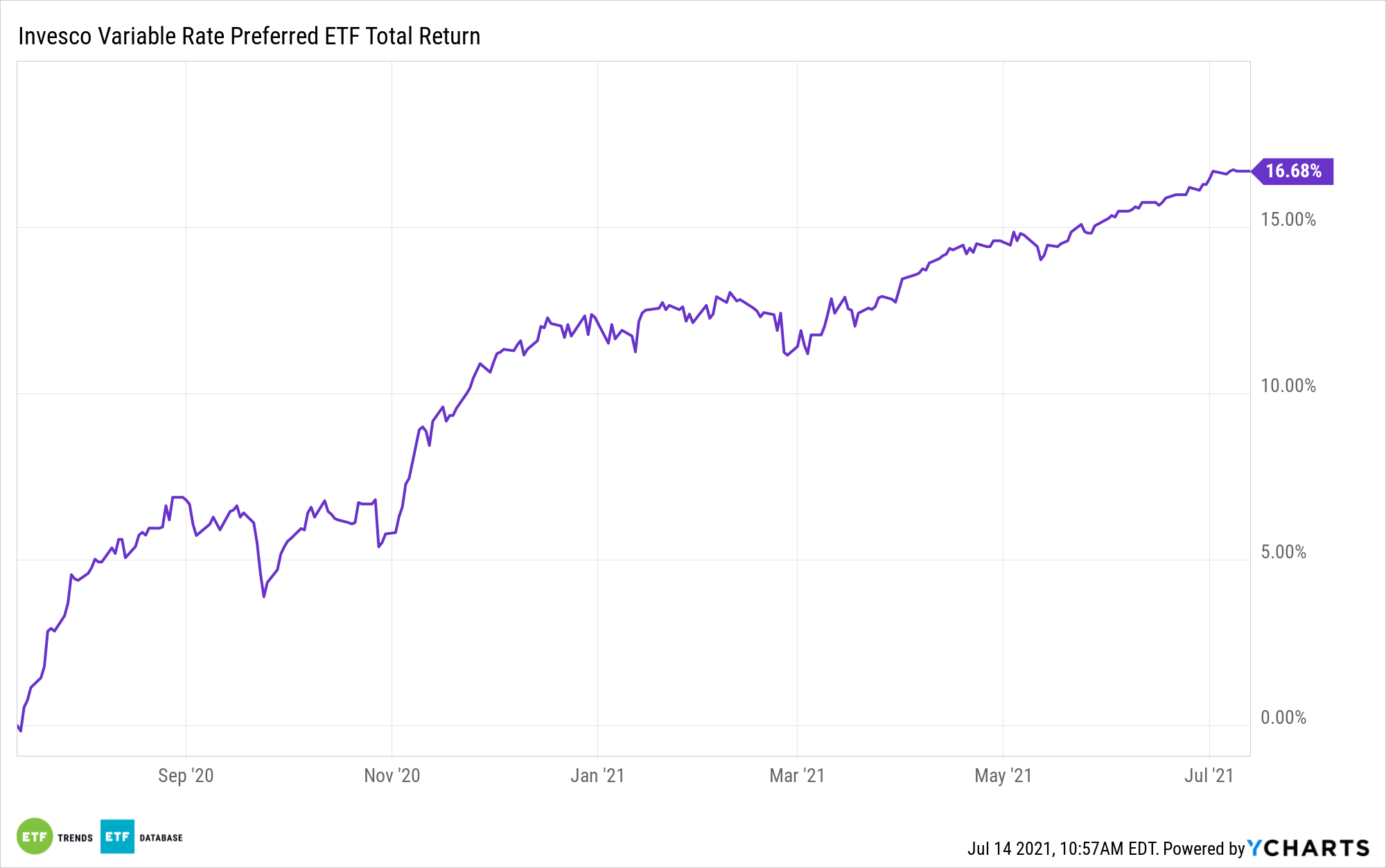

However, the Invesco Variable Rate Preferred Portfolio Fund (NYSEArca: VRP) could be the tonic for dull preferred returns.

“The good news is that preferred securities can offer investors higher income payments than many other fixed income investments, and large banks are generally in good shape to make those payments to preferred security holders,” writes Charles Schwab’s Collin Martin. “The bad news is that prices of preferred securities have rarely been higher than they are today. We see little room for price appreciation at this point, and a greater risk that prices will fall, albeit modestly, from current levels.”

Considering the VRP ETF?

Like many preferred ETFs, VRP is heavily allocated to issues from financial services companies – the sector that’s typically the largest issuers of preferred shares. While that means a lack of diversification (the sector is 73.57% of VRP’s weight), it’s not a drawback regarding income because domestic financial institutions are on solid ground with the resources to cover preferred obligations.

As Schwab’s Martin notes, banks recently passed the Federal Reserve’s stress tests with flying colors, paving the way for dividend increases on common stocks. That’s actually a positive for VRP because companies must tend to preferred dividends prior to paying out common dividends. Still, there are concerns about preferred price appreciation.

“There’s very little room for price appreciation going forward. Coupon payments should be the driver of total returns over the next six to 12 months, not price gains,” says Martin. “The average price of the ICE BofA Fixed Rate Preferred Securities Index is approaching $108, not far from its all-time high of $108.7 reached in 2013.”

VRP can combat this scenario, particularly if interest rates trend higher. Rising rates highlight the benefits of the fund’s floating and variable rate elements because floating rate products typically respond well to rising rates. If rates rise, investors may demand higher yields on preferreds, but with VRP, they don’t have to transition out of fixed rate issues. VRP’s variable rates do the legwork for them.

Over the past three years, the Invesco fund has modestly outperformed the ICE Exchange-Listed Preferred & Hybrid Securities Index.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.