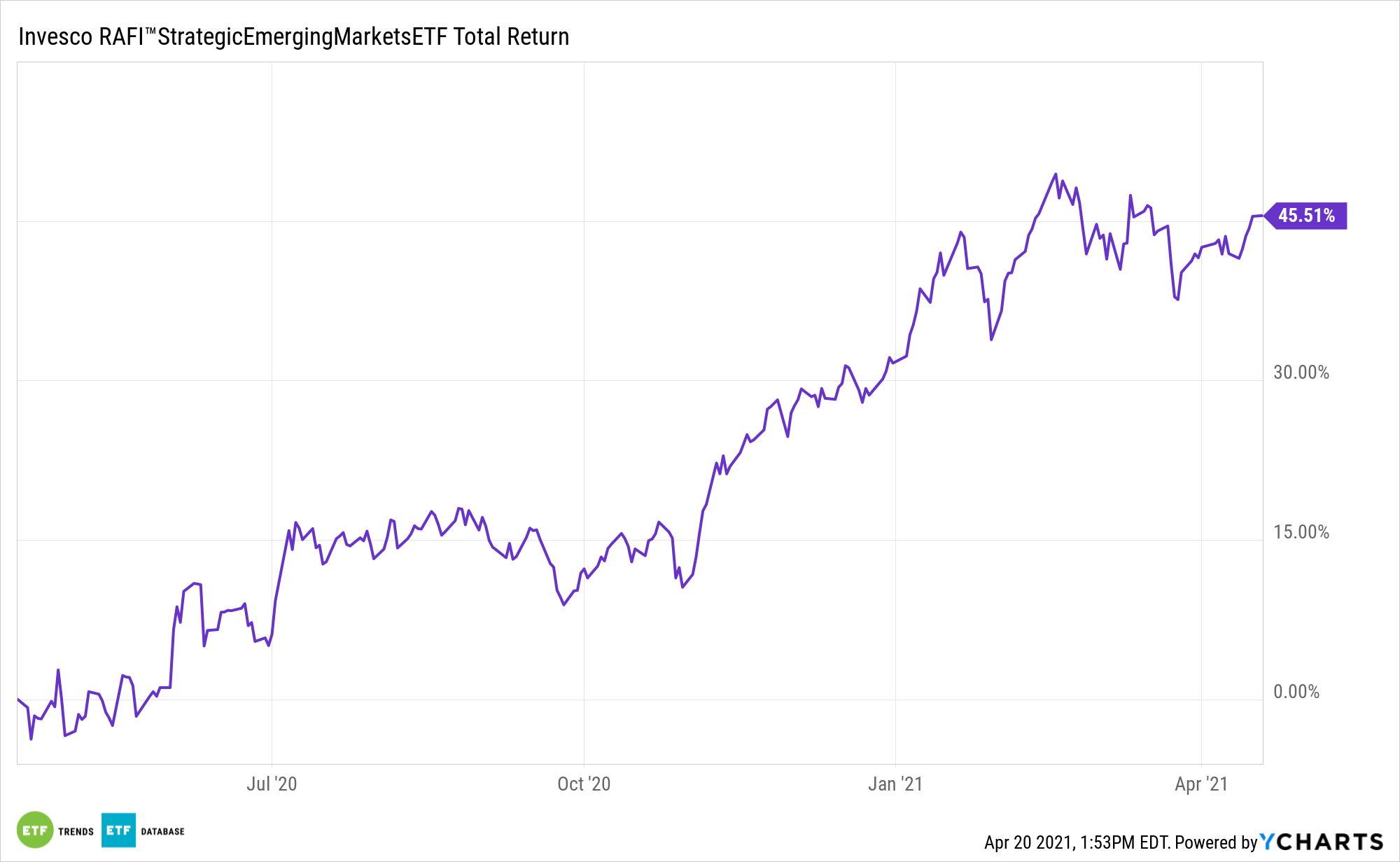

With emerging markets assets poised to benefit from earnings growth and rising coronavirus vaccination levels, investors may want to consider a factor-based approach with the Invesco RAFI™ Strategic Emerging Markets ETF (ISEM).

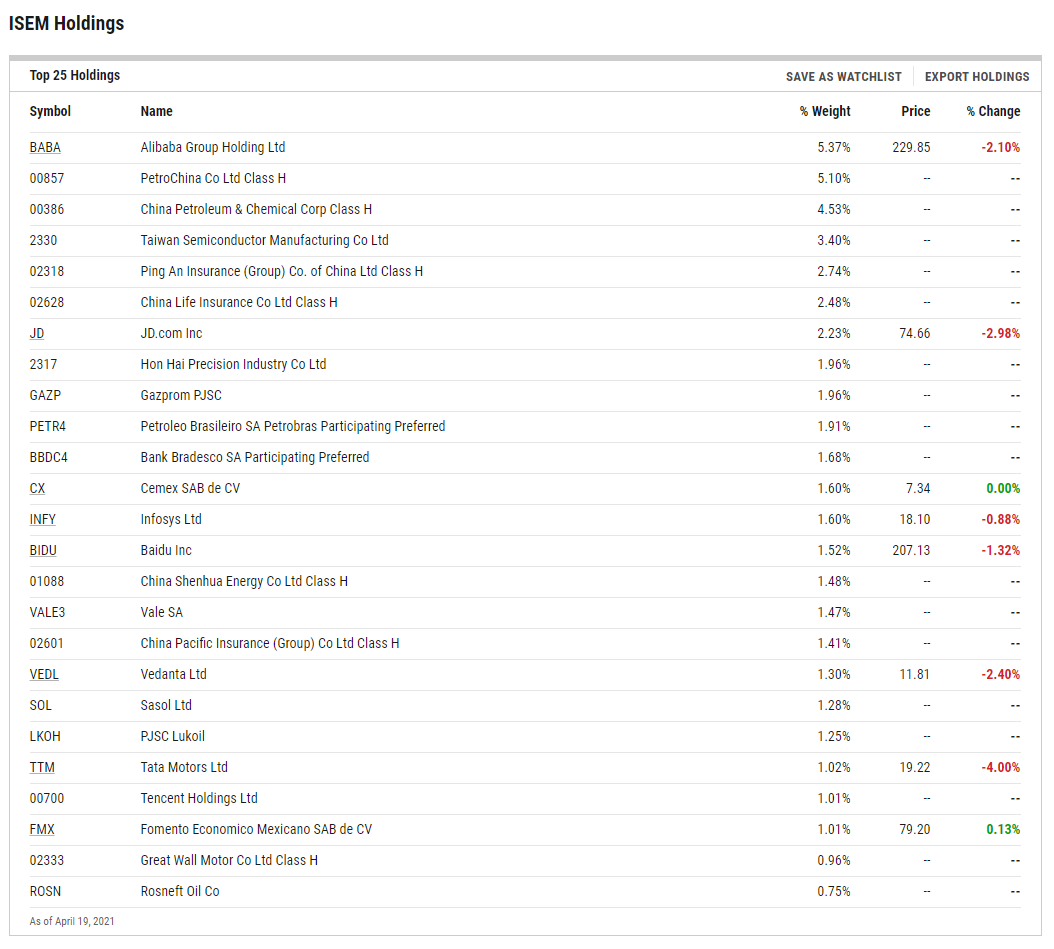

ISEM is based on the Invesco Strategic Emerging Markets Index. The Fund will normally invest at least 80% of its total assets in securities, American depositary receipts (ADRs), and global depositary receipts (GDRs) that comprise the Index.

The ETF’s index measures the performance of high quality, large-sized emerging market companies. The eligible equity securities are assigned a business-size score based on the equally-weighted average of sales, operating cash flow, total return of capital, and book value over the prior five years or life of the security.

“We see the economic restart and greater stability in U.S. government bond yields – as indicated by our new nominal theme – supporting emerging market assets over coming months,” writes BlackRock. “Their valuations appear relatively attractive in a world of low yields after a choppy start to the year. Risks to our view include potential policy tightening and sluggish vaccine rollouts in some EMs.”

‘ISEM’ Could Get Interesting

Analysts have been upwardly revising earnings estimates on emerging market companies faster than for those in developed countries. These factors could be signs that investors may want to deploy active management when allocating to developing economies.

“We expect our new nominal theme – a more muted response in nominal yields to higher inflation expectations – to hold as we move toward a full reopening. The U.S. dollar has strengthened so far this year, reflecting the faster-than-expected restart in the U.S. fueled by an accelerated vaccine rollout and large fiscal spending,” writes BlackRock.

ISEM allocates over half its weight to Chinese stocks, while Taiwan and Brazil combine for almost 23%. The ETF has chops as a cyclical trade because it devotes more than half its weight to the energy, consumer discretionary, and materials sectors.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.