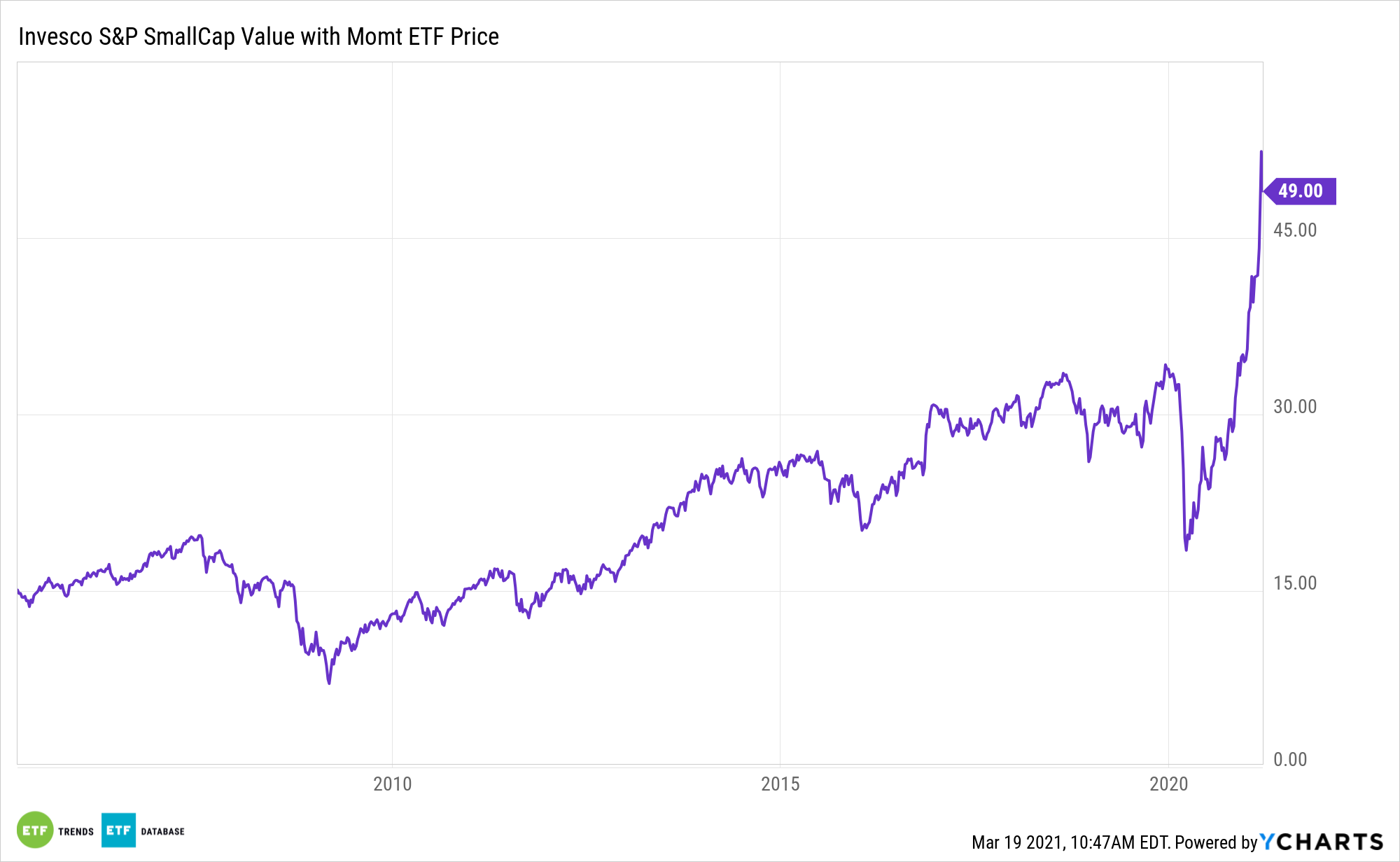

The Invesco S&P SmallCap Value with Momentum ETF (XSVM) flies under the radar, but it may be shedding that status as more investors find value in multi-factor small cap strategies.

XSVM seeks to track the investment results (before fees and expenses) of the S&P Small Cap 600 High Momentum Value Index. Strictly in accordance with its guidelines and mandated procedures, the index provider compiles, maintains, and calculates the underlying index, which is designed to track the performance of approximately 120 stocks in the S&P SmallCap 600® Index that have the highest ‘value’ and ‘momentum’ scores.

There are good reasons to go beyond traditional cap-weighted strategies with smaller stocks.

“While most multifactor funds focus on large- and mid-cap stocks, the payoff to factor investing has tended to be larger among smaller stocks,” writes Morningstar analyst Ryan Jackson. “Small-cap stocks may not always be in favor, but those who believe in factors should consider small-cap multifactor strategies, which have greater potential to beat their relevant benchmark than large-cap multifactor funds.”

Examining XSVM

XSVM charges 0.39% per year, or $39 on a $10,000 investment, a reasonable price for smaller factor strategies.

Historically, the small cap/value combination has been rewarding, but it took a big hit when value languished during the recently deceased bull market. The tendency of factor leadership to change from year to year underscores XSVM’s utility: with the Invesco ETF’s multi-factor approach, investors don’t incur the burden of factor timing.

“The value, momentum, low-volatility, size, and quality factors have historically been linked with superior risk-adjusted performance. The payoffs to value, momentum, and low volatility have tended to be greater among small-cap stocks,” continues Jackson.

Mispricing in the small cap market increases the allure of XSVM’s multi-factor approach.

“Inefficiencies in the small-cap market offer the best explanation for these factors’ greater payoffs among smaller stocks,” concludes Jackson. “Stock mispricing is more likely further down the market-cap scale. Smaller firms don’t receive the same degree of attention as their large-cap brethren. Because mispricing likely contributes to the success of each factor, it makes sense that greater mispricing would contribute to greater factor efficacy among smaller stocks.”

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.