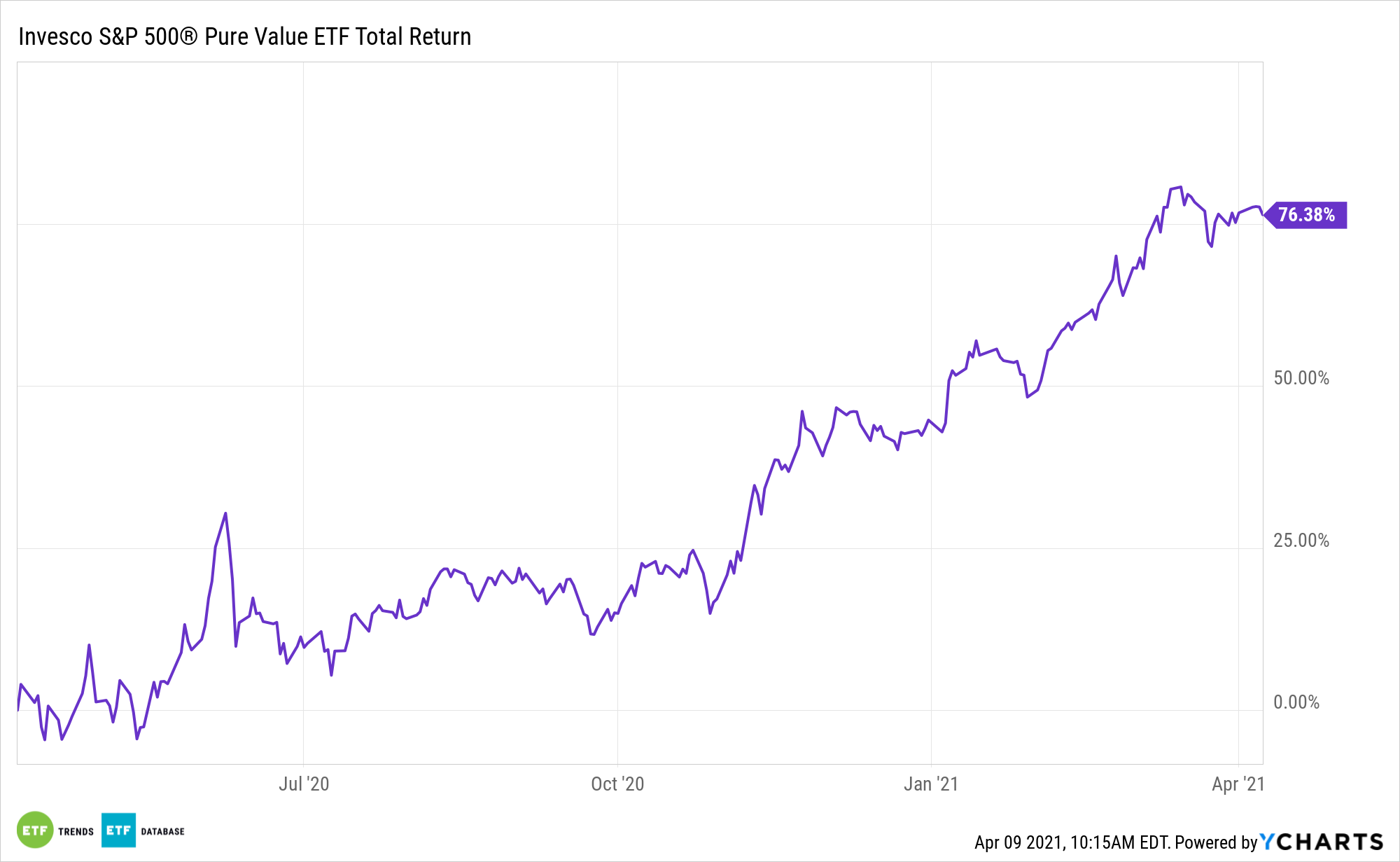

Up 22% year-to-date, the Invesco S&P 500® Pure Value ETF (RPV) is clearly benefiting from the value resurgence. Good news: that theme has some staying power.

RPV holdings and value stocks usually trade at lower prices relative to fundamental measures of value, like earnings and the book value of assets. On the other hand, growth-oriented stocks tend to run at higher valuations since investors expect the rapid growth in those company measures.

The ETF seeks to track the investment results (before fees and expenses) of the S&P 500® Pure Value Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index. Data suggest RPV has room to run despite its stellar start to 2021.

“While both growth and value extend benefits, portfolios may have room for greater value exposure. Market indexes typically tilt toward growth stocks,” according to BlackRock research. “Because investors assign higher prices to growth stocks, they carry higher market capitalizations – and greater representation in market-cap-weighted indexes. The S&P 500 Index was 67% growth stocks as of mid-February 2021. Value is similarly underrepresented in investor portfolios. A BlackRock Portfolio Solutions (BPS) review of more than 18,000 advisor model portfolios at year-end 2020 showed 62% were underweight value.”

RPV’s Value and Growth Considerations

RPV’s index assigns two scores – one for value and one for growth – based on the characteristics of the issuer. The “value score” is measured using three factors: book-value-to-price ratio, earnings-to-price ratio, and sales-to-price ratio. The “growth score” is measured using three other factors: three-year sales per share growth, the three-year ratio of earnings per share change to price per share, and momentum (the 12-month percentage change in price).

The exchange traded fund is also worth considering in the new inflationary environment.

“In the longer term, we see a higher inflation regime as supportive of value stocks. While we don’t see rising inflation as an imminent issue, it is a real risk in the medium term,” notes BlackRock. “As we discuss in our latest equity market outlook, the coronavirus crisis compelled the biggest global fiscal and monetary stimulus seen in the post-WWII era. Combined with pent-up demand accrued during lockdowns and consumer savings waiting to be unleashed, the risk for rising inflation is higher than it has been in decades.”

While they generally have solid fundamentals, value stocks may have lost popularity in the market and are considered bargain-priced compared with their competitors. Value fans believe this time may be different for value stocks, pointing to improving investment sentiment measures, abating fears of a recession and rebounding corporate profits.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.