Due in part to the impressive runs of the size and value factors in 2021, equal-weight exchange traded funds are generating buzz once more.

Investors shouldn’t overlook the Invesco Russell 1000 Equal Weight ETF (NYSEArca: EQAL), which follows the the Russell 1000 Equal Weight Index.

EQAL’s underlying index “is composed of securities in the Russell 1000 Index and is equally weighted across nine sector groups with each security within the sector receiving equal weight,” according to Invesco.

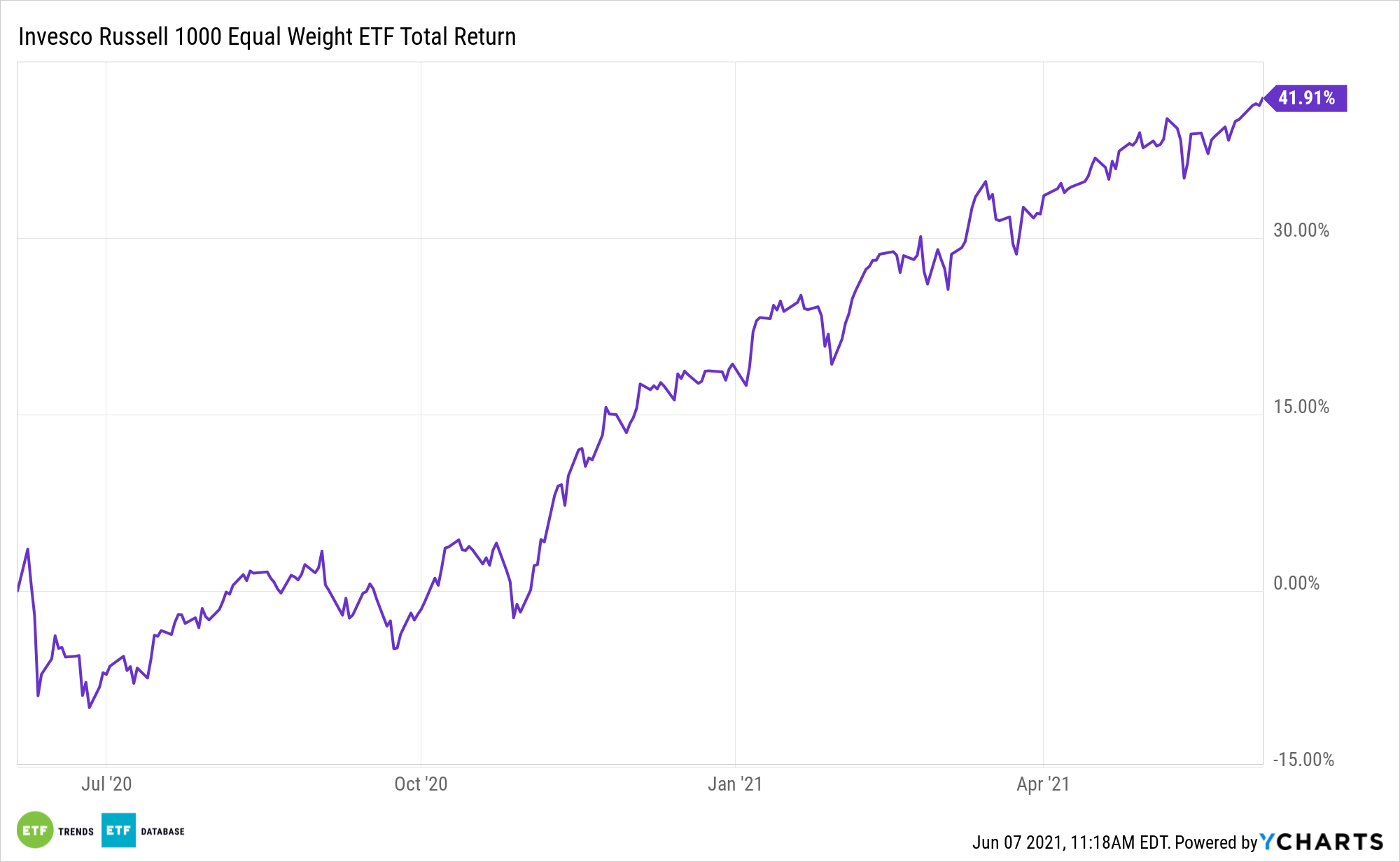

The strategy is rewarding investors in 2021. After hitting an all-time high last Friday, EQAL is higher by 18.41% year-to-date. That’s nearly 600 basis points higher than the largest ETF that tracks the cap-weighted version of the Russell 1000 Index.

EQAL’s Recipe for Success

When equal-weight strategies outperform, it’s common for market observers to point to smaller stocks and value assets.

Indeed, the recent value resurgence plays into the hands of EQAL investors because the Invesco ETF allocates about 41% of its weight to stocks with the value designation while those with the growth label account for just over 18% of the fund’s weight, according to issuer data.

As it pertains to EQAL, the size factor argument is perhaps more relevant simply because large caps represent just a quarter of the funds weight.

The S&P 400 MidCap 400 Index is higher by 18.58%, a showing that tops that of the large cap S&P 500. Over 52% of EQAL’s 1,007 holdings are mid cap names.

Another feather in EQAL’s cap is that, like many equal-weight funds, it limits or nearly eliminates single stock risk. Due to lengthy bull run by growth, some technology and internet stocks took on significant percentages in supposedly broad market, cap-weighted indexes, including the Russell 1000. For example, Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT) and Amazon (NASDAQ: AMZN) currently combine for about 13% of the cap-weighted Russell 1000.

Conversely, EQAL’s top 10 holdings combine for just 7.60% of the fund’s weight and the three largest components combine for just 1.41% (as of June 4).

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.