Among the various investment factors, many investors already know that growth, value, low volatility, and others are not constrained by market capitalization.

For some unknowing investors, the quality factor may appear to be the exception. After all, quality stocks often pay dividends, are highly profitable, buy back stocks, have low debt burdens and high return on equity, and boast other positive traits. Those characteristics are often associated with large-cap fare and aren’t always common with small-cap stocks. What’s more, it’s hard to find small-caps that possess all of those traits.

However, there are small caps that fit the bill as quality stocks — enough to put together an exchange traded fund such as the Invesco S&P SmallCap Quality ETF (XSHQ). XSHQ, which recently turned four years old, follows the S&P SmallCap 600 Quality Index.

That benchmark is “composed of 120 securities in the S&P SmallCap 600® Index that have the highest quality score, which is calculated based on the average of three fundamental measures: return on equity, accruals ratio and financial leverage ratio,” according to Invesco.

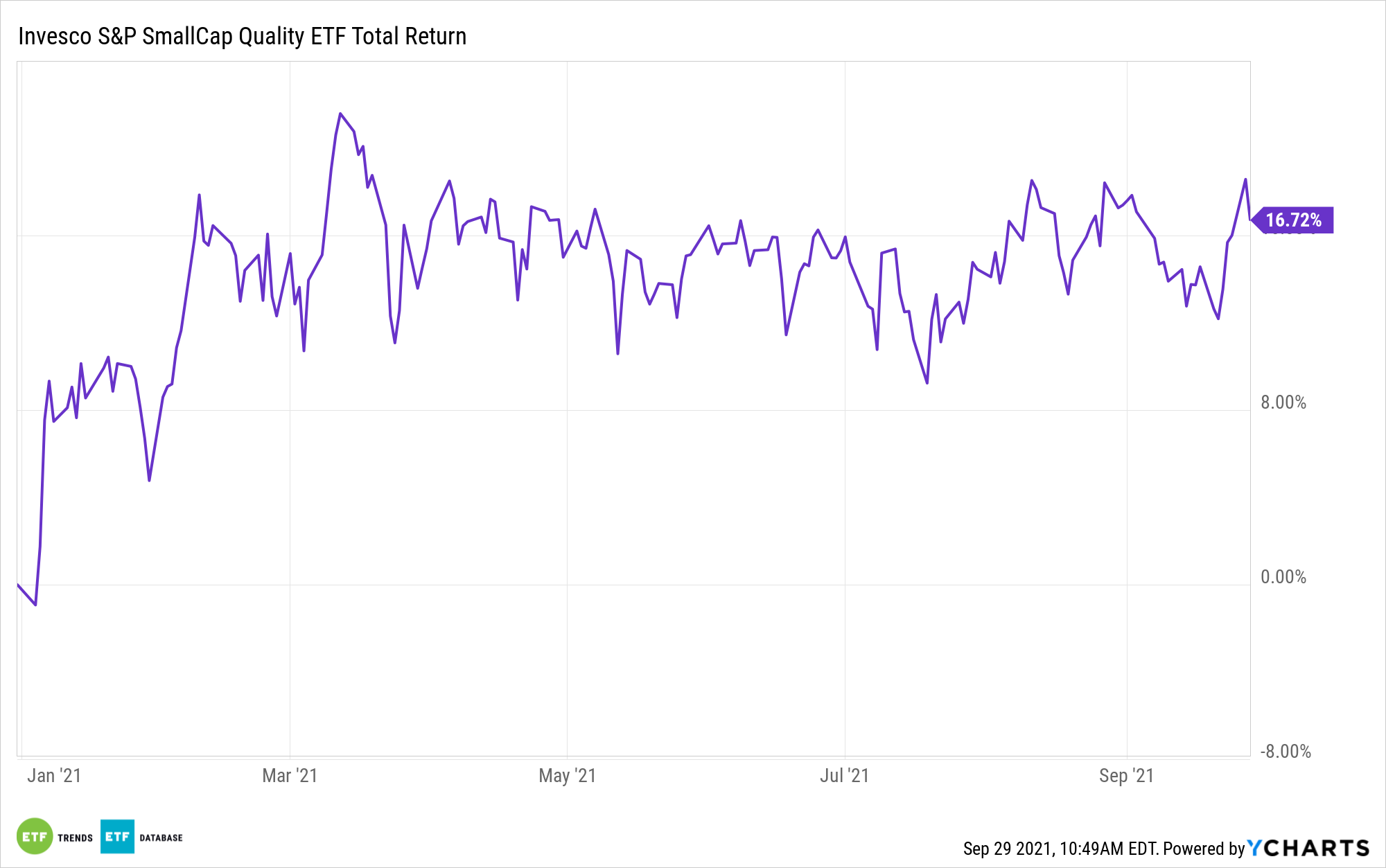

Proving that it’s hard to qualify as a small-cap quality name, XSHQ is home to just 120 stocks, but that exclusivity clearly isn’t hurting returns, as the fund is higher by 15.24% year-to-date. While that lags broader small-cap benchmarks, XSHQ could be ready to play some catch-up.

“During these time periods, quality stocks — shares of companies with strong balance sheets — tend to perform best, the firm found. In fact, high-quality stocks outperformed the equal-weighted Russell 2000 in every late cycle period since 1990, according to Bank of America’s analysis,” reports Hannah Miao for CNBC.

Like any other quality ETF, XSHQ is sector agnostic. However, there are groups where small-cap quality is more prevalent than others. For example, financial services and consumer discretionary names combine for 59.5% of XSHQ’s weight, indicating that the ETF has some cyclical leanings. Along those lines, about 34% of its components are also value stocks, compared with 19% that wear the growth label.

In addition to consumer discretionary, “Bank of America’s quality small-cap stock picks also span health care, energy, industrials, information technology, materials and real estate,” according to CNBC.

Industrial, technology, and healthcare stocks combine for nearly a third of XSHQ’s roster.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.