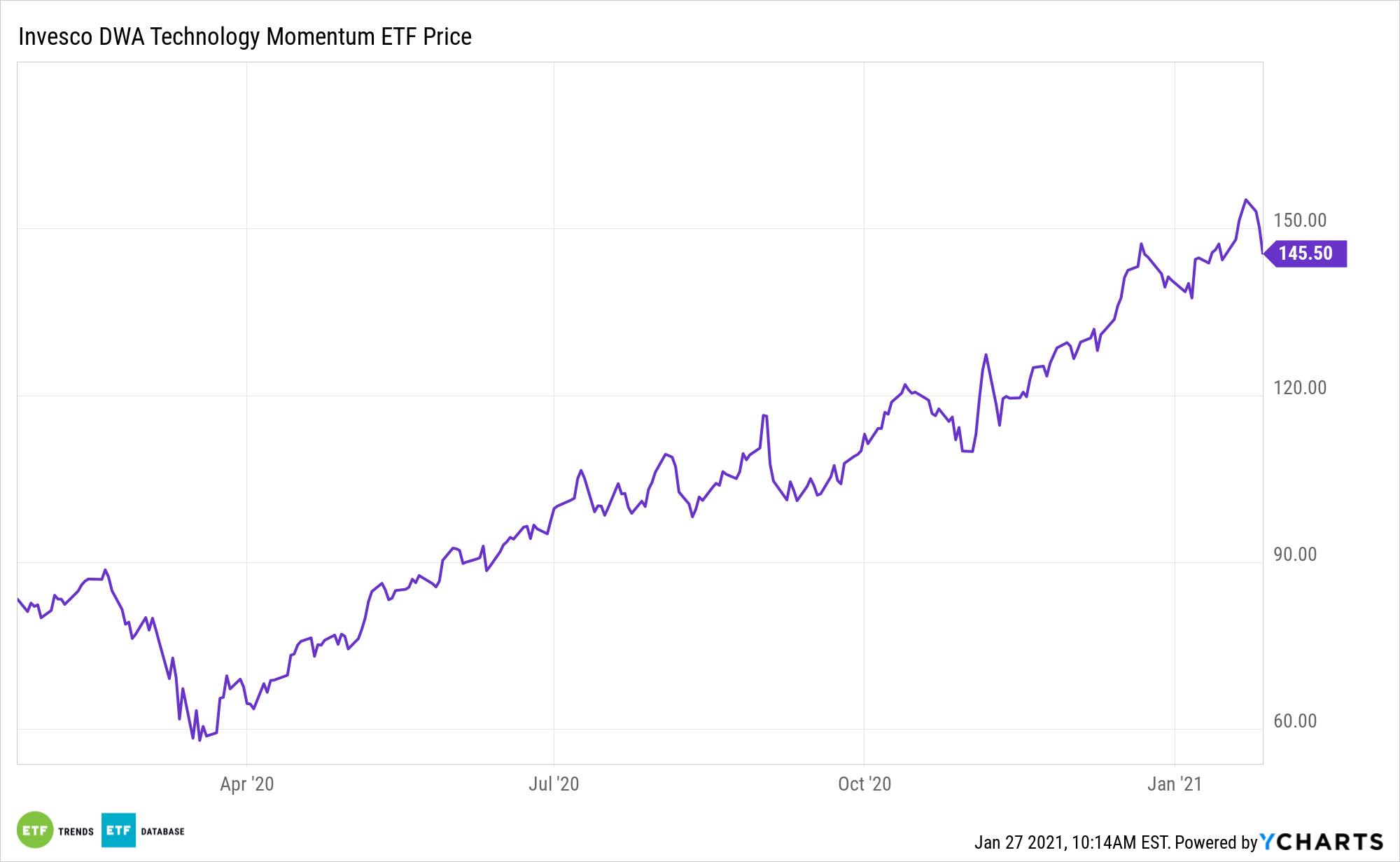

Technology was the best-performing sector last year. Momentum was the second-best investment factor. While the duo may illicit fears of a bubble, the technology sector is far different than it was more than two decades ago, and the Invesco DWA Technology Momentum ETF (PTF) still looks extremely attractive.

The ETF is based on the Dorsey Wright® Technology Technical Leaders Index (DWA Technology Technical Leaders Index). The Fund will normally invest at least 90% of its total assets in the securities that comprise the Index.

The Index is designed to identify companies that are showing relative strength (momentum), and is composed of at least 30 securities from the NASDAQ US Benchmark Index. Relative strength is the measurement of a security’s performance in a given universe over time as compared to the performance of all other securities in that universe. The Fund and the Index are rebalanced and reconstituted quarterly.

“The Tech sector of today is not your father’s Tech sector. Similarly, we can analyze the market from a factor perspective and look at the characteristics of Momentum today versus in the late 1990s. In several respects, the differences outweigh the similarities,” according to S&P Dow Jones Indices.

The Power of the PTF ETF

Momentum tends to be negatively correlated to factors like size and value since momentum identifies securities that are trending upwards. These stocks tend to reflect successful companies with positive trends that become bigger and bigger. Consequently, investors can also enjoy the diversification benefits of adding momentum strategies such as PFT to small cap and value-heavy portfolios.

Adding to the case for PTF is that momentum isn’t as volatile today as it was during the 2000 tech bubble.

“Relative volatility of Momentum was much higher then (December 1998-December 2000) than it is now, with an annualized standard deviation of daily relative returns of 15.9%—almost double the current period’s standard deviation of 8.1% (December 2018-December 2020),” notes S&P Dow Jones.

Momentum investing is rooted in the notion that securities that are on torrid paces will continue acting that way over the near-term, while laggards will continue slumping. Long-term data for the momentum factor are compelling, but the factor can be volatile.

PTF even has some quality traits, thanks to an almost 8% weight to Apple, which can defray some of the volatility associated with its small- and mid-cap names.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.