With Democrats controlling both houses of Congress and the White House, conventional wisdom held that 2021 should have been a banner year for renewable energy stocks.

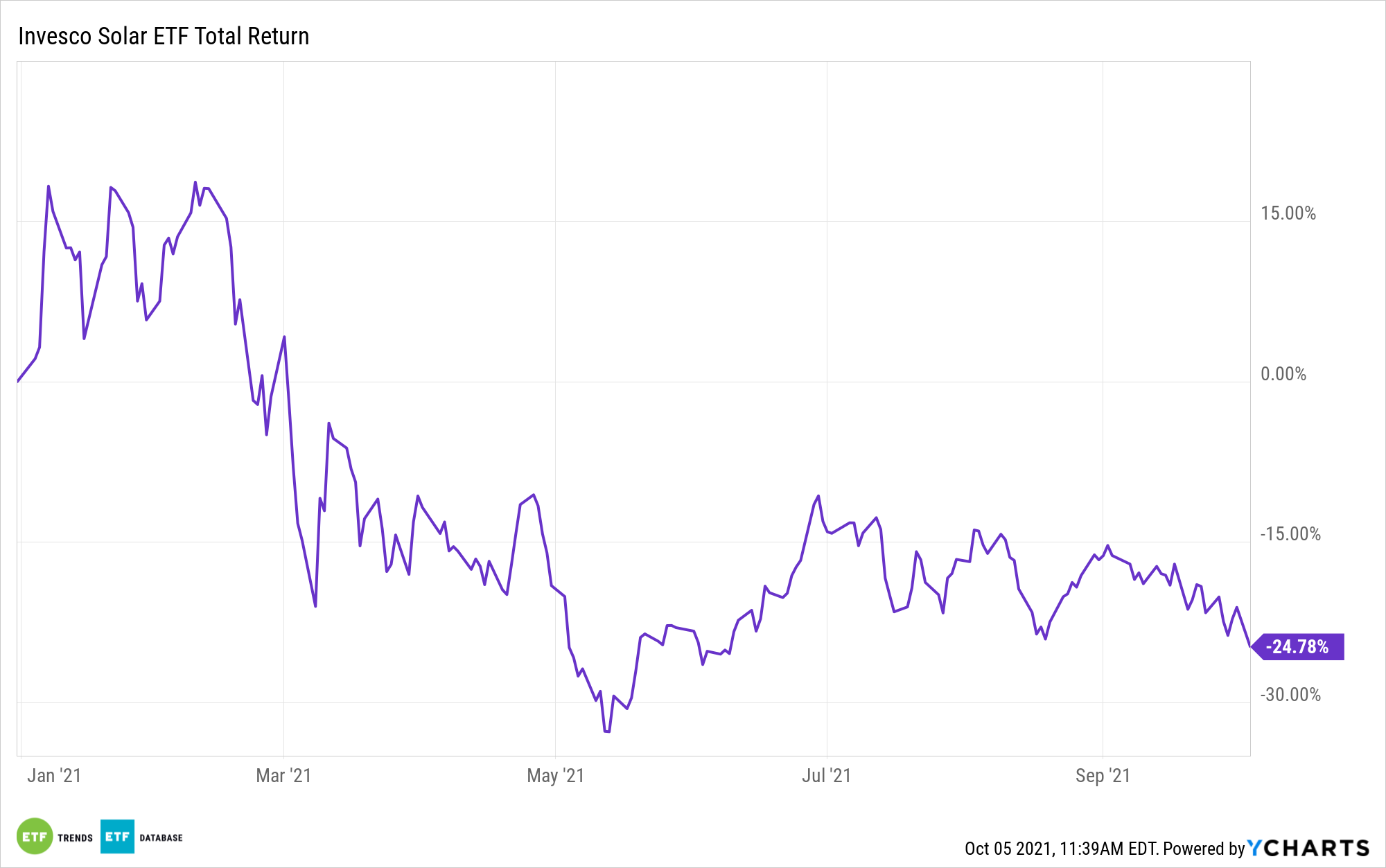

However, much of that ebullience was priced into those names before the year started, and the group is floundering in 2021. For example, the Invesco Solar ETF (TAN), the largest exchange traded fund focusing on solar equities, is lower by 24.78% year-to-date.

Some market observers believe that the repudiation of solar stocks this year is too harsh and that some TAN components still offer strong long-term potential. For example, BMO Capital Markets analysts led by Ameet Thakkar said that recent lethargy among solar equities is a buying opportunity.

“Global investment in clean energy is a multitrillion dollar, multidecade effort that will drive secular growth for many companies leading the transition away from carbon through the next several business cycles,” said the BMO team in a recent note to clients.

The research firm says that solar stocks could be in for some turbulence over the next few quarters, but adds that “a multidecade secular growth story” is afoot. Importantly for investors considering a position in TAN, BMO is bullish on several of the ETF’s marquee holdings, including SolarEdge Technologies Inc. (NASDAQ:SEDG) and Enphase Energy (NASDAQ:ENPH).

“Enphase makes a specialized inverter known as a microinverter, and this technological advantage sets the stock up for long-term gains,” reports Pippa Stevens for CNBC. “BMO has a $200 target on the name, which is 29% above where shares closed on Friday. The firm pointed to ‘meaningful earnings growth,’ which it pegs at a 30% compound annual growth rate from 2020 to 2025 driven by more solar systems, increased revenue per customer as batteries and vehicles are integrated, and expansion into commercial and international markets.”

Regarding SolarEdge, BMO says that the company’s core inverter product is increasingly prominent in a fast-growing segment of the solar market. SolarEdge and Enphase combine for 20.67% of TAN’s roster. The research firm is also enthusiastic on Sunrun (RUN) and Sunnova Energy International Inc. (NOVA). Sunrun is the biggest provider of residential solar systems.

“NOVA offers exposure to the fast-growing U.S. residential solar market that is energized by government policy goals, EV adoption, and demand for energy storage,” notes BMO.

Those two stocks are top 10 holdings in TAN and combine for about 9.7% of the ETF”s weight.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.