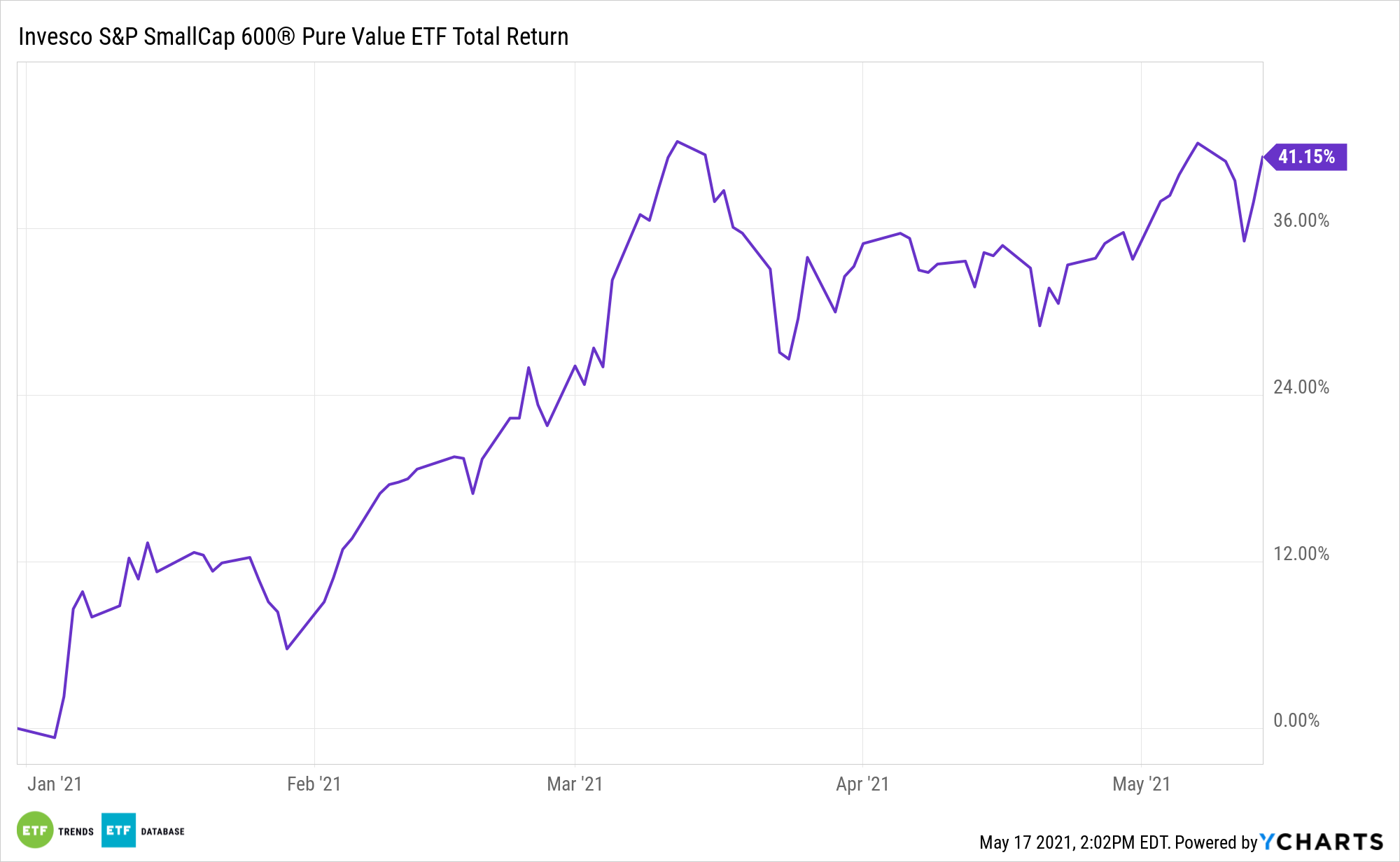

Proving the potency of the small cap value combination, the Invesco S&P SmallCap 600 Pure Value ETF (RZV) is up over 41% year-to-date.

That’s a big gain in a short amount of time, but it doesn’t imply RZV’s upside from here is limited. In fact, there are reasons to believe to that the current value run is still in its early innings. Despite small cap value’s recent bullishness, and weakness in small cap growth, the gaps between the two are still wide. That could mean RZV still has more work to do to narrow spreads against growth rivals.

“From a strategic perspective, most long-term investors need the capital appreciation potential that this asset class has consistently delivered. Tactically, markets are signaling a chance to sell what is dear and buy what is on sale, presenting a rare window to rebalance without regret of doing so,” according to Wells Fargo Asset Management.

See also: Value Investing Getting a Dividend Renaissance Boost

Small Caps x Value

In addition to the longer-ranging efficacy of the small cap value combination, RZV is relevant to investors today because of its heavily cyclical sector tilts.

The Invesco fund allocates over three-quarters of its weight to financial services, industrial, consumer discretionary, materials, and energy stocks, confirming it’s tilting the right way in an environment that favors stocks levered to an economic recovery. Some of those sectors have recently experienced profitability challenges, but that’s turning for the better.

“Admittedly, cheap stocks have been less profitable between 2017 and 2020. However, their profitability has improved considerably in recent months. In fact, cheap stocks were actually slightly more profitable than their expensive peers at the end of March 2021,” according to Robeco.

Adding to the case for RZV is that, broadly speaking, value stocks are building momentum.

“The recent value recovery has led to a change in sentiment regarding value stocks,” adds Robeco. “Price momentum – measured as a stock’s return over the last 6 to 12 months – is one way to gauge market sentiment. While value and momentum tend to be negatively correlated – therefore providing diversification benefits – there have been a few periods in history when value stocks exhibited strong momentum. We expect this to happen again in the coming months.”

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.