Value stocks are generating plenty of attention this year. Many market observers believe that trend should extend to mid- and small-cap fare.

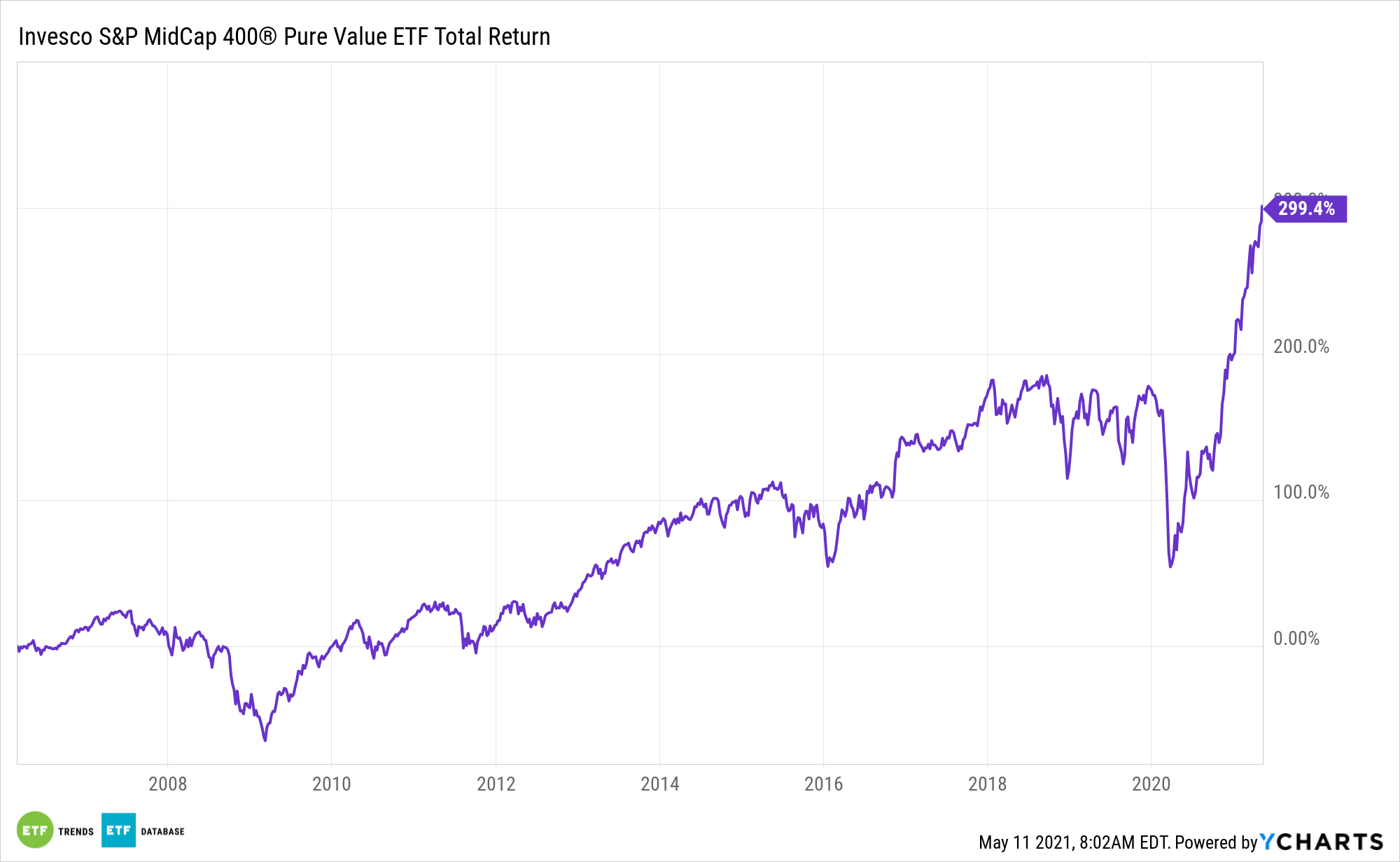

That could be a sign that the already formidable Invesco S&P MidCap 400 Pure Value ETF (RFV) can build on its 2021 momentum. RFV follows the S&P MidCap 400® Pure Value Index. Several factors point to RFV extending its bullishness.

“The outperformance in mega-cap tech stocks has likely nearly run its course as valuations in these stocks have moved up considerably in recent weeks, thanks to better-than-expected earnings and a retreat in bond yields,” said Andrea Bevis, senior vice president, UBS Private Wealth Management in Boston. “We believe the next leg of the equity rally will be driven by value stocks, and small and mid-cap segments of the market.”

Ringing Up ‘RFV’

Not only are mid caps leading large- and small-caps this year, but RFV has the right sector mix to capitalize in the current environment. Nearly two-thirds of its sector weight is allocated to groups with the cyclical designation – a notable traits at a time when cyclicals are leading, growth is faltering, and defensives are lagging.

“Despite recent tech strength, investors should diversify beyond mega-cap tech companies and rotate into cyclical and value-oriented areas of the market that should continue to benefit from higher yields and a broadening economic recovery,” adds Bevis. “Investors should continue to use periods of market volatility to add exposure to cyclical sectors, which are beneficiaries of the economic recovery. Sectors with a high quality cyclical bias, such as consumer discretionary, energy, and financials, are our most preferred sectors of the market.”

As of May 10, RFV allocates approximately 43% of its roster to financial services, materials and energy stocks, levering the fund to both rising Treasury yields (banks stocks) and soaring commodities prices (energy and materials). That cements RFV’s status as a beneficiary of the reflation trade.

“Investors should continue to use periods of market volatility to add exposure to cyclical sectors, which are beneficiaries of the economic recovery. Sectors with a high quality cyclical bias, such as consumer discretionary, energy, and financials, are our most preferred sectors of the market,” continues Bevis. “While investors have been worrying about inflation lately, we expect any near-term spike in inflation to be temporary and are not concerned with persistent inflation. Strong corporate earnings should outweigh concerns about supply chain constraints and rising commodity and transportation costs.”

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.