Chinese stocks were among the first to be affected by the onset of the coronavirus pandemic last year, only to finish 2020 among the best performers in the world.

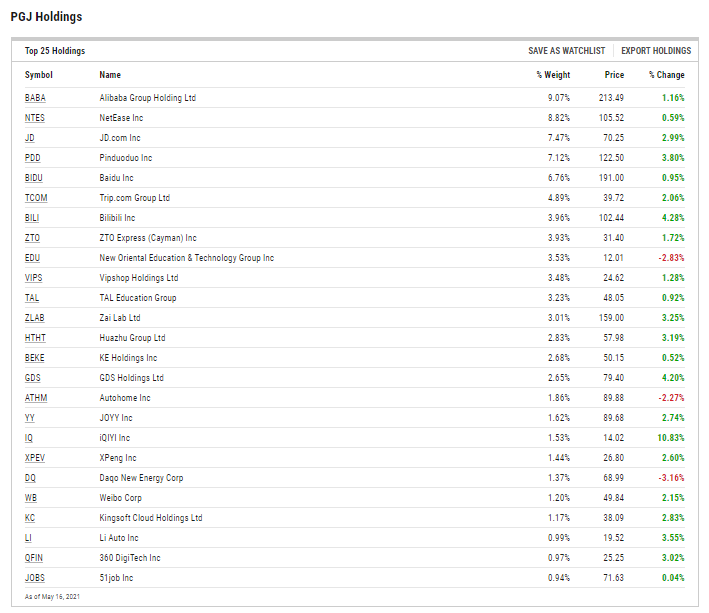

That momentum carried over into 2021, but some exchange traded funds, including the Invesco Golden Dragon China ETF (PGJ), are encountering headwinds due to Beijing’s suddenly heavy-handed approach to regulating Chinese tech.

While more overt regulation may paint an ominous picture in the eyes of some investors, it cannot be ignored that China has massive ambitions to domesticate its tech needs and reduce dependence on imports, which could be a longer-ranging catalyst for funds like PGJ.

“Economically, China has an ambition to double GDP by 2035 – surpassing the U.S. and firmly shifting the center of gravity for global growth to Asia in coming years,” notes BlackRock. “China’s wide-ranging plans touch many flash points in the U.S.-China relationship, with the Covid pandemic amplifying each country’s focus on economic resilience. Secure supply chains and self- sufficiency in critical technologies and industries are a strategic priority and could drive a rewiring of global trade. Intensifying competition on key technologies, such as 5G and semiconductors, is one example.”

China Also Moving Toward Sustainability

An important element to the long-term PGJ thesis is China’s moves to bolster sustainability – goals some PGJ components will play roles in helping the country reach.

“Sustainability will be a powerful driver of global returns in the medium term, in our view, and ever more central to all investment decisions,” adds BlackRock. “There are many aspects to sustainability – and the weight placed on each differs across investors. As a result, the overall assessment of China is investor specific. We consider both the current status as well as the direction of travel when it comes to assessing China’s sustainability credentials. We see improvement on several fronts – notably its environmental commitments – but recognize there is further to go, and commitments need to be realized.”

In fact, PGJ is a credible play on China’s sustainability ambitions.

“Our overweight to Chinese assets versus benchmark indexes does not change after taking into account the impact on climate change on expected returns. The composition of Chinese equity indexes is better aligned with the transition to a low-carbon economy, in our view,” concludes BlackRock.

PGJ allocates just 6% of its weight to industrial and energy stocks and has no materials exposure, steering clear of many environmental offenders.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.