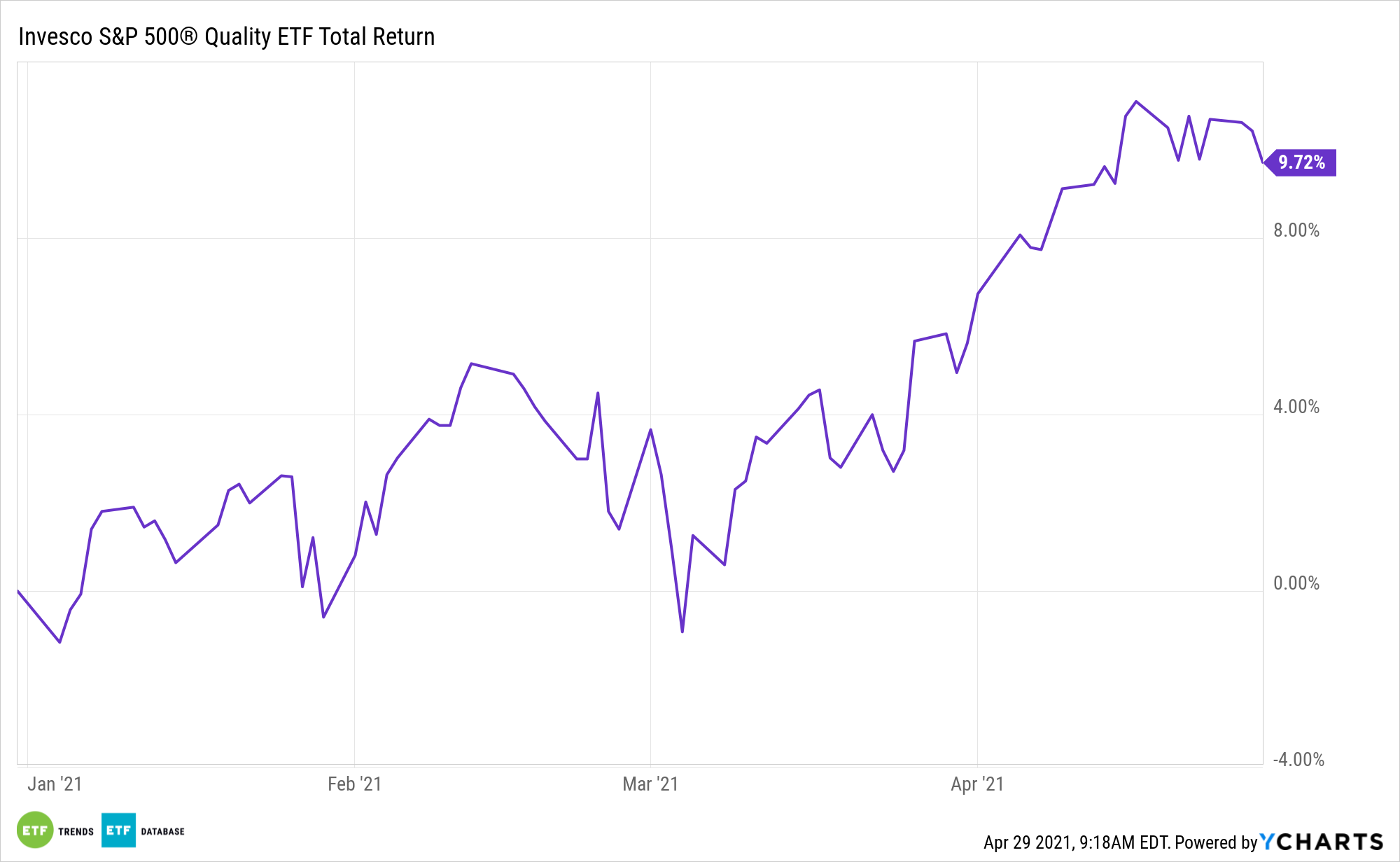

Investment factors move in and out of the limelight based on performance, but quality often proves durable. It’s also relevant again today, indicating that the Invesco S&P 500 Quality ETF (NYSEArca: SPHQ) is a promising asset to consider.

SPHQ seeks to track the investment results of the S&P 500 Quality Index. In selecting constituent securities for the underlying index, the index provider calculates the quality score of each security in the S&P 500 Index, then selects the 100 stocks with the highest quality score for inclusion in the underlying index.

See also: Top 24 Quality Factor ETFs

The Invesco ETF is higher by 39% over the past year, confirming quality can offer investors upside. SPHQ also taps into an important element of the quality factor: earnings.

“Companies witnessing positive analyst earnings revisions are more likely to lead. This supports my recent preference for financials, including U.S. and European banks and consumer finance, mining companies, manufacturing and the more cyclical portions of tech, such as payment companies,” according to BlackRock research.

SPHQ’s Favorable Traits

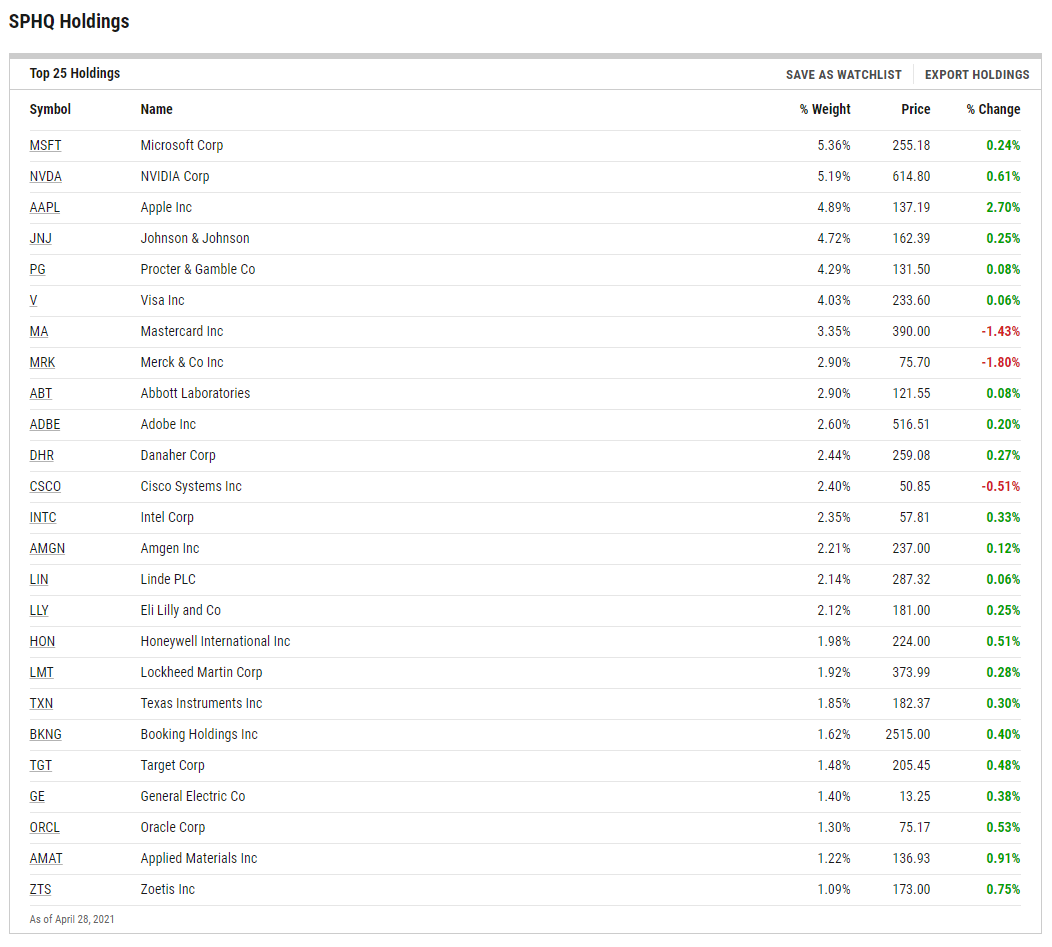

The $2.68 billion SPHQ holds 100 stocks and can serve as a sector-level template for locating high-quality fare.

In fact, while SPHQ is sector agnostic, its applications of the quality factor overtly tell investors where quality is easily allocated, as the fund devotes two-thirds of its weight to technology and healthcare stocks.

The tech weight also indicates quality and growth don’t have to be mutually exclusive. 36% of SPHQ’s roster is allocated to stocks with the growth classification. That compares to 22% with the value designation. The tech exposure is meaningful for another reason: earnings growth.

“Unlike last year when earnings multiples surged, this year’s gains are being driven by earnings growth. Companies witnessing positive analyst earnings revisions are more likely to lead. This supports my recent preference for financials, including U.S. and European banks and consumer finance, mining companies, manufacturing and the more cyclical portions of tech, such as payment companies,” added BlackRock’s Russ Koesterich. “While this bull market is barely a year old, with major averages more than 80% above the 2020 lows we are no longer in the first stage. As the bull market matures chasing volatility may be less rewarding. Instead, focus on cyclical exposure, a reasonable price and an ability to drive earnings growth.”

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.