Closed-end funds (CEFs) are relatively under the radar compared to peers like exchange-traded funds (ETFs) and mutual funds. Closed-end funds are generally desirable for two reasons: 1) high income; and 2) premium/discount mechanism. But despite these higher yields, these funds are primarily invested in by a niche group of retail investors. Combining them with ETFs has allowed a broader group of investor access to these investments. But should investors look at passive or active ETFs when it comes to closed-end fund investing? This note discusses the difference between active and passive ETFs of CEFs.

Active ETFs are gaining market share—here’s why

While ETFs are traditionally passive products, active opportunities in the broader ETF market have been growing significantly over the past few years. According to data from NYSE, active ETFs gathered over $130 billion in assets last year and accounted for 22% net flows. In total, active assets have over $530 billion in assets. While that is still only about 6.5% of total ETF assets, the percentage has grown from 5% last year. Investors tend to look for active management in an uncertain environment. But when the market shows some signs of life, investors can also become more confident that active strategies can capture returns better than passive strategies. In the case of closed-end funds, there has been a lot of uncertainty due to rising rates and its effect on closed-end fund distributions.

Passive ETFs of CEFs have historically had higher distributions

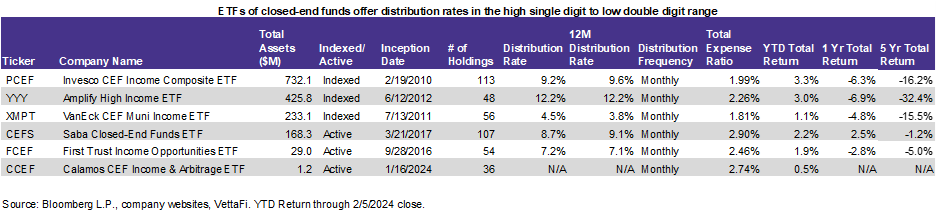

On average, closed-end funds pay distributions in the high single-digit to low-double-digit percentage range. As with any security selection, it can be difficult to predict the timing of distribution cuts. That is why an ETF may diversify away some of that risk. With passive products, you can get a broad range of diversification among funds, sectors, and managers. With active products, you can still get diversification but leave security selection in the hands of professional managers.

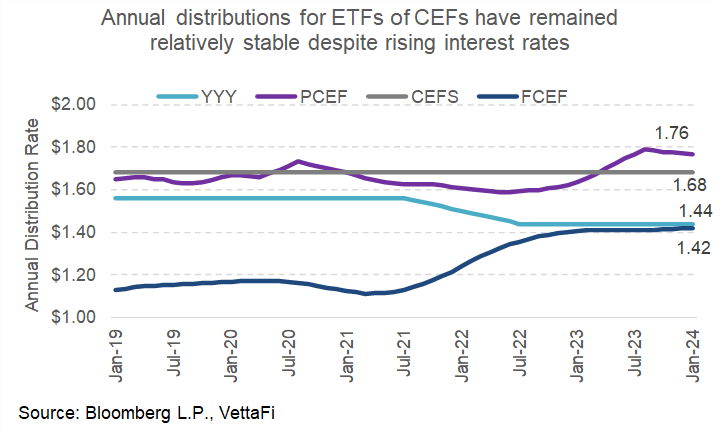

Looking at distributions, passive ETFs tend to do better than active ETFs. Passive ETFs have distributions in the high-single-digit and low double-digit range. The Amplify High Income ETF (YYY), for example, tracks an index that ranks CEFs by several criteria. Those criteria include distribution yield, fund discount, and average daily value traded with twice as much weight given to yield. Active ETFs of CEFs have historically had lower distribution rates than their passive counterparts. The good news is that, on an absolute basis, those distributions have remained relatively stable over the years.

Active ETFs of CEFs have historically had higher total return

Another attractive feature of closed-end funds is their premium/discount mechanism. Unlike ETFs, CEFs may be priced at a premium or discount to their underlying assets. Those valuation gaps tend to normalize. (That means a fund trading at a discount to its underlying assets will see its price appreciate to close the gap. A fund trading at a premium to its underlying assets will see its price depreciate to close the gap).

Active ETFs like the Saba Closed-End Funds ETF (CEFS), the First Trust Income Opportunities ETF (FCEF), and the Calamos CEF Income & Arbitrage ETF (CCEF) typically use strategies to find funds trading at discounts and then sell them once that discount narrows. This can help contribute to a higher total return in addition to higher income. Passive ETFs can build rules based on similar strategies. For example, the Invesco CEF Income Composite ETF (PCEF) and the VanEck CEF Muni Income ETF (XMPT) track indexes where constituents are given higher weights based on how wide their discounts are and lower weights based on larger premiums. This is similar to “buying low and selling high.”

Active and passive ETFs of CEFs serve different purposes

Passive and active have two different goals. Most passive ETFs of CEFs like PCEF and XMPT benchmark a universe and have historically been able to provide higher distributions. Active ETFs of CEFs have outperformed in total return over the long term; however, these have higher fees and lower liquidity and tend to also be volatile in the short term. Passive ETFs of CEFs have been around for much longer and have more assets. So I believe there is less space for new entrants because there are already some established players. Active ETFs of CEFs have less assets but have had recent launches and more room for new strategies (CCEF, for example, was just launched in January 2024).

For more news, information, and strategy, visit the ETF Education Channel.