The Invesco S&P MidCap Quality (NYSEARCA: XMHQ) combines two potent investment concepts: the quality factor and mid cap stocks.

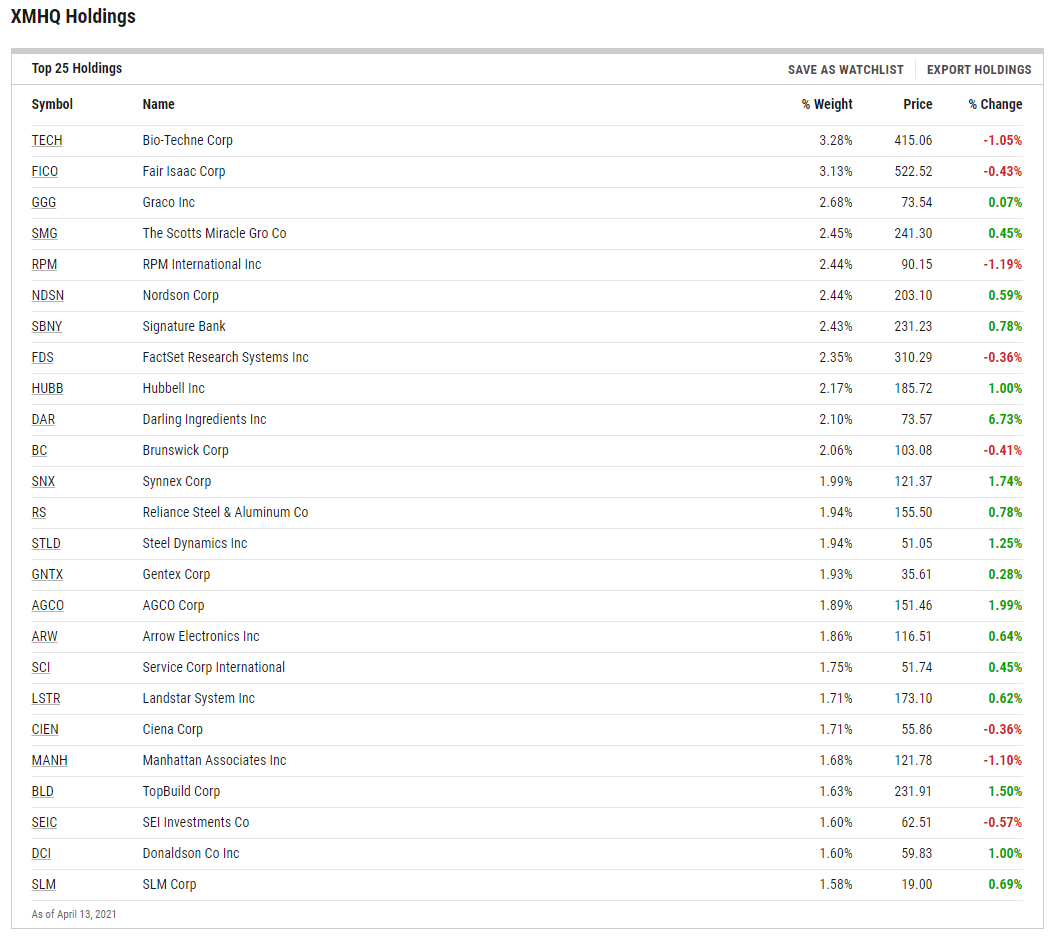

XMHQ launched in late 2006 and is home to 78 stocks. The Invesco exchange traded fund tracks the S&P MidCap 400 Quality Index.

“The Index is a modified market capitalization weighted index that holds approximately 80 securities in the S&P Midcap 400® Index that have the highest quality scores, which are computed based on a composite of three proprietary factors,” according to Invesco.

‘XMHQ’: Appealing to a Wide Audience

Quality has historically outperformed other investment factors during economic slowdowns, but that thesis could be challenged if quality ETFs amass large positions in cyclical sectors such as tech.

Valuing high quality value is particularly important as bull markets enter their waning stages, as some market observers believe the current bull market is doing. In the early stages of bull markets, lower quality companies see their shares soar. However, as the bull matures, investors often exhibit a preference for higher quality fare with more compelling valuations.

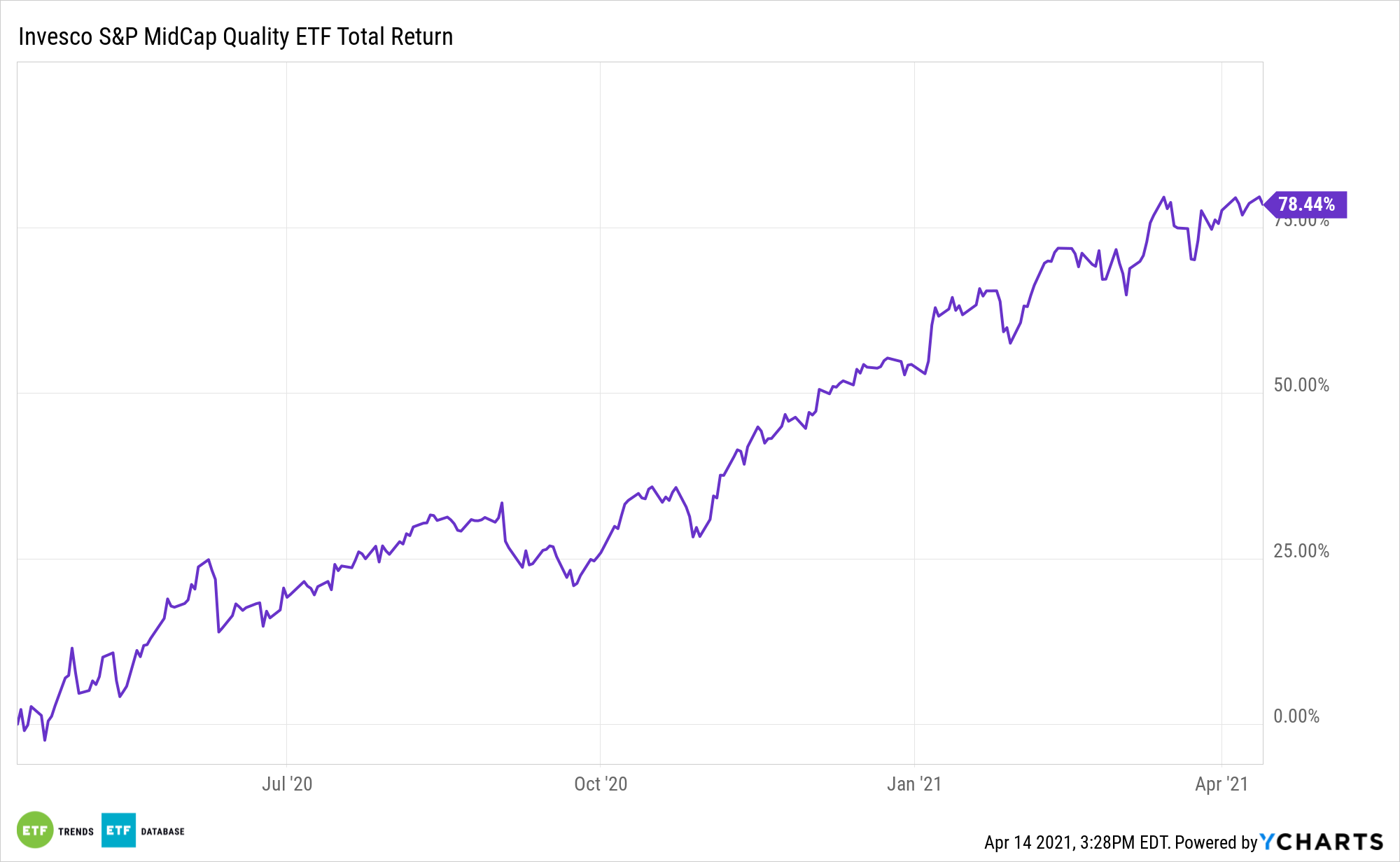

Additionally, quality should not be conflated with low volatility, but there are times when quality stocks display low volatility traits. That was the case during last year’s market dip, indicating that the quality factor can provide some protection during times of elevated market stress.

As investors look over their equity market exposure, they may find that large cap stock positions are too big for rapid growth and small caps expose them to volatile short-term moves. Middle-capitalization stocks, sometimes referred to as the market’s sweet spot, can help investors achieve improved risk-adjusted returns. Mid cap companies are slightly more diversified than their small cap peers, which allows many to generate more consistent revenue and cash flow, along with more stable stock prices. Many are not so big that their size slows down growth. The mid cap category has also outperformed its larger peers, but with lower volatility than small caps. Moreover, the returns of mid cap stocks have also beaten those of small cap stocks during the trailing three-, five-, and 10-year periods, with lower volatility to boot.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.