The healthcare sector is getting its groove back, as a variety of exchange traded funds dedicated to the group are printing or residing near new highs.

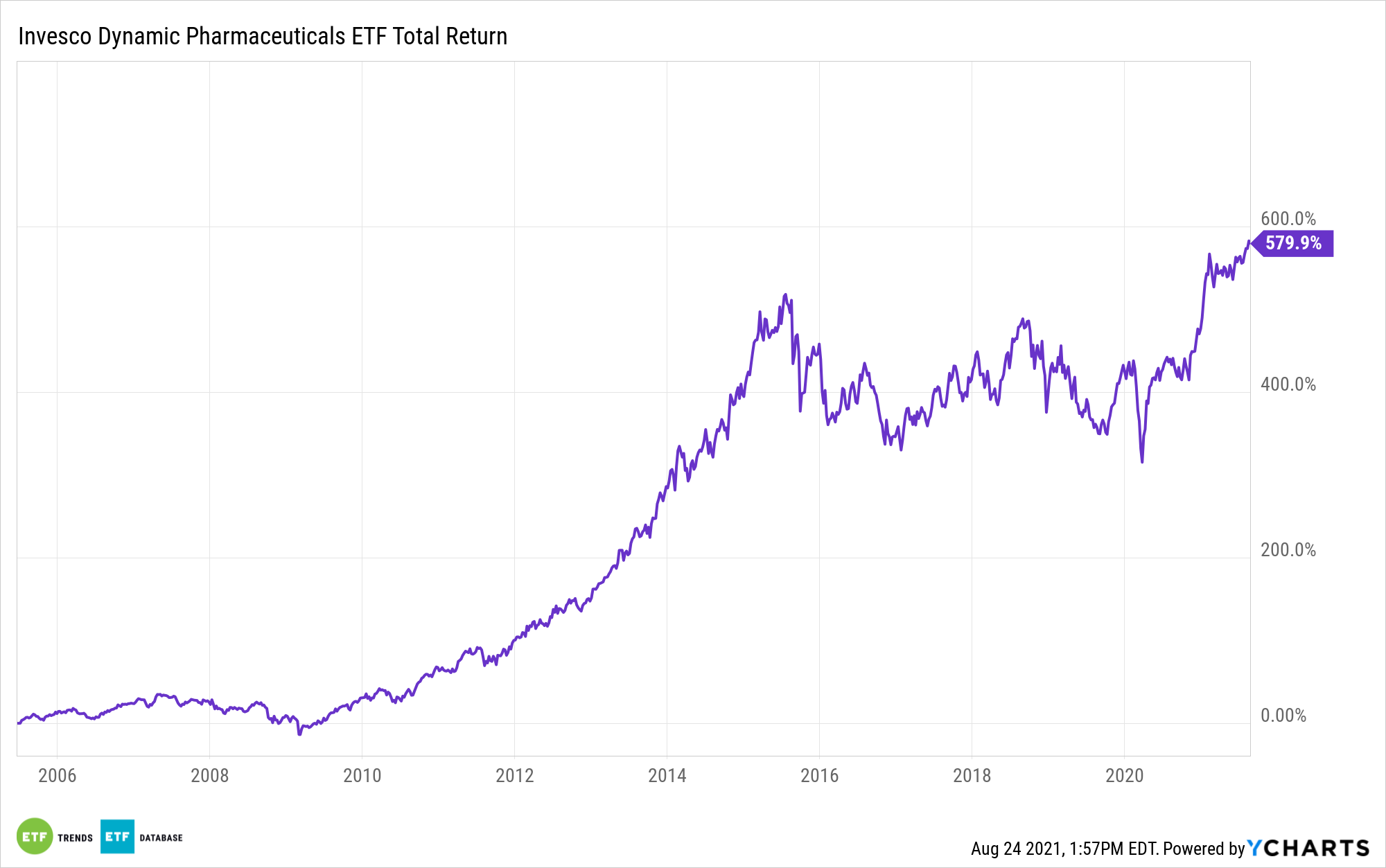

The Invesco Dynamic Pharmaceuticals ETF (NYSEArca: PJP) is part of that group and closed just 2% below its all-time high last Friday. The $447 million PJP may be well-suited to capitalize on what could be a lengthy rally for healthcare stocks.

The fund, which recently turned 16 years old, follows the Dynamic Pharmaceutical Intellidex Index. That’s a difference-maker relative to traditional healthcare ETFs because PJP’s index evaluates companies based on “price momentum, earnings momentum, quality, management action, and value,” according to Invesco.

That methodology could be attractive to investors at a time when some market observers are bullish on healthcare sector fundamentals, such as value.

“Valuations are relatively attractive, and balance sheets in the sector are generally in good shape, increasing the possibility of higher dividend payments, share-enhancing stock buybacks, and M&A,” writes Charles Schwab’s David Kastner.

Regarding mergers and acquisitions activity, the average market capitalization of PJP components is $101.3 billion, indicating it’s roster is likely lined by more buyers than sellers. Plenty of those companies have the war chests with which to go shopping.

As Kastner notes, the cash positions of healthcare firms are a big reason why the sector has been a steady dividend growth destination. PJP yields just 0.69%, implying plenty of room for payout growth.

The ETF is home to four of the largest domestic dividend payers in dollar terms – AbbVie (NYSE: ABBV), Johnson & Johnson (NYSE: JNJ), Merck (NYSE: MRK) and Pfizer (NYSE: PFE). Those four stocks combine for about 24% of PJP’s weight.

“Despite some risks associated with potential prescription-drug price controls, this sector has greater potential to outperform in an environment where the economic growth rate moderates and overall market gains are less pronounced, in our opinion,” adds Kastner.

The sector is the only one of 11 that Schwab has an “outperform” rating on – one bolstered by the group’s increasingly growthy tendencies.

“While Health Care is traditionally considered to be a defensive sector, it also has growth characteristics that are complemented by many positive long-term fundamental factors,” said Kastner.

PJP has some outlet for growth by way of a roughly 43% weight to mid- and small-cap stocks.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.