At a time when a small amount of stocks are increasingly prominent in cap-weighted benchmarks, equal-weight exchange traded funds are important for investors looking to mitigate single stock risk while maintaining high levels of diversification.

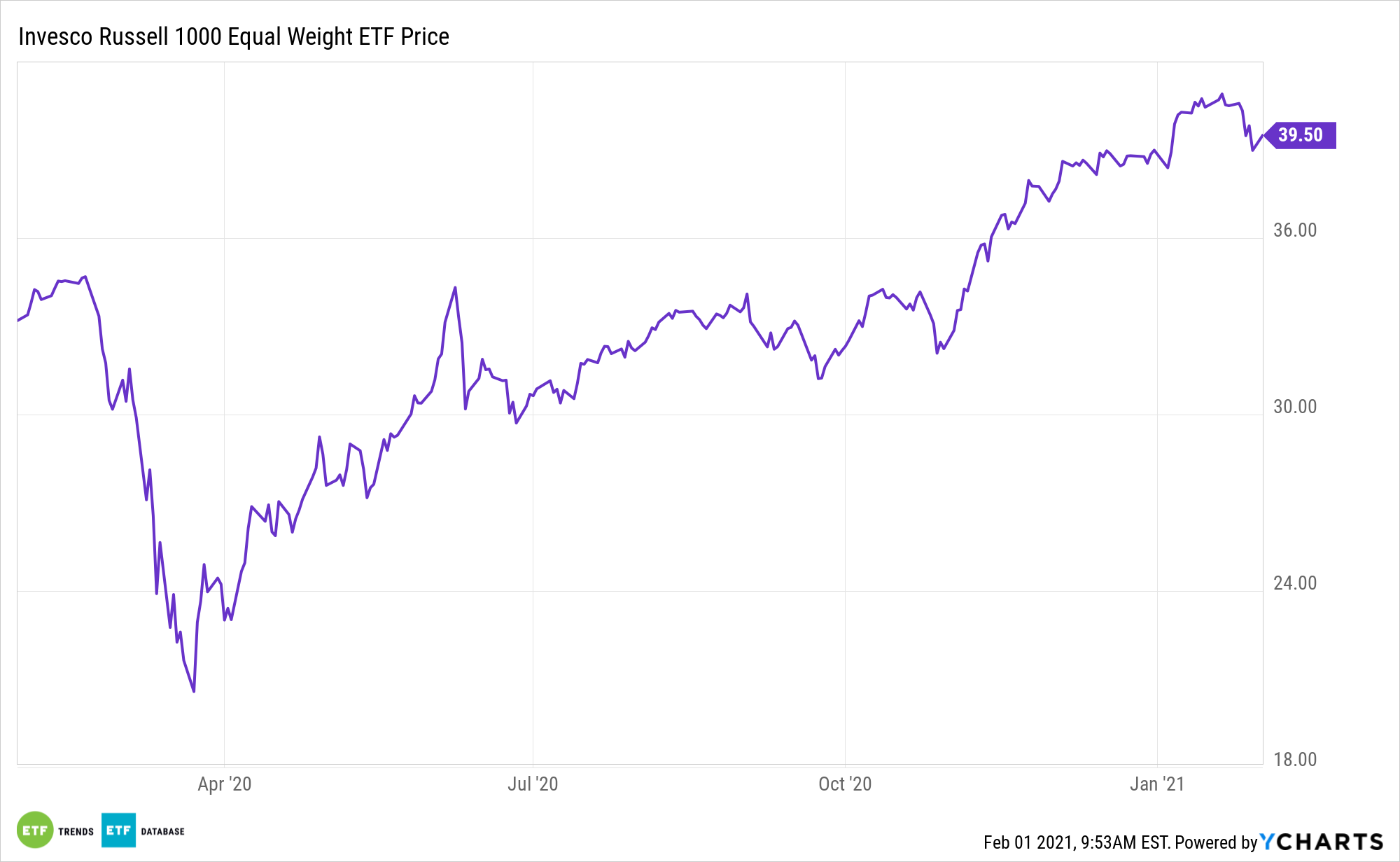

The Invesco Russell 1000 Equal Weight ETF (NYSEArca: EQAL) is one equal-weight exchange traded fund (ETF) for investors seeking broad market exposure. EQAL tracks the Russell 1000 Equal Weight Index.

That benchmark “is composed of securities in the Russell 1000 Index and is equally weighted across nine sector groups with each security within the sector receiving equal weight,” according to Invesco.

The ETF’s index methodology helps mitigate the sector biases inherent in a constituent equal-weight approach. This methodology also enables the index to contra-trade against the most recent price movements at the sector and constituent levels as the index rebalances.

In addition to EQAL, Invesco offers an extensive lineup of equal-weight ETFs, including sector funds and funds addressing small caps and other assets classes.

Examining the EQAL ETF

“For investors looking to gain large-cap exposure with lower sensitivity to the biggest names, and potentially to take advantage of reductions in market concentration, Equal Weight may be worth considering,” according to S&P Dow Jones Indices.

None of EQAL’s 999 holdings exceed weights of 0.71%. Conversely, the three largest members of the S&P 500 combine for almost 17% of that index’s weight.

“Equal weight’s smaller size exposure helps to explain the link between market concentration and equal weight’s relative returns,” notes S&P Dow Jones. “All else equal, if the largest companies (to which equal weight has less sensitivity) outperform, concentration rises, and equal weight is likely to underperform its cap-weighted benchmark. Conversely, outperformance among smaller companies (to which equal weight has greater allocations) leads to reduced concentration and the likelihood of equal weight outperformance.”

EQAL’s underlying index has provided downside protection over time, with smaller drawdowns than both its cap-weighted and constituent-only equal-weighted counterparts during the dotcom bubble bust and global financial crisis. Furthermore, Russell 1000 Equal Weight Index took less time to fully recover.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.