Thought to ponder…

“We cannot solve life’s problems except by solving them. This statement may seem idiotically tautological or self-evident, yet it is seemingly beyond the comprehension of much of the human race. This is because we must accept responsibility for a problem before we can solve it. We cannot solve a problem by saying ‘It’s not my problem.’ We cannot solve a problem by hoping that someone else will solve it for us. I can solve a problem only when I say, ‘This is my problem and it’s up to me to solve it.’”

M. Scott Peck

The Road Less Traveled

The View from 30,000 feet

Last week the Fed raised rates 25 bps in what many expect will be the final rate hike of the cycle. Although the long slog towards a pause appears to be at, or near, its conclusion, the hard part for the markets may be yet to come as nervous investors are forced to reconcile conflicting views between the Fed and the markets. From the Fed’s perspective, gearing analysis on current data, inflation remains too high, the labor market is too tight and economic activity has yet to show significant signs of deterioration. Taken in isolation, these factor to point towards persistent risk of inflationary pressures and an upward bias for Fed Funds. The markets on the other hand, which are gearing analysis on forecasts, see disinflationary forces in commodities, forward looking signals of employment weakness, credit contraction and worries about the stability of the banking system. The Fed’s measurements call for concern about inflationary pressures, while the markets measures call for caution about deteriorating growth and the likelihood of non-linear events.

- The Fed hits an apprehensive pause button, and markets call bullshit

- Fed remains skeptical that inflationary forces will be subdued because of labor market pressures and Goods / Shelter prices that have stabilized and begun moving higher

- Markets are looking through inflationary trends due to weak leading indicators and credit contraction concerns

- The most Frequently Asked Question from client’s this week: When can we expect to see the next bull market?

The Fed hits an apprehensive pause button, and calls bullshit

- Observations from Fed’s prepared statements and press conference:

- The Fed continues to emphasize their commitment to getting inflation down to their 2% goal.

- There was a transition in the tenor of comments to being more data-dependent and moving away from language that some additional policy may be appropriate to how much more firming may be appropriate.

- The Fed answered 18 questions during the press In the answers for 6 out of 18 the questions Powell referenced the Fed moving to making an “ongoing assessment” of the economy to determine if there will be additional hikes.

- The statement that made the markets nervous: “we — on the Committee, have a view that inflation is going to come down, not so quickly, but it’ll take some time. And in that world, if that forecast is broadly right, it would not be appropriate to cut rates, and we won’t cut rates. If you have a different forecast and, you know, markets — or have been from time-to-time pricing in, you know, quite rapid reductions in inflation, you know, we’d factor that But that’s not our forecast.”

- The Fed also acknowledged that the problems in the banking system will create tighter credit standards (supply of credit).

- Observations from market reaction:

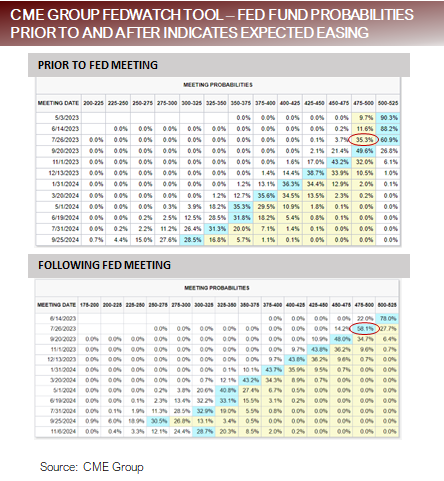

- Comparing market Fed Fund projections prior to the Fed’s statements, with projections after the Fed’s statements, the markets transitioned to increasing the probability of a rate cut in July to greater than 50%. Directly opposite of what the Fed stated.

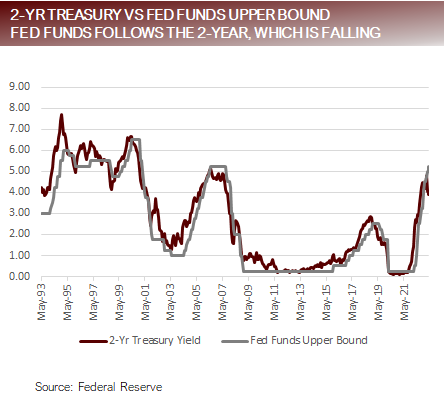

- The 2-Yr Treasury, considered a market proxy for the intermediate-term direction of Fed Funds, hit an intra-day high of 99% on the day of the Fed decision and closed at 3.80%, indicating the market expectations are for lower rates.

The markets take a different view than the Fed

Fed remains skeptical that the inflation story is over

- The Fed previously stated they are watching three areas to determine the trends in inflation:

- + Goods – Supply chains on the mend and demand is abating

- +/– Shelter – Signs that rents and housing prices are cooling, but will lag being included inflation (recent data not helping)

- — Services ex-Shelter – The Fed’s largest concern, with little sign of sufficient downward pressure to move inflation towards target

- During the press conference the Fed elaborated on the key measures they are using the provide guidance on wages, noting that wage increases across these measures need to be closer to 3% to be consistent with having inflation be near

- Employment Cost Index – current reading 8% and trending lower

- Average Hourly Earnings – current reading 4% and trending lower

- Atlanta Fed Wage Tracker – current reading 4% and trending higher

- Compensation per Hour – current reading 8% and trending higher

- Key inflationary forces that had spiked in 2021 and began to cool in 2022 have shown renewed signs of inflationary impulse

- Labor Market – Friday’s payroll report showed strength across the board: Lower unemployment, more jobs, higher participation

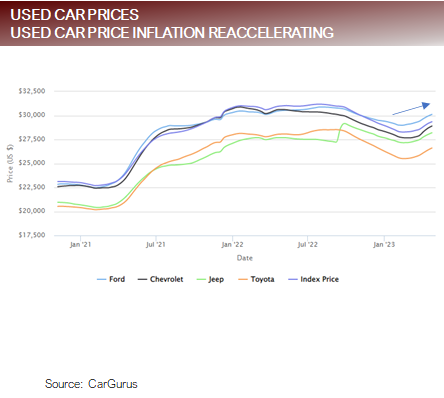

- Used Car Prices – up 8% since the end of February (based on price data from CarGurus)

- Airline Tickets – up 6% since January (based on CPI data from Bureau of Labor Statistics)

The largest driver of Services Ex-Housing still too high and key Goods prices reaccelerating

Markets are looking through inflationary trends due to weak leading indicators and credit contraction

- The financial markets are focusing on leading indicators with disinflationary impulse

- Employment

- Initial and Continuing Jobless Claims – Moved up to highest levels since 2021 over the last two months

- Layoff Announcements – Challenger & Grey Layoff Announcement up 175% year-over-year

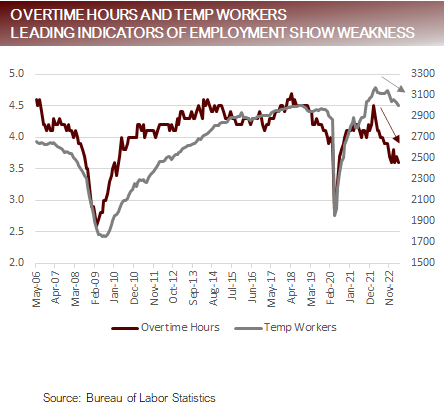

- Overtime and Temp Workers – Overtime hours lowest since GFC and Temp Workers closing in on pre-pandemic levels

- Sentiment

- National Small Business Optimism – Current reading is lower than any other time in last 50 year besides GFC and 1980

- University of Michigan – Current reading is lower than any other time in last 40 year beside GFC and 1980

- Yield Curve – Most deeply inverted yield curve since 1981

- TIPS Breakevens and Forwards – Anchored at levels consistent with pre-pandemic inflation expectations

- Commodity Complex

- Oil – Down 5% YTD, despite OPEC cuts orchestrated to elevate prices

- Lumber – Down 1% YTD

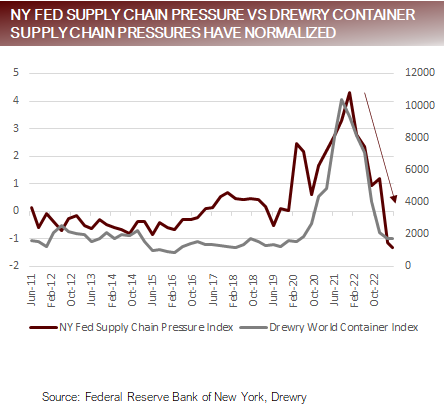

- Supply Chain Pressures and Freight Costs

- NY Fed Supply Chain Pressure Index – At lowest level in history of index

- Drewry World Container Index – Indicates global shipping rates have returned to pre-pandemic range

- Credit Supply

- Senior Loan Officer Survey – Consistent with recessionary levels

- National Small Business Expect Tighter Credit Conditions – At highest level since GFC

- Credit Demand

- Credit Card Usage – Credit card usage rolling over according to Visa and Bank of America

- Employment

Rate cutting view is founded on data indicating pandemic imbalances are normalizing

FAQ: When can we expect to see the next bull market?

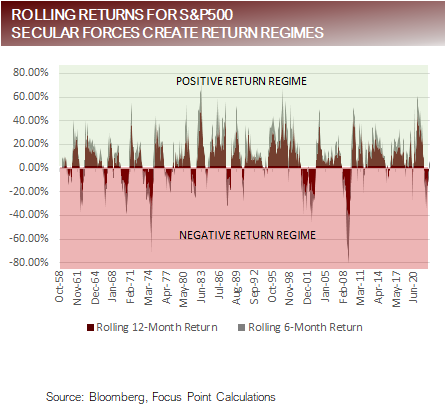

- There are two types of bull markets: Cyclical and Secular

- Cyclical Bull Markets are driven by technicals, flows and reversions to the mean when the markets are sharply oversold and tend to last three to nine The most common is the infamous “rip your face off” bear market rally.

- Secular Bull Markets are driven by market cycles. There is not just one long-term market cycle. The alignment of long-term market cycles creates incredibly powerful secular forces that act as gravity for higher and lower return regimes that typically last three to eight years. Examples of long-term market cycles include:

- Equity Risk Premia Cycle

- Earning yield versus the risk-free rate of return proxy (higher risk-free rates lower earnings yield is poor for return outlook)

- Inflation Cycle

- Caused by excess government support allowing for increased demand against constrained supply

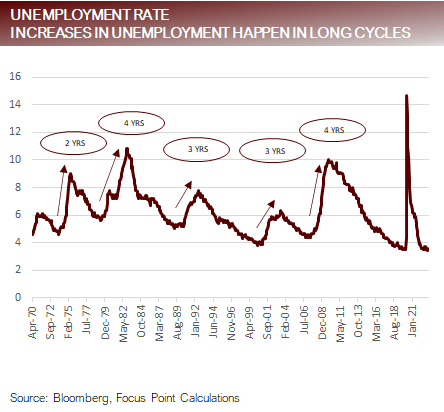

- Employment Cycle

- An imbalance in labor supply leads to persistently unbalanced market that activates interest rate policy

- Commodity Cycle

- Policy, demand and rate environments drive long-term supply decisions that create structural over or under supply

- Housing Cycle

- Interest rate environment and demographics determine demand function that is poorly matched with supply response

- Equity Risk Premia Cycle

- Current secular drivers support a convergence of forces that point to a challenging return environment

The convergence of secular forces leads to return positive or negative return regimes

Putting it all together

- Both the Fed and the markets have plausible cases to support their respective positions of holding rates steady or cutting, which makes the direction of rates a lively debate.

- The Fed’s case for pausing rest on stress in the banking system and the resulting reduction in credit doing some of its work for This is a huge week for data with the Senior Loan Officer Survey due to be published. The Fed will be looking for evidence of a slowdown in credit supply to gain confidence that some of is inflation fighting work is being done by the private sector so they can move to the sidelines.

- There are few signs that the economy is materially slowing, which supports the bull case of economic strength, however those same forces imply continued inflationary pressure, which negates expectations for rate cuts.

- With 85% of the S&P500 companies having reported Q1 earnings, the current quarter marks the best quarter for earnings and revenue beats since Earnings and revenue are undeniably strong versus expectations.

- The Atlanta Fed GDPNow forecast for Q2 is 7%, well above market consensus and Federal Reserve estimates.

- Bulls should be cautious because Fed has raised rates to threshold levels where financial stability is a concern. When impacts are felt from weakness in financial stability the effects tend to be non-linear.

- The largest risk remains how the unresolved divergence related to rate cuts in 2023 The Fed is communicating there will be no rate cuts, while the markets expect rate cuts beginning this summer. Investors need to think carefully about condition that would instigate the Fed to cut rates because those conditions likely do not support higher equity prices.

For more news, information, and analysis, visit the ETF Education Channel.

DISCLOSURES AND IMPORTANT RISK INFORMATION

Performance data quoted represents past performance, which is not a guarantee of future results. No representation is made that a client will, or is likely to, achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Focus Point LMI LLC

For more information, please visit www.focuspointlmi.com or contact us at [email protected] Copyright 2023, Focus Point LMI LLC. All rights reserved.

The text, images and other materials contained or displayed on any Focus Point LMI LLC Inc. product, service, report, e-mail or web site are proprietary to Focus Point LMI LLC Inc. and constitute valuable intellectual property and copyright. No material from any part of any Focus Point LMI LLC Inc. website may be downloaded, transmitted, broadcast, transferred, assigned, reproduced or in any other way used or otherwise disseminated in any form to any person or entity, without the explicit written consent of Focus Point LMI LLC Inc. All unauthorized reproduction or other use of material from Focus Point LMI LLC Inc. shall be deemed willful infringement(s) of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Focus Point LMI LLC Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Focus Point LMI LLC Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

All unauthorized use of material shall be deemed willful infringement of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights. While Focus Point LMI LLC will use its reasonable best efforts to provide accurate and informative Information Services to Subscriber, Focus Point LMI LLC but cannot guarantee the accuracy, relevance and/or completeness of the Information Services, or other information used in connection therewith. Focus Point LMI LLC, its affiliates, shareholders, directors, officers, and employees shall have no liability, contingent or otherwise, for any claims or damages arising in connection with (i) the use by Subscriber of the Information Services and/or (ii) any errors, omissions or inaccuracies in the Information Services. The Information Services are provided for the benefit of the Subscriber. It is not to be used or otherwise relied on by any other person. Some of the data contained in this publication may have been obtained from The Federal Reserve, Bloomberg Barclays Indices; Bloomberg Finance L.P.; CBRE Inc.; IHS Markit; MSCI Inc. Neither MSCI Inc. nor any other party involved in or related to compiling, computing or creating the MSCI Inc. data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

Important Disclosures

This communication reflects our analysts’ current opinions and may be updated as views or information change. Past results do not guarantee future performance. Business and market conditions, laws, regulations, and other factors affecting performance all change over time, which could change the status of the information in this publication. Using any graph, chart, formula, model, or other device to assist in making investment decisions presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves and market participants using such devices can impact the market in a way that changes their effectiveness. Focus Point LMI LLC believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision. Focus Point LMI LLC or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. Neither Focus Point LMI LLC nor the author is rendering investment, tax, or legal advice, nor offering individualized advice tailored to any specific portfolio or to any individual’s particular suitability or needs. Investors should seek professional investment, tax, legal, and accounting advice prior to making investment decisions. Focus Point LMI LLC’s publications do not constitute an offer to sell any security, nor a solicitation of an offer to buy any security. They are designed to provide information, data and analysis believed to be accurate, but they are not guaranteed and are provided “as is” without warranty of any kind, either express or implied.

FOCUS POINT LMI LLC DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

Focus Point LMI LLC, its affiliates, officers, or employees, and any third-party data provider shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Focus Point LMI LLC publication, and they shall not be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information or opinions contained Focus Point LMI LLC publications even if advised of the possibility of such damages.