Thought to Ponder…

“Vast emptiness, nothing holy. What is the mind like if it’s not occupied with plans and schemes, and fears that the plans and schemes will fail? What if your unexamined beliefs were to fall away and you were to live without them, and also to live without the thought that you had given anything up?

-John Tarrant

Bring Me the Rhinoceros

The View from 30,000 feet

The biggest stories of the week were centered around intensified conflict in the Red Sea drawing the U.S. further into direct engagement, Ukraine stepping up attacks against Russian infrastructure, earnings, the Q4 GDP release, PCE and China’s latest attempts to breath some life into their economy to restore confidence in capital markets. I was commenting to a client late last week that one of the research services we follow posted their top five “Black Swans” for 2024. In the interest of protecting their copywrite, I won’t share them with you but what I will share is that to my surprise, four out of five of them were geopolitical, and one was associated with as downturn outside the U.S. Perhaps even more interesting, is that none of the risks they identified were events that would tip the U.S. into a recession, although – spoiler alert, they expect a recession in the U.S. I’m not convinced. What we know to date is that for the last six months annualized Real GDP has had a 4 handle, and annualized PCE has had a 1 handle. This doesn’t represent a soft-landing, it’s closer to a fairytale. I’m not saying that there won’t be a recession, but what I will say is the most recent data is shifting the probabilities away from a recession. This is good news for the economy but may be bad news for anyone expecting the Fed to embark on an aggressive rate cutting campaign any time soon. As financial markets come to terms with a less accommodative Fed, we should be prepared for some market indigestion. It would likely take a crack in the labor market to bring about something more ominous for the U.S. markets and start to move the probabilities away from a soft / no landing scenario.

- Earnings Dashboard Update: All things Magnificent

- Breaking down performance in the S&P500 YTD

- Inflation Dashboard: More moves in the right direction

- The most Frequently Asked Question from clients this week: What could derail the disinflationary story tied to a soft landing?

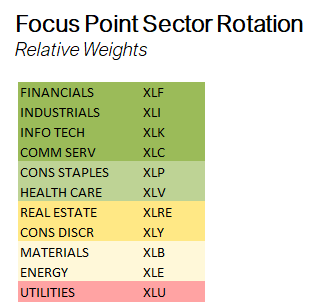

- Focus Point Sector Rotation Update: “The more things change the more they stay the same” – Cinderella

Earnings Dashboard Update: All things Magnificent

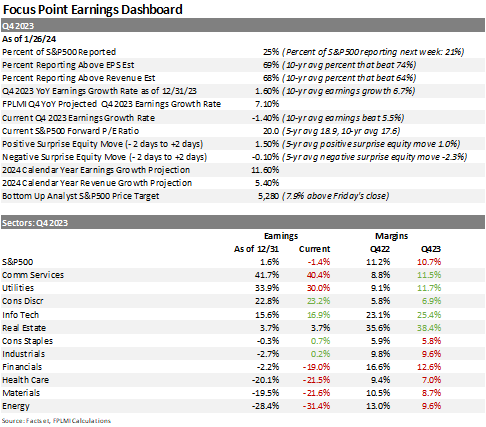

- Three weeks into earnings season, the results can be characterized as lackluster, at best. The margin of earnings beats are below historical norms and the combined actual and estimated of the remaining Q4 release is now projecting a negative -1.40% loss for Q4. That’s the bad news.

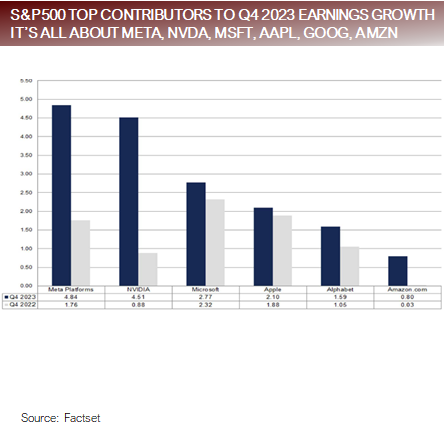

- The good news is that this week 106 companies are set to report including some of the powerhouse tech leaders, which is where the earnings leadership is coming from anyway. Consider this, according to Factset estimates:

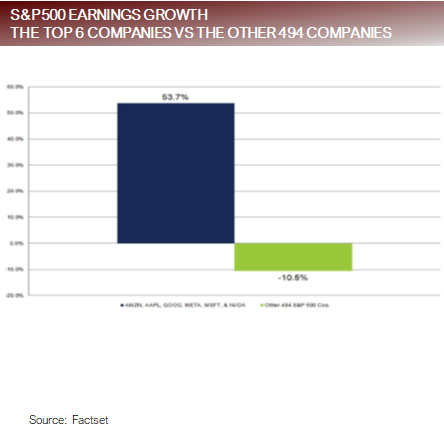

- Six out of seven of the Magnificent 7 are expected to be the top contributors to earnings in Q4. Those six names have an average estimated EPS growth of 53.7%.

-

- Excluding these six companies, the S&P500 earnings growth rate would be projected at -10.5% for Q4.

-

- The four top earnings growers in the Magnificent 7 are expected to have an average Q4 earnings growth rate of 79.7%

The new year starts off like the last year ended – all about the Magnificent 7

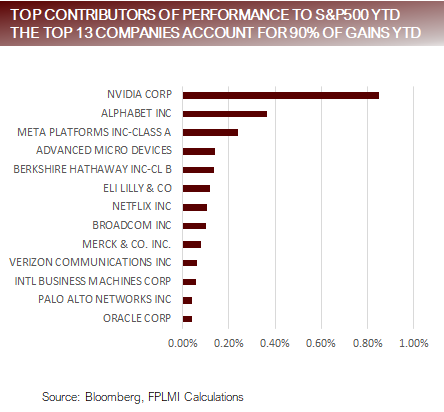

Breaking down performance in the S&P500 YTD

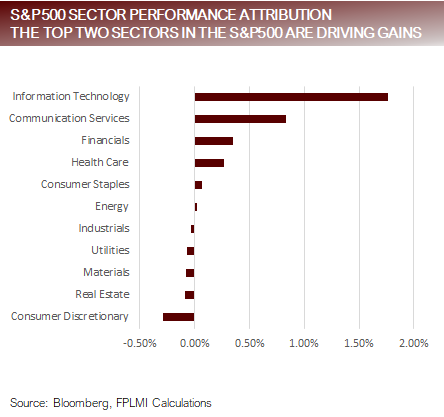

- Year-to-date the S&P500 has resumed the trends of 2023, with the best two performing sectors being Comm Services and Information Technology. Together these two sectors account for 100% of the gains in the S&P500, with the other nine sectors adding up to approximately zero contribution.

- Through Friday’s close the S&P500 was up +2.61%. There were 150 companies within the S&P500 that had gains in excess of +2.61%.

- The top 31 companies in the S&P500 account for 100% of the gain in the S&P500.

- The average stock in the S&P500 is down -0.9% year-to-date, with the median stock down -0.1%. The Equal Weight S&P500 is down -0.2% on the year. The Russell 2000 is down -2.4% year-to-date.

- Tesla, which is down -26.25% for the year, has now dropped out of the top ten largest weights in the S&P500, while Broadcom has moved into the top 10, making the index even more heavily tilted towards Info Tech and Comm Services. In fact, eight out of ten of the largest names are Info Tech or Comm Services with the other two being Berkshire Hathaway and Eli Lilly.

- Globally, the concentration isn’t much better with only five out of the 26 countries we follow having a positive year, which incidentally is better than where we closed last week when only three countries were in the green.

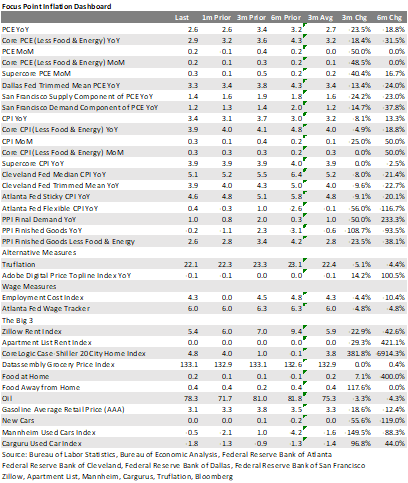

Inflation Dashboard: More moves in the right direction

Source: Bureau of Labor Statistics, Bureau of Economic Analysis, Federal Reserve Bank of Atlanta Federal Reserve Bank of Cleveland, Federal Reserve Bank of Dallas, Federal Reserve Bank of San Francisco Zillow, Apartment List, Mannheim, Cargurus, Truflation, Bloomberg

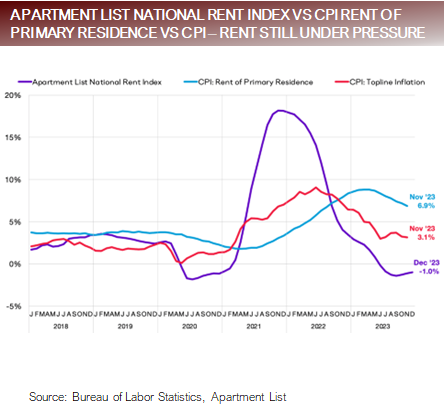

- The biggest story on inflation last week was the PCE report, which showed a continued disinflationary trend, supporting the view that the Fed will need to move to a less restrictive stance in the short-term, or real rates will move from a restrictive level to an overly-restrictive level.

- The three-month annualized pace of inflation slowed to 1.5%, and the six-month annualized pace of inflation continued at its most recent reading of 1.9%.

- Earlier in the week the first reading on Q4 2023 GDP came in at 3.3%, following the Q3 2023 GDP of 4.9%.

- The first measure of the Atlanta Fed GDPNow was produced last week indicating that Q1 2024 is growing at a 3.0% pace.

- Taken in totality, the economy is currently running at above potential growth, at full-employment, with inflation below the Fed’s targeted range.

Continued signs of normalization in rental markets and supply factors

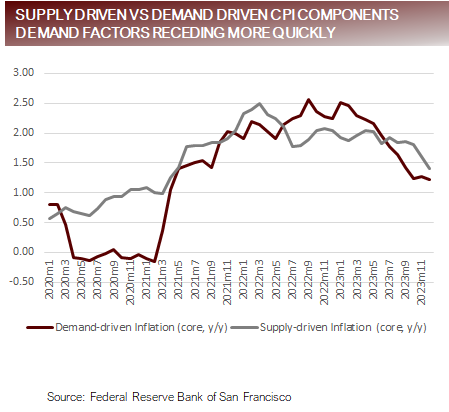

FAQ: What could derail the disinflationary story tied to a soft landing?

- The big picture is that the economy is growing at above potential with inflation over the last six months now below the Fed’s targeted range. In a perfect world, the Fed would gradually turn less restrictive, allowing inflation to flatten out around 2.0%. However, there are some real risks to this glide path:

-

- As the Fed lower rates, financial conditions will ease creating a pick-up in economic activity that is likely to drive inflationary pressures higher.

- There are geopolitical factors out of the Fed’s control working against the disinflationary story.

- Congestion in the Red Sea due to Houthi attacks is gumming up global supply chains, creating parts shortages and ultimately will drive prices higher if the situation is not resolved soon.

- The financial markets have not yet placed a geopolitical risk premium on oil prices due to the turmoil in the Middle East, but we are one missile away from that changing at any moment, and given that fact there are missiles flying, this risk should not be overly discounted.

-

-

- The Chinese government is becoming more aggressive in their efforts to reflate the economy, even resorting to banning short selling and buying equities in the open markets. Current policies in China probably aren’t enough to create an inflationary wave, but the direction of travel for the Chinese government is more intervention, which is a risk to the global disinflationary story.

-

FP Sector Rotation Update: “The more things change the more they stay the same” – Cinderella

- The Focus Point Sector Rotation Model is a combined trend following and mean reversion model that utilizes seven factors to analyze daily price data on sectors to determine the strength of upward trends.

- Four industry groups are leading the way for the markets in 2024, with the largest gains coming from the big winners of 2023, Info Tech and Comm Services.

- Sectors are exhibiting early cycle leadership, with companies that would benefit from lower rates moving higher.

Putting it all together

- Last week was the most enlightening week of data for the year, with GDP showing growth above potential, while PCE indicating inflation below the Fed’s target. This should set the stage for the Fed to lower rates. If only it were that simple.

- The Fed faces a host of challenges related to the decision to lower rates:

- Lower rates will ease financial conditions further, creating the potential for inflation to reignite.

- There are events happening in the geopolitical theater that the Fed has no control over that could cause another uptick in inflation, such as hostilities in the Middle East and Chinese stimulus.

- The Fed faces a host of challenges related to the decision to lower rates:

- Market leadership has once again concentrated at the top. The Magnificent 7 is back. Tesla is out, Broadcom is in.

- The markets have moved to pricing the rate cut in March as a coin flip and showing less conviction about the pace in the remainder of 2024. Further indigestion is to be expected as the markets adjust expectations.

- The larger picture is that inflation continues to fall at a faster pace than expected, the labor market remains strong, which is causing resiliency in demand and corporate profits. It’s hard to be pessimistic with this as the backdrop, but with expectations for S&P500 earnings to grow at 11.6% in 2024, well above historical averages, and six rate cuts priced in versus a Fed that’s broadcasting three cuts, it’s also hard to feel like the markets aren’t priced for perfection.

For more news, information, and analysis, visit the ETF Education Channel.

DISCLOSURES AND IMPORTANT RISK INFORMATION

Performance data quoted represents past performance, which is not a guarantee of future results. No representation is made that a client will, or is likely to, achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Focus Point LMI LLC

For more information, please visit www.focuspointlmi.com or contact us at [email protected] Copyright 2024, Focus Point LMI LLC. All rights reserved.

The text, images and other materials contained or displayed on any Focus Point LMI LLC Inc. product, service, report, e-mail or web site are proprietary to Focus Point LMI LLC Inc. and constitute valuable intellectual property and copyright. No material from any part of any Focus Point LMI LLC Inc. website may be downloaded, transmitted, broadcast, transferred, assigned, reproduced or in any other way used or otherwise disseminated in any form to any person or entity, without the explicit written consent of Focus Point LMI LLC Inc. All unauthorized reproduction or other use of material from Focus Point LMI LLC Inc. shall be deemed willful infringement(s) of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Focus Point LMI LLC Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Focus Point LMI LLC Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

All unauthorized use of material shall be deemed willful infringement of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights. While Focus Point LMI LLC will use its reasonable best efforts to provide accurate and informative Information Services to Subscriber, Focus Point LMI LLC but cannot guarantee the accuracy, relevance and/or completeness of the Information Services, or other information used in connection therewith. Focus Point LMI LLC, its affiliates, shareholders, directors, officers, and employees shall have no liability, contingent or otherwise, for any claims or damages arising in connection with (i) the use by Subscriber of the Information Services and/or (ii) any errors, omissions or inaccuracies in the Information Services. The Information Services are provided for the benefit of the Subscriber. It is not to be used or otherwise relied on by any other person. Some of the data contained in this publication may have been obtained from The Federal Reserve, Bloomberg Barclays Indices; Bloomberg Finance L.P.; CBRE Inc.; IHS Markit; MSCI Inc. Neither MSCI Inc. nor any other party involved in or related to compiling, computing or creating the MSCI Inc. data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

This communication reflects our analysts’ current opinions and may be updated as views or information change. Past results do not guarantee future performance. Business and market conditions, laws, regulations, and other factors affecting performance all change over time, which could change the status of the information in this publication. Using any graph, chart, formula, model, or other device to assist in making investment decisions presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves and market participants using such devices can impact the market in a way that changes their effectiveness. Focus Point LMI LLC believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision. Focus Point LMI LLC or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. Neither Focus Point LMI LLC nor the author is rendering investment, tax, or legal advice, nor offering individualized advice tailored to any specific portfolio or to any individual’s particular suitability or needs. Investors should seek professional investment, tax, legal, and accounting advice prior to making investment decisions. Focus Point LMI LLC’s publications do not constitute an offer to sell any security, nor a solicitation of an offer to buy any security. They are designed to provide information, data and analysis believed to be accurate, but they are not guaranteed and are provided “as is” without warranty of any kind, either express or implied.

FOCUS POINT LMI LLC DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

Focus Point LMI LLC, its affiliates, officers, or employees, and any third-party data provider shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Focus Point LMI LLC publication, and they shall not be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information or opinions contained Focus Point LMI LLC publications even if advised of the possibility of such damages.