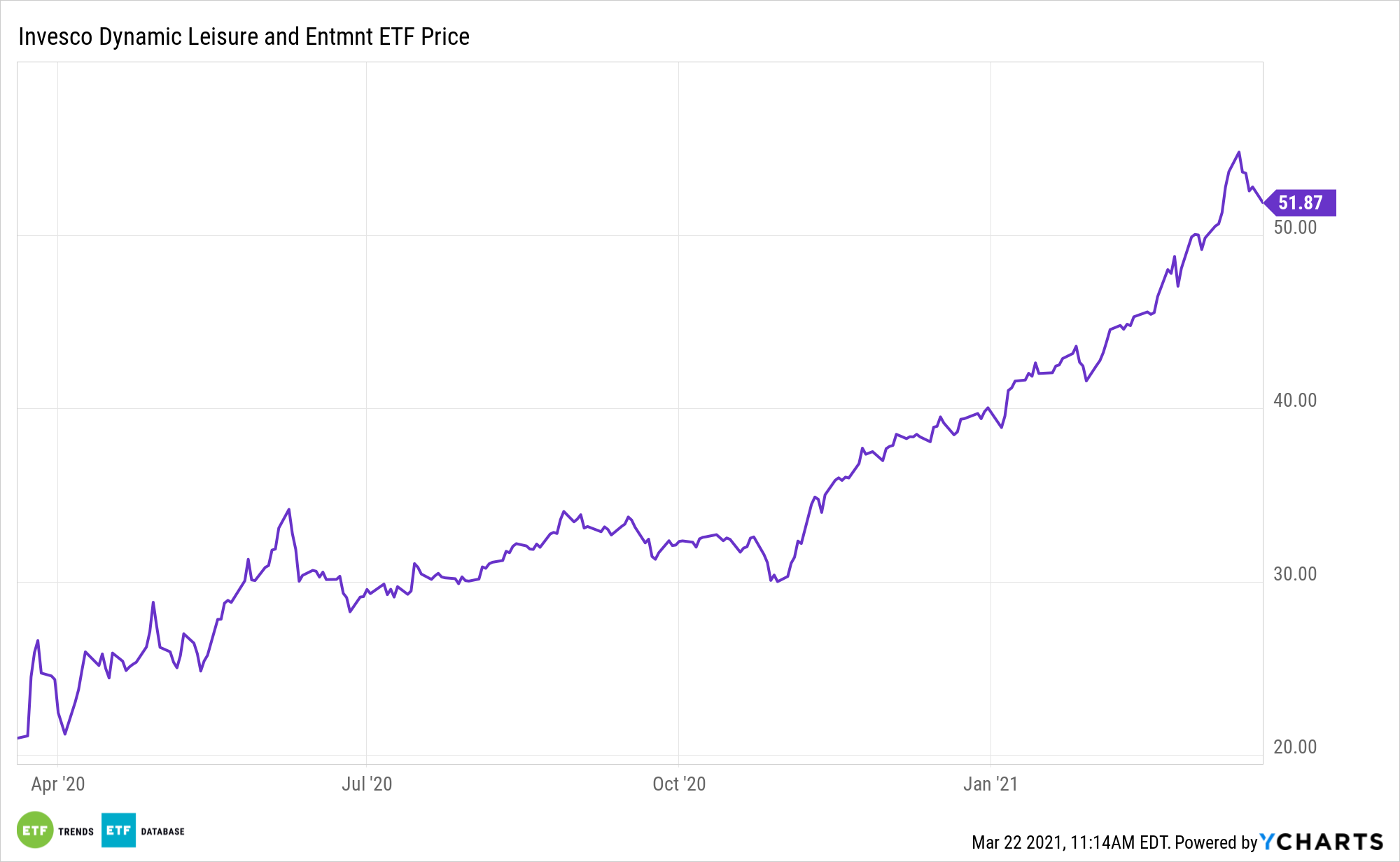

The environment is ripe for the reopening trade with airlines, casino and cruise operators, hoteliers, and more heating up. For investors that don’t want to pick individual industries and stocks, the Invesco Dynamic Leisure and Entertainment ETF (PEJ) is a great idea for the moment.

PEJ is based on the Dynamic Leisure & Entertainment Intellidex℠ Index (Index). The Fund will normally invest at least 90% of its total assets in common stocks that comprise the Index.

The Index is designed to provide capital appreciation by thoroughly evaluating companies based on a variety of investment merit criteria, including: price momentum, earnings momentum, quality, management action, and value. The Index is comprised of common stocks of 30 US leisure and entertainment companies. The Invesco ETF is hot, jumping 8.45% over the past week.

“At the time of writing, the US is now more than 10% vaccinated while acquired immunity through infections is speculated to put US immunity far higher,” writes Invesco’s Rene Reyna. “Even before herd immunity is reached, cases have recently fallen as much as 60%, potentially pulling at least some of the re-opening into spring. This has driven investors to speculate about how to invest as the economy rotates back into something far more familiar. Through unprecedented economic stimulus, consumers also have large reserves of cash on hand, and they will likely be eager to spend it when they can finally venture safely out of their homes.”

The Travel and Leisure Sector

More cities and states are progressing with reopening efforts following coronavirus shutdowns. Investors looking to gauge the success of those plans may want to look at consumer cyclical stocks. That group is a key driver of PEJ performance.

While the travel and leisure stocks still face headwinds, the reopening of the U.S. economy, albeit gradual, could provide an assist to PEJ. The ETF offers a more direct approach to the reopening trade than many consumer discretionary ETFs, making it a credible consideration today.

See also: An ETF Combo for Two Gauges of Economic Health

“Taking a more nuanced industry approach, investors could potentially target their desired exposure. In the case of PEJ, the fund tracks the Dynamic Leisure & Entertainment Intellidex index, which focuses squarely on the externally facing consumer,” adds Reyna. “Screening companies through bottom-up revenue data, the index universe ranges from hospitality to entertainment programming, investing in companies such as hotels, restaurants, cruises and airlines, media companies, theme parks, and movie theaters.”

PEJ is up almost 32% year-to-date.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.