The Nasdaq-100 Index (NDX) is one of the more beloved equity benchmarks among advisors and investors, and one of the big reasons for that status is NDX’s penchant for being home to an array of innovative growth stocks.

On that note, it’s a luxury to be able to access some of those names before they gain entry into the Nasdaq-100. Fortunately, there’s the Nasdaq Next Generation 100 Index, which provides exposure to the 100 stocks next in line for a promotion to NDX. The Invesco NASDAQ Next Gen 100 ETF (QQQJ) is the exchange traded fund tracking that benchmark.

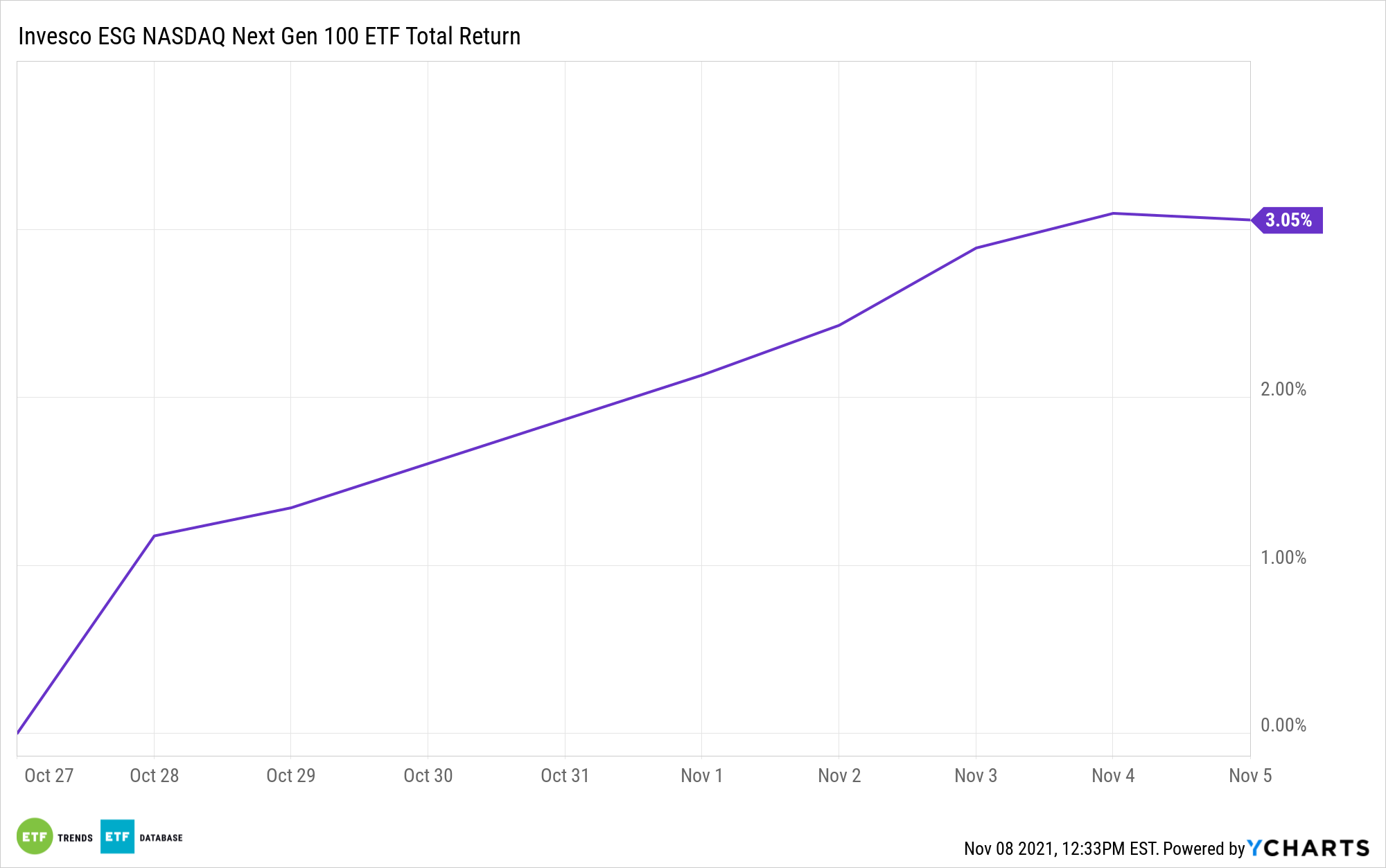

For investors who want to add environmental, social, and governance (ESG) standards to the Next Gen 100, the newly minted Invesco ESG NASDAQ Next Gen 100 ETF (QQJG) answers that call.

QQJG, which debuted late last month, follows the Nasdaq Next Generation 100 ESG Index — the ESG counterpart to the aforementioned Next Gen 100 index. QQJG’s methodology is straightforward, but it still employs some strict standards for admittance.

“To satisfy the ESG criteria, an issuer must not be involved in certain specific business activities, such as alcohol, cannabis, controversial weapons, gambling, military weapons, nuclear power, oil & gas, and tobacco,” according to Invesco. “Additionally, an issuer must be deemed compliant with the United Nations Global Compact principles, meet business controversy level requirements, and have an ESG Risk Rating Score that meets the requirements for inclusion in the Index.”

Overall, QQJG is home to 93 of the 100 stocks found in the non-ESG version of the Next Gen 100. The bulk of the names excluded from the new ETF are gaming names, including Caesars Entertainment (NASDAQ:CZR), DraftKings (NASDAQ:DKNG), and Penn National Gaming (NASDAQ:PENN), among others. Even with the exclusion of those names, consumer discretionary is QQJG’s second-largest sector weight at 14.69%.

While it’s a new ETF, QQJG is relevant at a time when investors are demanding more ESG ratings and scoring.

“Environmental, Social, and Governance ratings have become a key focus for companies and investors. By achieving good ESG ratings, a company can receive positive market recognition. As a result, companies now tend to spend more time and effort on improving ESG ratings in order to attract investors,” according to IHS Markit research.

Another perk offered by QQJG is the fact that it’s a solid idea for investors looking for a mid-cap ESG solution, which is currently an underserved niche. About 78% of QQJG’s components are mid-cap stocks, nearly 43% of which are growth names.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.