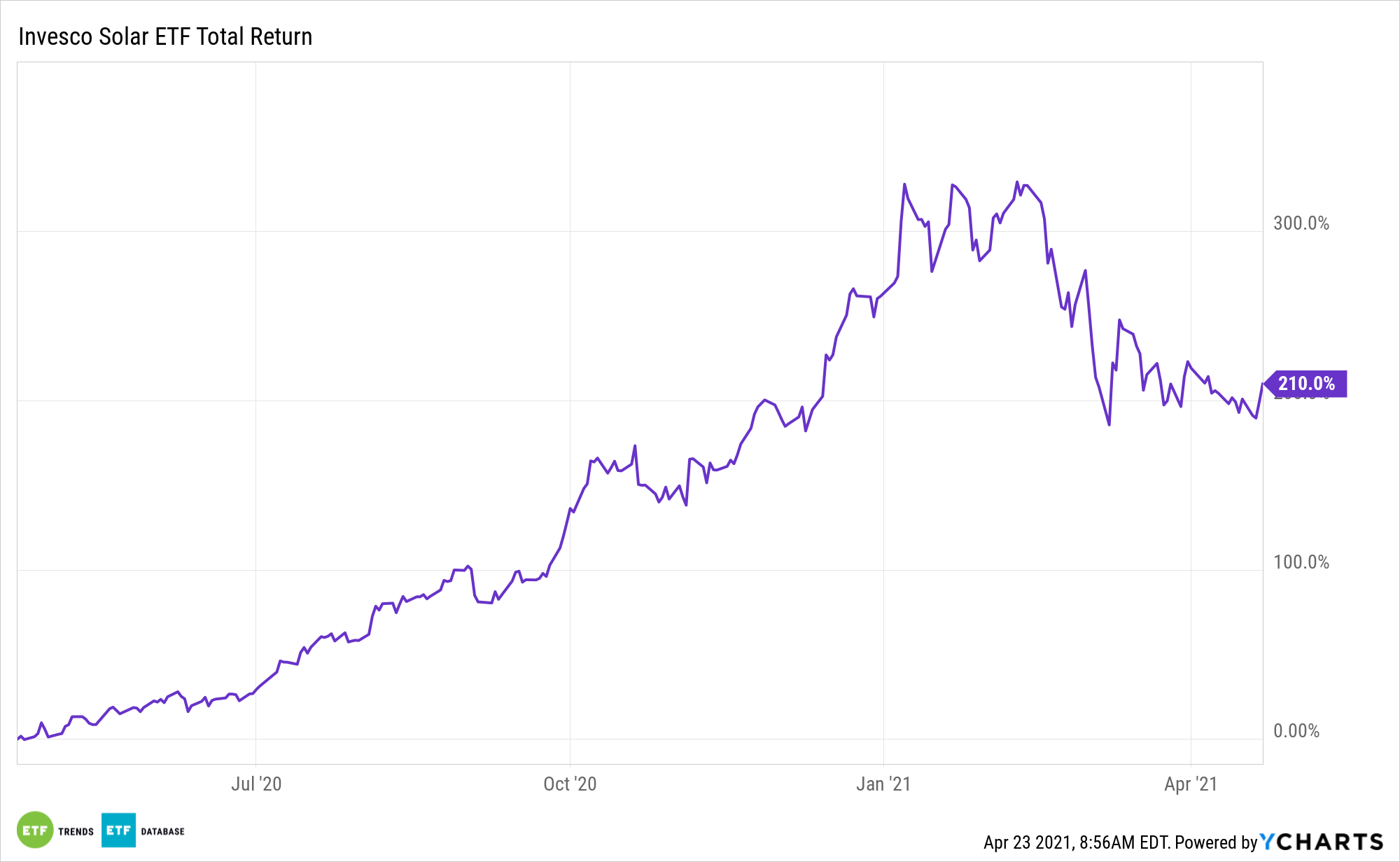

Down 14% year-to-date, the Invesco Solar ETF (TAN) is cooling off following a blistering run in 2021, but analysts believe that many solar stocks can bounce back.

The TAN ETF is based on the MAC Global Solar Energy Index. The Fund will invest at least 90% of its total assets in the securities, American depositary receipts (ADRs), and global depositary receipts (GDRs) that comprise the Index.

With solar companies heading to the first-quarter earnings confessional next week, TAN could have the catalysts for a near-term rebound.

“The bar is low (for a change); expect beats in [residential],” Goldman Sachs said in a research note cited by CNBC. “Significant underperformance in solar equities in recent months has created an attractive buying opportunity for the group.”

Don’t Throw ‘TAN’ Out with the Bathwater

Some experts argue that TAN’s slack start to 2021 is the result of rising Treasury yields punishing growth stocks. However, solar stocks, historically speaking, aren’t highly correlated to interest rates, meaning TAN’s drubbing may be unjustified.

“Experts point to several factors fueling the pullback, including fears over what rising rates could mean for the industry’s cost of capital, a broad market rotation out of growth and into value and concerns about stretched valuations,” reports Pippa Stevens for CNBC.

Adding to the case for TAN is that valuations, which are often rich in the solar industry, aren’t excessively high today.

“Multiples no longer seem elevated; recommend adding to positions,” JPMorgan said in a note. “We believe industry demand trends remain favorable.”

More clarity on the fate of President Biden’s clean energy spending plan could also provide a boost for TAN.

“President Joe Biden’s recently unveiled infrastructure proposal is one of the major catalysts for renewable energy and clean tech,” adds CNBC. “The plan earmarks more than $600 billion for climate-related spending, including $100 billion for the power grid and $174 billion for electric vehicles. The Investment Tax Credit, which has been key to the solar industry’s growth would, also be extended. The bill has faced opposition.”

President Biden previously laid out a $2 trillion sustainable infrastructure plan to pave the way for the U.S. power sector to be carbon free by 2035, and for the country to be carbon neutral by 2050.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.