Thought to ponder…

“We don’t have the power to choose all of our experiences, but we always have the ability to choose our behavior in the midst of them and in their wake, and those choices are what define our character.” -Greg Everett, Tough

The View from 30,000 feet

A week ago, we commented in Macro Thoughts to expect more volatility in March because, with earning season drawing to a close, there would be less availability of corporate news, so the markets were likely to trade with increased attention on data releases and politics. Last week did not disappoint. The average intraday range of the S&P500 last week was 0.88%, which compares the average since the start of the year of 0.76%. The week was loaded with trigger points, including a full Fed speaking calendar and Powell’s semiannual testimony to Congress, where Powell reassured Fed watchers that the Fed would be cutting interest rates “at some point in 2024” and the Fed is “not far” from having confidence that inflation is on a trajectory to 2% that would usher in the beginning of an easing cycle. Biden’s State of the Union speech kicked off the rematch between Biden and Trump. The next nine months promises to provide a lot of fireworks with the Wall Street Journal describing the difference between the two candidates’ views as those of “A resurgent America making steady progress toward a future of shared prosperity” versus “a dystopian backwater on a path to ruin.” It was labor week, with data on job openings, unemployment claims, hiring and unemployment. The net result of the data was a continuation of the view that the labor market is tightening and moving towards the Fed’s projections. Next week will be particularly interesting with CPI on Tuesday. Last month’s CPI came in hot. This month will hold special importance because now that the labor market is confirming signs of weakening, if CPI continues to run above estimates, the Fed will be stuck between rock and hard place, where the economy is growing, inflation is persistent, and the employment market is softening, not what they’re looking for.

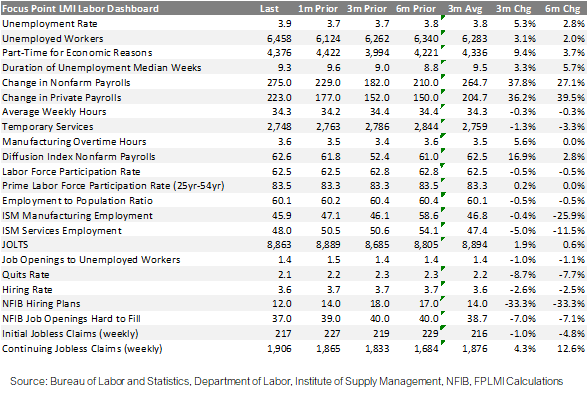

- Labor Dashboard: Unemployment rate finally confirms cooling in the labor markets

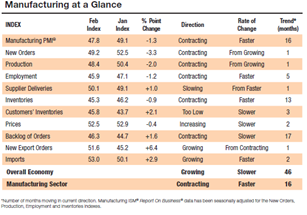

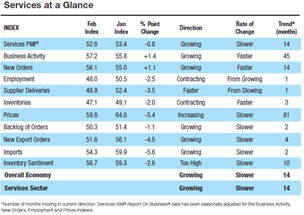

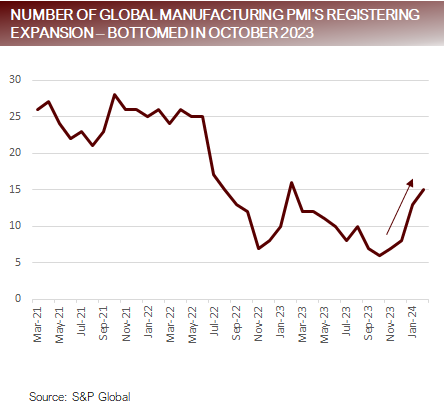

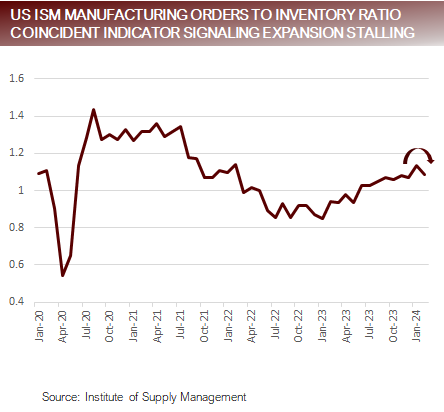

- Global Purchasing Manager Indexes (PMIs) showed signs of an improving global manufacturing economy vs. Institute of Supply Management (ISM) US-centric view which signaled softening

- Broadening out of the markets fait accompli – eleven out of eleven sectors now up on the year

- Focus Point Sector Rotation Update: Fading 2023 leadership

Labor Dashboard: Unemployment rate finally confirms cooling in the labor markets

- After months of deteriorating data, the unemployment rate finally hooked higher, reaching its highest level since January 2022.

- Although the change in nonfarm payrolls came in higher than 75 out of 76 of the Bloomberg survey estimates, the market impact was muted due to heavy downward revisions of prior months.

- The quits rate fell to levels not seen since 2017, indicating that workers may be getting nervous about leaving their jobs.

- NFIB Hiring Plans continue to fall, while a lower percentage of companies surveyed by NFIB are finding Jobs Hard to Fill.

- There is a clear downtrend in ISM Manufacturing and Services Employment component.

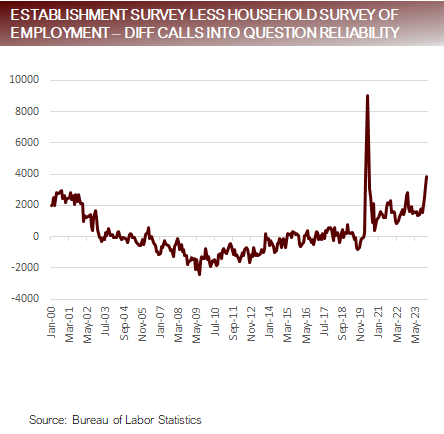

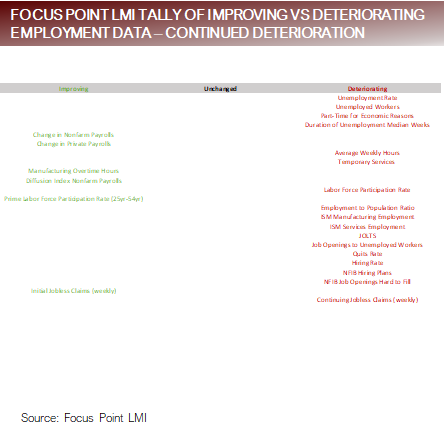

The majority of employment indicators are falling, with questions looming on reliability of data

Global PMIs improving global economy vs. ISM in the US, not so much

- Global Manufacturing PMIs are

- 4 out of 5 of American PMIs are improving, with Columbia being the sole outlier, that continues to

- 12 out of 13 of European PMIs are improving, with Germany being the sole outlier, that continues to

- 6 out of 12 of the Asian PMIs are improving, suggesting a mixed bag in

- Global Manufacturing PMIs bottomed in October, with only 6 out of 30 countries in expansion, and have since improved to 15 out of 30 countries in expansion.

- Global Services PMIs are a mixed bag with 7 out of 13 PMIs

- US Institute of Supply Management Surveys are deteriorating. The brief uptick in January has dissipated and the leading indicators are softening. The weakness is particularly evident in the manufacturing data.

Global Manufacturing sectors showing revival, with strength centered in Europe

Broadening out of the markets fait accompli – eleven out of eleven sectors now up on the year

- At the end of January 4 out of 11 sectors in the S&P500 were up for the By the end of February 9 out of 11 sectors were up for the year. As of last the close on Friday, 11 out of 11 sectors were up on the year.

- The broadening out also includes international markets. Last week the MSCI EAFE Index, which measures developed global equity markets outside the US, outperformed the S&P500 by 260 basis points, which was the 8th largest gap in outperformance over the S&P500 in the last 120 weeks, with only one week in 2023 being

- The S&P500 was up 72% as of the close Friday, with 38% of the companies in the S&P500 outperforming the index, which compares favorably to the end of January when only 28% of the companies were outperforming the index. However, this still falls short of the 10-years prior to the pandemic when about 49% of the companies within the index outperformed the index.

- The Magnificent 7 has fallen apart in 2024, with Nvidia and Meta remaining top dogs driving the index and the other 5 nowhere to be In fact, Nvidia is the best performing company in the S&P500 this year, up a staggering +76.8%, while the worst performing company in the index, another familiar Mag 7 name, Tesla, which is down -29.4% for the year.

- Nvidia and Meta together account for 64% of the gain in the S&P500 this The top 10 largest companies together account for 82% of the gain in the S&P500 for the year.

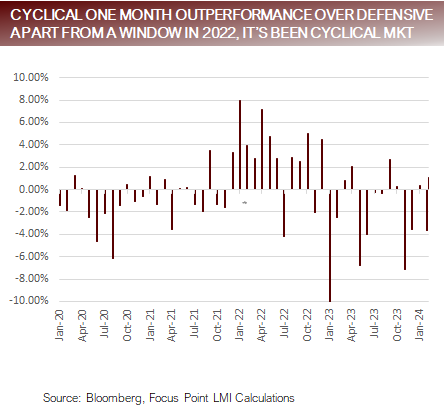

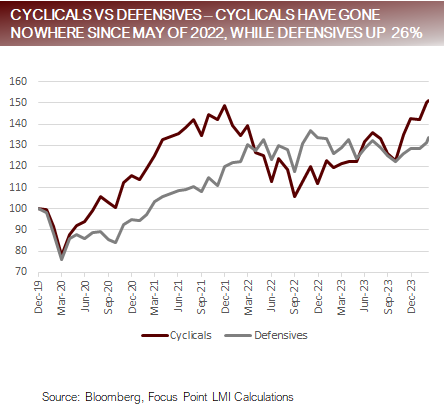

- Since the beginning of March, Defensives have outperformed Cyclicals by 104 basis Only two months in 2023, did Defensives outperform Cyclicals by more, which were September, the worst month of 2023 and April, the month after SVB blew up.

Cyclical vs Defensive performance – March a winner for cyclicals, but they are still a laggard

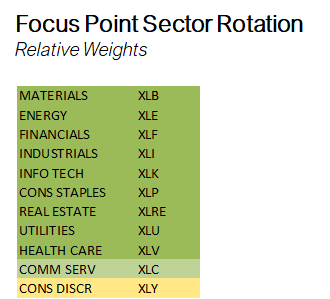

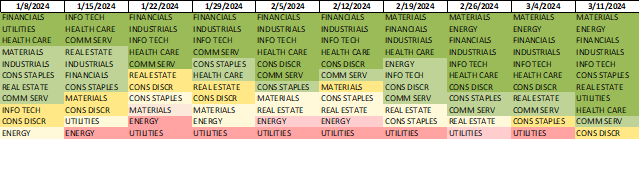

Focus Point Sector Rotation Update: Fading 2023 leadership

- The Focus Point Sector Rotation Model is a combined trend following and mean reversion model that utilizes seven factors to analyze daily price data on sectors to determine the strength of upward trends.

- The trends broadened out with 10 out of 11 sectors in

- The two closest sectors to failing their uptrends are Comm Services and Info Tech.

- Good news from a breadth standpoint, falls under the careful what you wish for header, because Comm Services and Info Tech make up 39% of the S&P500, and without them it will be difficult for the index to gain meaningful

Putting it all together

- In the larger picture, the messaging from the Fed is unchanged – they expect 2024 to be the year that they begin rate Expectations surrounding the timing and number of cuts varies from economic print to economic print and from Fed President speech to Fed President speech. The markets will remain volatile around data releases and Fed speeches.

- The election campaigning kicked off in earnest last week. The two parties have dramatically different viewpoints of the state of the Union. This too will generate volatility speeches depending.

- The market are in the dead zone between reporting seasons for the next four weeks. In markets with light corporate earnings news, between reporting seasons, the markets are susceptible to increased volatility because things other than company driven news can grab headlines and more easily sway investor sentiment.

- The most recent Atlanta Fed GDPNow is measuring economic activity in Q1 at 2.5%, above trend. Progress on disinflationary trends have stalled, and hinge on what happens with housing (owners equivalent rent) and wages.

- Stronger than expected economic activity combined with stalled inflation could be a bad tasting cocktail for the markets because the Fed may be hesitant to cut rates into this However cooling labor markets may signal the Fed should start cutting soon. If these trends continue, it puts the Fed in quandary, where they may be damned if they do and damned if they don’t’.

For more news, information, and analysis, visit Vettafi | ETF Trends.

Performance data quoted represents past performance, which is not a guarantee of future results. No representation is made that a client will, or is likely to, achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Focus Point LMI LLC

For more information, please visit www.focuspointlmi.com or contact us at [email protected] Copyright 2024, Focus Point LMI LLC. All rights reserved.

The text, images and other materials contained or displayed on any Focus Point LMI LLC Inc. product, service, report, e-mail or web site are proprietary to Focus Point LMI LLC Inc. and constitute valuable intellectual property and copyright. No material from any part of any Focus Point LMI LLC Inc. website may be downloaded, transmitted, broadcast, transferred, assigned, reproduced or in any other way used or otherwise disseminated in any form to any person or entity, without the explicit written consent of Focus Point LMI LLC Inc. All unauthorized reproduction or other use of material from Focus Point LMI LLC Inc. shall be deemed willful infringement(s) of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Focus Point LMI LLC Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Focus Point LMI LLC Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

All unauthorized use of material shall be deemed willful infringement of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights. While Focus Point LMI LLC will use its reasonable best efforts to provide accurate and informative Information Services to Subscriber, Focus Point LMI LLC but cannot guarantee the accuracy, relevance and/or completeness of the Information Services, or other information used in connection therewith. Focus Point LMI LLC, its affiliates, shareholders, directors, officers, and employees shall have no liability, contingent or otherwise, for any claims or damages arising in connection with (i) the use by Subscriber of the Information Services and/or (ii) any errors, omissions or inaccuracies in the Information Services. The Information Services are provided for the benefit of the Subscriber. It is not to be used or otherwise relied on by any other person. Some of the data contained in this publication may have been obtained from The Federal Reserve, Bloomberg Barclays Indices; Bloomberg Finance L.P.; CBRE Inc.; IHS Markit; MSCI Inc. Neither MSCI Inc. nor any other party involved in or related to compiling, computing or creating the MSCI Inc. data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

This communication reflects our analysts’ current opinions and may be updated as views or information change. Past results do not guarantee future performance. Business and market conditions, laws, regulations, and other factors affecting performance all change over time, which could change the status of the information in this publication. Using any graph, chart, formula, model, or other device to assist in making investment decisions presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves and market participants using such devices can impact the market in a way that changes their effectiveness. Focus Point LMI LLC believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision. Focus Point LMI LLC or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. Neither Focus Point LMI LLC nor the author is rendering investment, tax, or legal advice, nor offering individualized advice tailored to any specific portfolio or to any individual’s particular suitability or needs. Investors should seek professional investment, tax, legal, and accounting advice prior to making investment decisions. Focus Point LMI LLC’s publications do not constitute an offer to sell any security, nor a solicitation of an offer to buy any security. They are designed to provide information, data and analysis believed to be accurate, but they are not guaranteed and are provided “as is” without warranty of any kind, either express or implied.

FOCUS POINT LMI LLC DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

Focus Point LMI LLC, its affiliates, officers, or employees, and any third-party data provider shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Focus Point LMI LLC publication, and they shall not be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information or opinions contained Focus Point LMI LLC publications even if advised of the possibility of such damages.