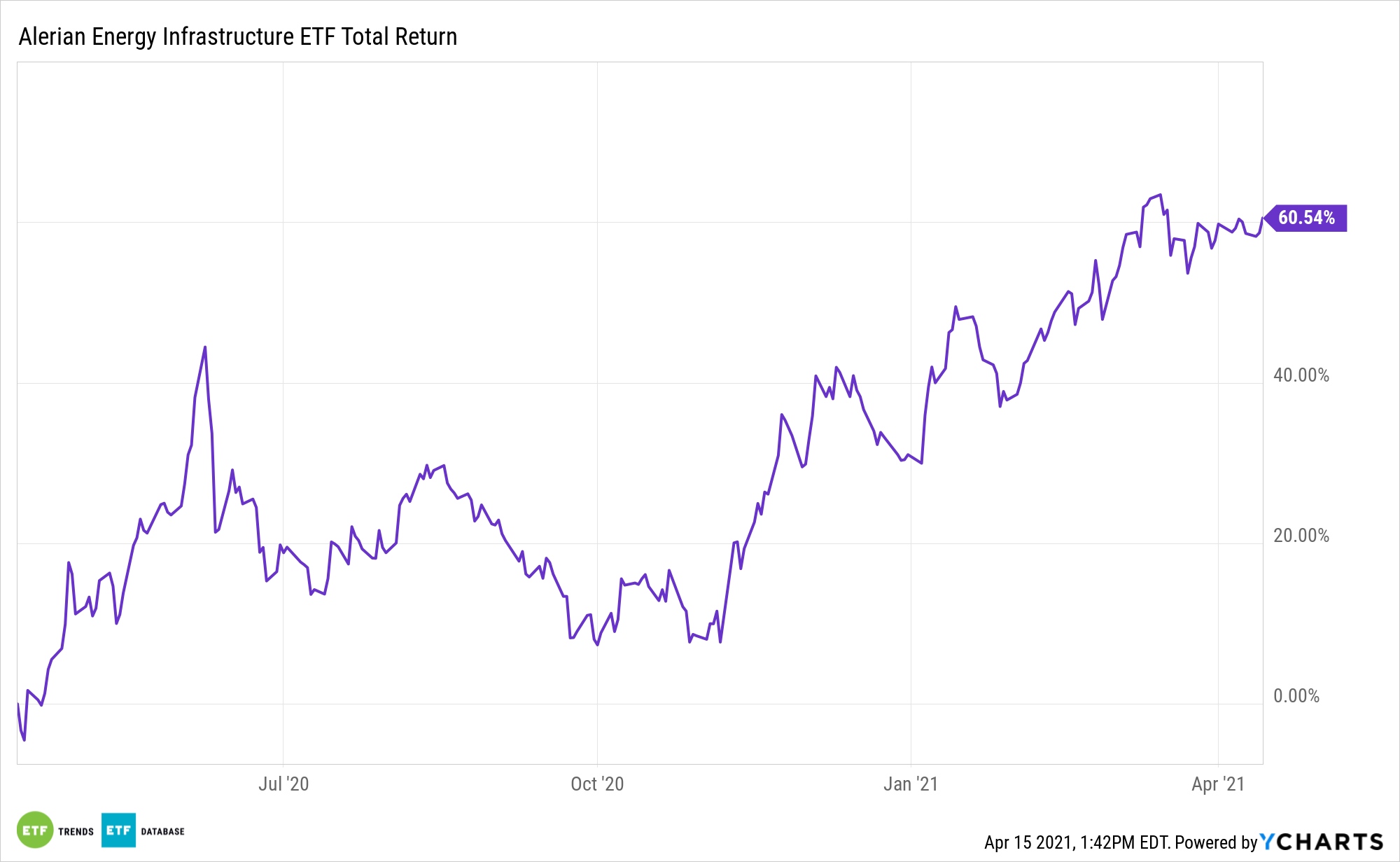

Midstream energy assets like the Alerian Energy Infrastructure ETF (ENFR) could be worth revisiting as recent data points look supportive of additional energy sector upside.

The ALPS ETF tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which helps investors capture some of the high yields from MLPs while limiting the tax hit from solely owning MLPs. Part of the good news for the sector is that some well-known investors are revisiting energy equities.

On Wednesday, “Oil prices surged almost 5% after a report from the International Energy Agency followed by U.S. inventory data raised optimism about returning demand after last year’s coronavirus lockdowns crushed fuel consumption,” reports Seeking Alpha.

The Marvelous Midstream Space

In a stubbornly low interest rate environment, investors are seeking out alternative avenues to generate extra yield. Midstream energy companies and master limited partnerships are two of the more credible asset classes in this arena.

“The EIA reported U.S. crude inventories fell by 5.9M barrels last week, far exceeding the consensus outlook for a 2.9M barrel drop, while gasoline supplied rose to 8.9M bbl/day, the highest since August and indicating strong U.S. consumption of the fuel,” added Seeking Alpha.

For investors looking to get into the energy patch while reducing some of the volatility associated with instruments associated directly with crude prices, ENFR makes some sense due to its midstream exposure.

Additionally, the midstream space is usually more defensive and less volatile than other energy segments due to steady, reliable cash flows.

This segment is fundamentally related to the sector company businesses, can potentially increase yield generation, and is historically excluded from the S&P 500 and Dow Jones Averages, providing another layer of diversification benefits.

“Oil prices might be breaking out of their month-long wicked trading range as the normally pessimistic IEA is sounding pretty darn bullish,” Price Futures Group analyst Phil Flynn adds.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.