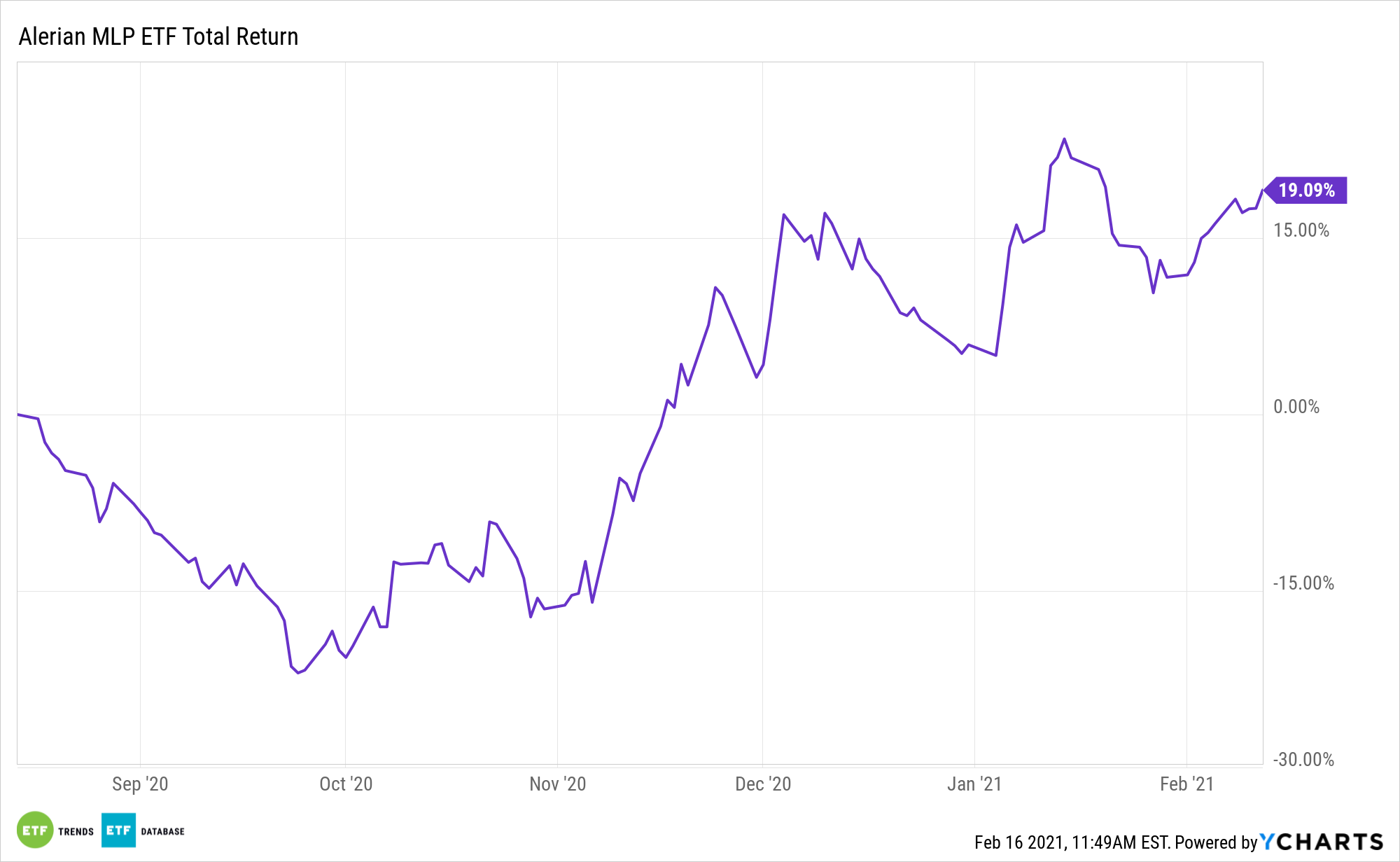

After a dismal showing in 2020, the energy sector is the best-performing group in the S&P 500 to start 2021. The wave is lifting boats with master limited partnerships (MLPs), including the ALPS Alerian MLP ETF (NYSEArca: AMLP).

AMLP seeks investment results that correspond generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

Historically, MLPs weren’t highly correlated to oil prices in either direction, but in recent years, the income-generating asset class displayed more sensitivity to crude fluctuations. That could be benefit AMLP investors this time around.

MLPs primarily deal with the distribution and storage of energy products, so their business model is less reliant on the commodities market since the structure profits off the quantity of oil and natural gas it is able to move around. Consequently, MLPs have historically shown a weaker correlation to energy prices over longer periods as MLPs act more like energy toll roads, profiting on the volume of oil moving through their pipelines.

“One Citigroup analyst who has successfully predicted market moves before expects the bullish run to continue — and possibly result in Brent crude rising above $70 this year. Citi’s Ed Morse said this week that the oil market was ‘tightening faster than expected,’ with a backlog of stored oil that had built up last year quickly emptying out. Morse predicted the 2014 oil crash when many analysts were expecting strong prices to continue,” reports Avi Salzman for Barron’s.

Tax Benefits and Oil Forecasts Are Lifting AMLP

By generating at least 90% of income from natural resource-based activities such as transportation and storage, an entity can qualify as an MLP and not be taxed as a corporation. The IRS treats shareholders of an MLP as partners, making the MLP itself a pass-through entity, which means that taxes are avoided at the corporate level, and investors avoid the double taxation of income.

Citi “analysts see Brent averaging $64 a barrel this year. By 2022, however, they expect oil producers to start pumping more, resulting in prices falling somewhat. Their 2022 average price expectation is $58,” according to Barron’s. “Other analysts also have bullish predictions for oil. Bank of America’s Francisco Blanch wrote on Thursday that oil demand could rebound strongly over the next three years, defying expectations for a near-term peak in demand.”

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.